The Market Brief

Hey team. U.S. futures were flat during early trading on Wednesday after a strong start to the week, driven by easing inflation data and a temporary U.S.-China trade truce.

Let’s see what’s ahead for this market!

Macro Viewpoint

U.S. stock index futures held steady on Wednesday after markets kicked off the week on a strong note, buoyed by a soft inflation report and a temporary trade truce between the U.S. and China.

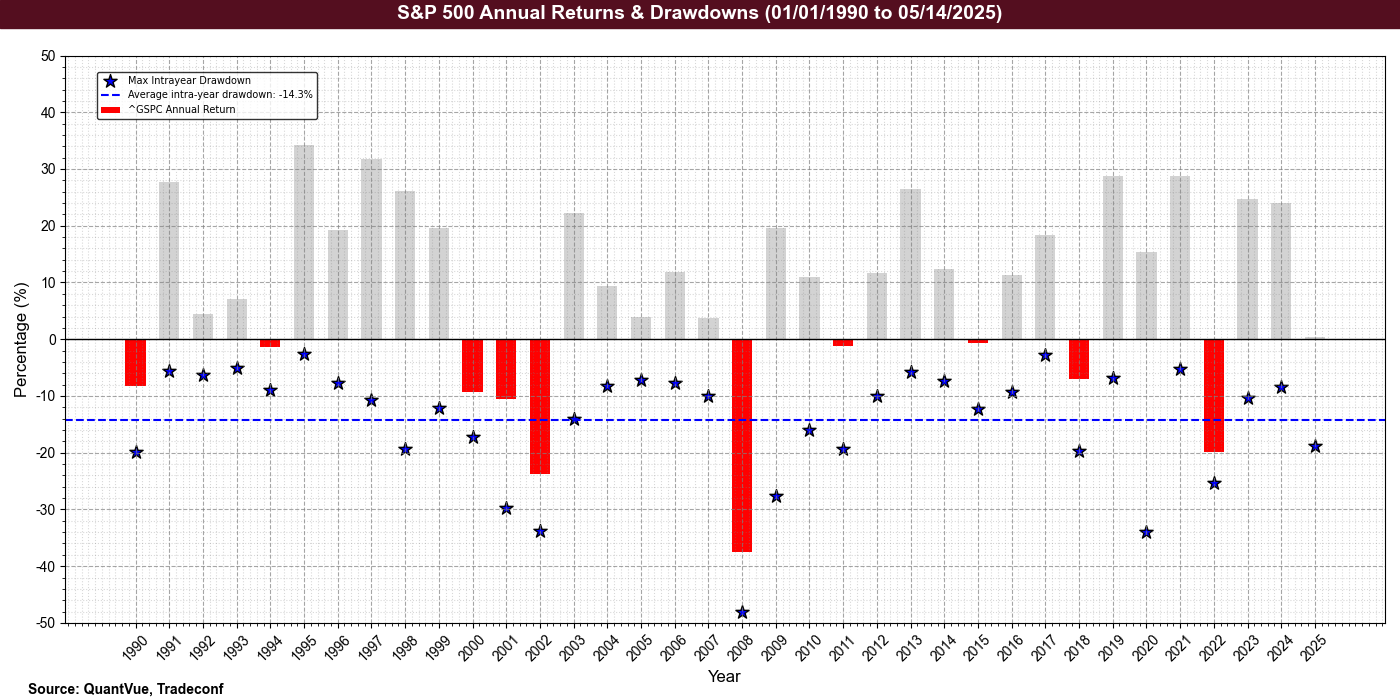

We’ve shared exclusively with our Subscribers way back on Apr 06 that the 4800 area on the S&P500 was a good opportunity and institutional investors was positioned to defend it.

Given the rally post US-China trade truce, SPX has now erased all its YTD losses.

We are in a “good news is good news and bad news is ignore” regime. The NFP print did not reflect any negative impact from the trade war which may be the case with this week’s data.

Wall St. Prime Intel

One week ago, we reiterated our “tactical bullish” view, sharing evidence why we thought the market had better odds to advance towards the 6000s when the market was sitting at the 5600s at the time of that post.

Fast forward over a week later, we have reached the 5900s as forced buybacks accelerated and bearish funds capitulated.

At the time this post was made on May 5 [HERE], we didn’t know of any economic number, tariff deals, or any market-moving catalyst. We simply based our view on data points around flows of institutional traders, hedge funds, and CTAs.