The Market Brief

Stocks wavered ahead of Wednesday’s Federal Reserve interest-rate decision, with investors juggling a busy slate of earnings reports from major companies.

Impact Snapshot

🟥 ADP Nonfarm Payrolls - 8:15am

🟥 U.S. GDP - 8:30am

🟥 FED rate decision - 2:00pm

🟥 FOMC Press Conference - 2:30pm

🟥 Key earnings (after close): MSFT 0.00%↑ META 0.00%↑

Macro Viewpoint

S&P 500 futures hovered near flat ahead of the interest rate decision, a topic that’s recently sparked tension between the White House and Fed Chair Jerome Powell.

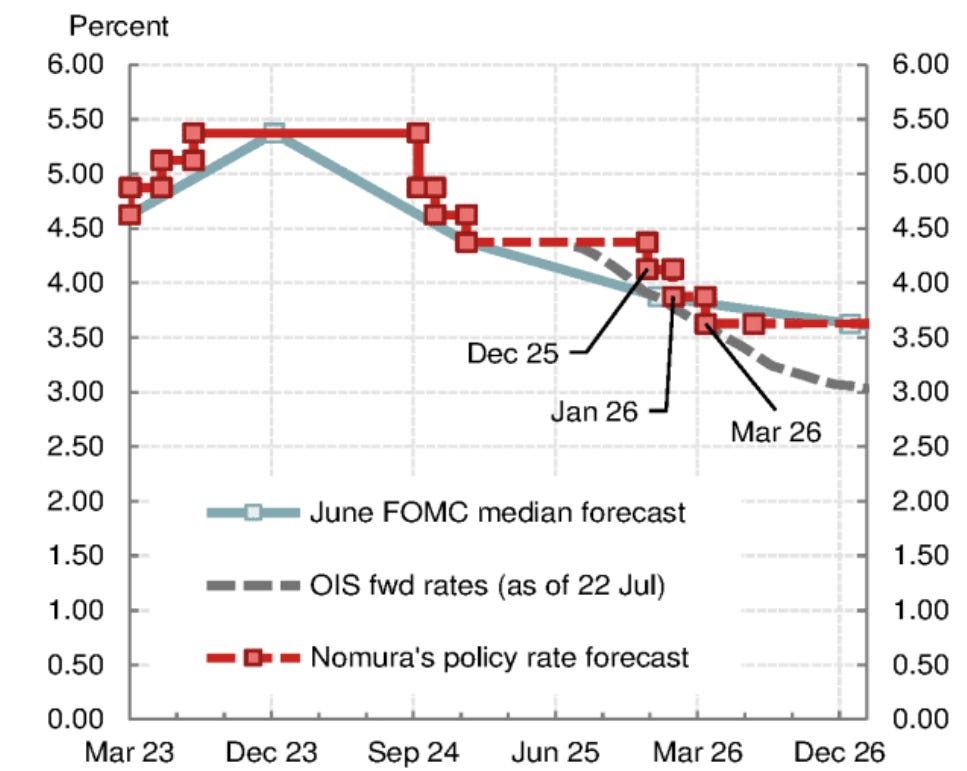

The FOMC will likely keep the policy rate unchanged at its 30 July meeting.

Key observations to expect:

Powell is likely to maintain his near-term outlook that inflation will accelerate in coming months, allowing him to emphasize a patient approach to rate cuts.

The June CPI report showed nascent signs of tariff-induced price pressures, pointing to a pickup in core goods prices, while recent growth data has remained resilient.

We expect tariffs to be higher after the 1 August deadline, keeping inflation risks skewed to the upside as tariff-induced price pressures materialize.

This is a free edition of the Market Brief. To receive our institutional research, consider becoming a paid subscriber.👇