The Market Brief

U.S. futures edged higher during early trading on Friday as optimism built that the jobs report will set the stage for the Federal Reserve to resume cutting interest rates this month.

Impact Snapshot

🟥 Unemployment Rate - 8:30am

🟥 Non-Farm Payrolls - 8:30am

Macro Viewpoint

The August nonfarm payrolls release, the first since Trump dismissed the Biden-appointed BLS commissioner last month, is projected to show an increase of about 75k jobs, only slightly above July’s 73k gain. Markets will also be watching closely for revisions, especially after July’s steep downward adjustments.

This report will be pivotal in shaping expectations for Fed rate cuts through the rest of the year. A September move is already largely priced in, following July’s weak employment data and Powell’s dovish tone at Jackson Hole.

If the numbers come in especially weak, Powell could even be pushed toward a 50bps cut.

NFP SCENARIOS

First, these outcomes below are skewed positively which we think reflects the market’s view that this print is unlikely to impact the September Fed meeting.

Above 110k. SPX gains 1% to loses 1.5%

Between 85k – 110k. SPX gains 50bp – 1.25%

Between 65k – 85k. SPX gains 50bp – 100bp

Between 40k – 65k. SPX gains 25bp – 50bp%

Below 40k. SPX loses 25bp – 75bp.

A weaker than expected print will increase calls for 50bp, and the magnitude of the downside risk could re-anchor investor expectations around the timing of a recession.

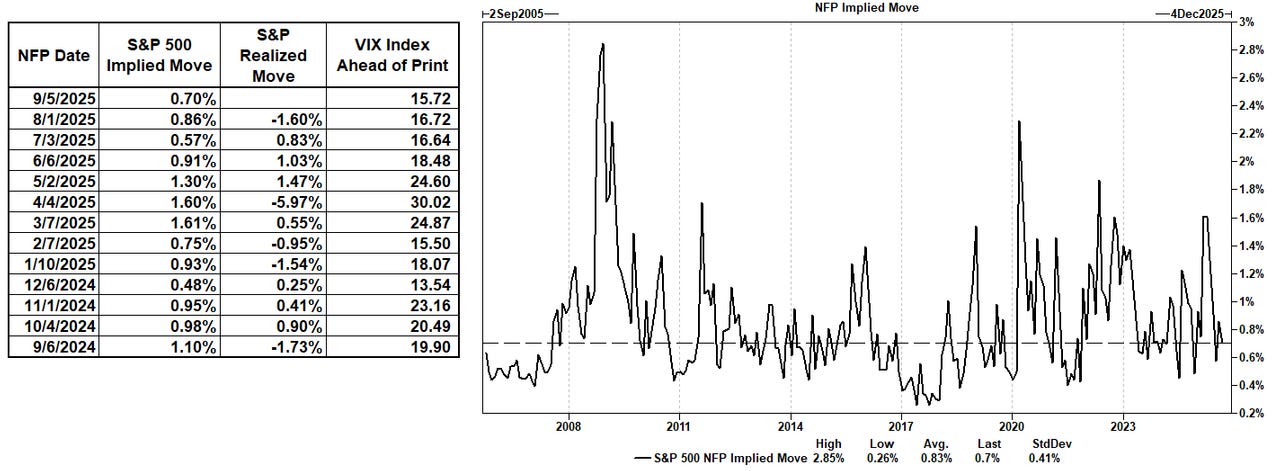

The option straddle is pricing in a 0.70% move tomorrow, which would be one of the lowest NFP day moves if it materializes. Notably, the last time the VIX was lower ahead of the NFP print was in February 25.

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.

We help you develop better context and create a robust entry models by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack. 👇