Are we there yet?

Hey team. The S&P 500 ended the week down 9.1%—its largest weekly decline since March 2020—erasing trillions of dollars in market capitalization.

Let’s reflect back on what we’ve been seeing since last month, what took place during last week, and see what’s ahead for the markets!

Before The Fact

While it might seem like the unexpected wave of tariffs was “the sole cause” of this extreme pullback—the likes of which we haven’t seen since the COVID crash—the way it goes in financial markets is this:

Larger moves happen because the stage is already set for them behind the scenes.

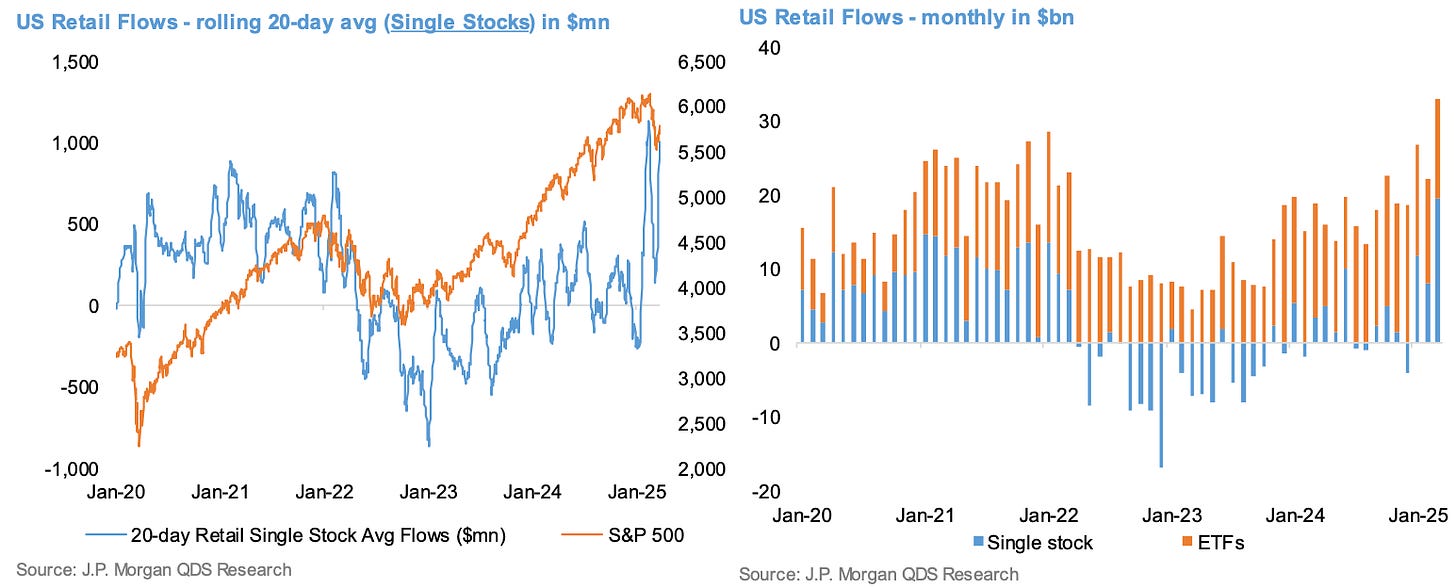

We’ve been covering this sell-off since Mar 07, 2025, when we first shared evidence that institutional money managers and hedge funds were dumping global stocks at the fastest pace on record.

(Read an update we shared on 11 Mar on the free Substack version👇)

This was evident not only from a technical perspective, but also through the institutional flow and positioning data we've consistently shared on our reports.

Trust The Senior

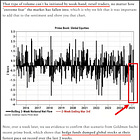

The following picture was shared with our Paid Subscribers on Apr 01, reiterating that the big money managers kept shorting the US despite the market seeing a brief 3-day recovery.

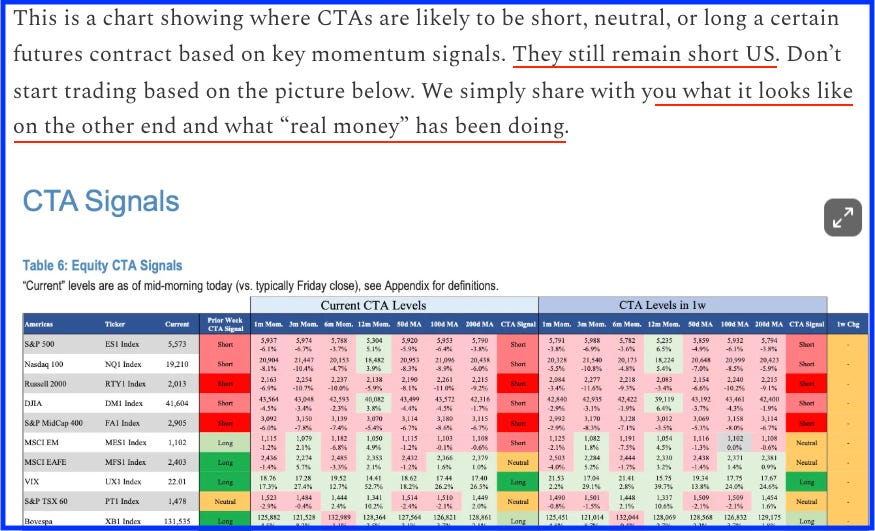

While hedge funds rushed for the exits, retail investors bought like never before.

Net retail inflows into U.S. ETFs and single stocks hit a record ~$40 billion in March. But as retail investors continued to buy the dip, major indices pushed lower.

On Thursday alone we saw the largest 1-day notional net global selling from hedge funds on record, driven by short sales and to a lesser extent long sales (3 to 1).

Every region was net sold, led by North America which made up over 75% of the total notional global net selling. CTAs are now short $24.7B of US equities.

How does this translate to a trader?

In markets, it's typically asset managers, hedge funds, CTAs, and other institutional players who are the first to lean on the exit door.

When their models pick up on a shift in sentiment or signal rising risk they are the ones that will get out of that door first.

Since early March, we’ve seen positioning unwind among the largest market participants—while retail traders continued to aggressively buy the dip.

The result? The market was getting long on weaker hands traders that are extremely sensitive to any negative sentiment and will very often exit their positions the moment a catalyst hits. That means free fall and lack of underlying support.

The “black swan” event of tariffs was just a catalyst that amplified the sell off as now everyone is trying to get out of the same door at the same time.

Wall St. Prime Intelligence

We’ve been sharing premium insights about institutional positioning since early last month, exclusively for our paid Subscribers. (e.g. CTAs short U.S. signals / downside hedges / no strong buybacks / downtrend continuation)

In today’s Weekly Prime Intelligence we share:

Flow of Funds: Where are CTAs, Hedge Funds, Asset managers positioned next?

Where we see technical support for the market.

Latest comments from investment banking trading desk floors.