The Market Brief

Hey team. U.S. stock index futures plummeted early Monday and currently staging a recovery attempt as investors barreled into government bonds on economic worries over the fallout of U.S. President Donald Trump's sweeping tariff plans.

Let’s see what’s ahead for the markets.

Macro Viewpoint

Whether you’re a new trader or investor, been in the markets for one year or four decades, what you’re experiencing right now since last week is historic, one that will be talked about for the decades to come.

Global markets have moved past COVID magnitude and right now are reflecting similarities to the 2008 sell-off, with China's stock market suffering the worst single-day crash since then, Hong Kong’s Seng index closing with the biggest one-day drop since 1997, Singapore’s stocks closing down with the biggest one-day drop in more than 16 years.

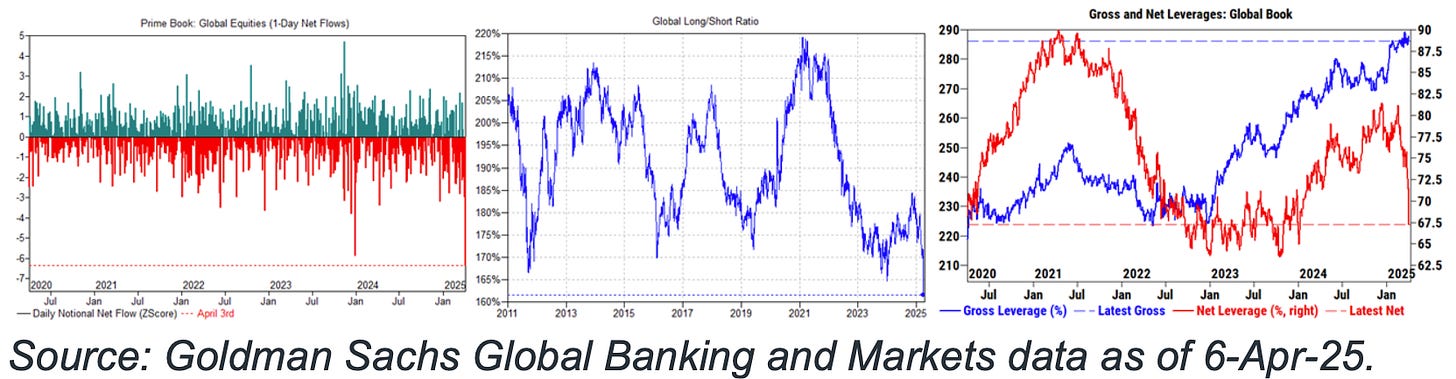

The GS Global Prime book saw its heaviest week of selling last week on record, with the long/short ratio falling to a record low and net leverage falling further.

The president has an opportunity to call a 90-day time-out, negotiate, and resolve unfair asymmetric tariff deals. If that happens, the markets would rally aggressively.

That said, the longer this persists, the more negotiation will turn to retaliation.

The reality is that the market was not priced for this outcome. It was holding onto economic rational scenarios… tariffs being an end to a means (better trade deals… buying US goods/energy), not a deep-set ideological view.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.