More Than Headlines

US stocks on Friday saw the worst one-day selloff since April (S&P 500 down 2.4% on the week) as investors digested renewed US-China trade tensions and the ongoing government shutdown.

Impact Snapshot

Q3 Earnings Season Kicks Off: JPM 0.00%↑ WFC 0.00%↑ GS 0.00%↑ BLK 0.00%↑ C 0.00%↑ BAC 0.00%↑ MS 0.00%↑AXP 0.00%↑

Fed Chair Powell Speaks - Tuesday

Macro Viewpoint

Tariffs hit harder in an economic data vacuum. The impact of the US government shutdown will continue to be in focus next week, with several US data releases affected, including the CPI.

This comes on top of several releases that have already been delayed, including last week’s US jobs report. As it stands, there is still no sign of a compromise that would end the shutdown.

Meanwhile, earnings season is set to ramp up next week, especially in the financial sector.

More Than Headlines

On Friday, the S&P 500 erased $1.5 trillion in market cap in a matter of hours.

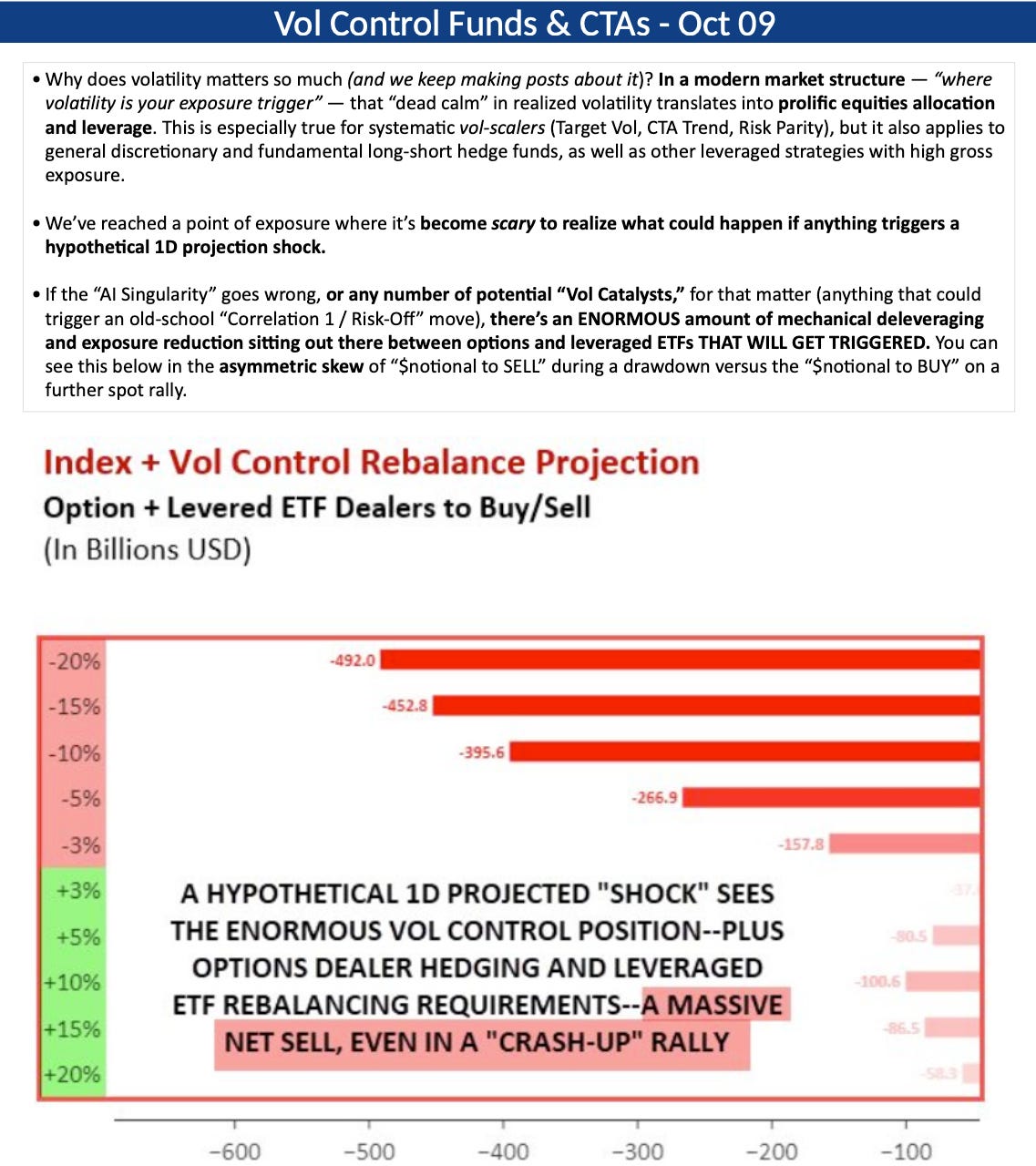

While everyone is blaming the selling on a headline, we were particularly focused on the consequences of the mechanical selling expected to accelerate on any moves greater than one percent in either direction since last Sunday on Oct 5.

Larger moves in the market happen because the stage is already set for them behind the scenes.

The image below shows one of many warning signs we’ve gathered thought the week and prior to Friday’s sell-off.

From the implied vol divergence to FOMO kicking in and the forecasting of significant mechanical selling on the tape, the market gave us the warnings before the fact.

With CTAs and volatility-control funds operating near maximum leverage, these strategies became increasingly sensitive to changes in both trend and realized volatility.

Historically, some of the most convex rebalancing episodes have occurred under similar conditions. This suggested to us that the right catalyst could trigger an abrupt decline driven purely by reflexive volatility responses , which is exactly why we dedicated the entire week to talking about volatility.

We also believe that what really happened on Friday was a rush to protect larger long positions rather than a rush to exit them. Hedging risk versus liquidating positions. Big difference.

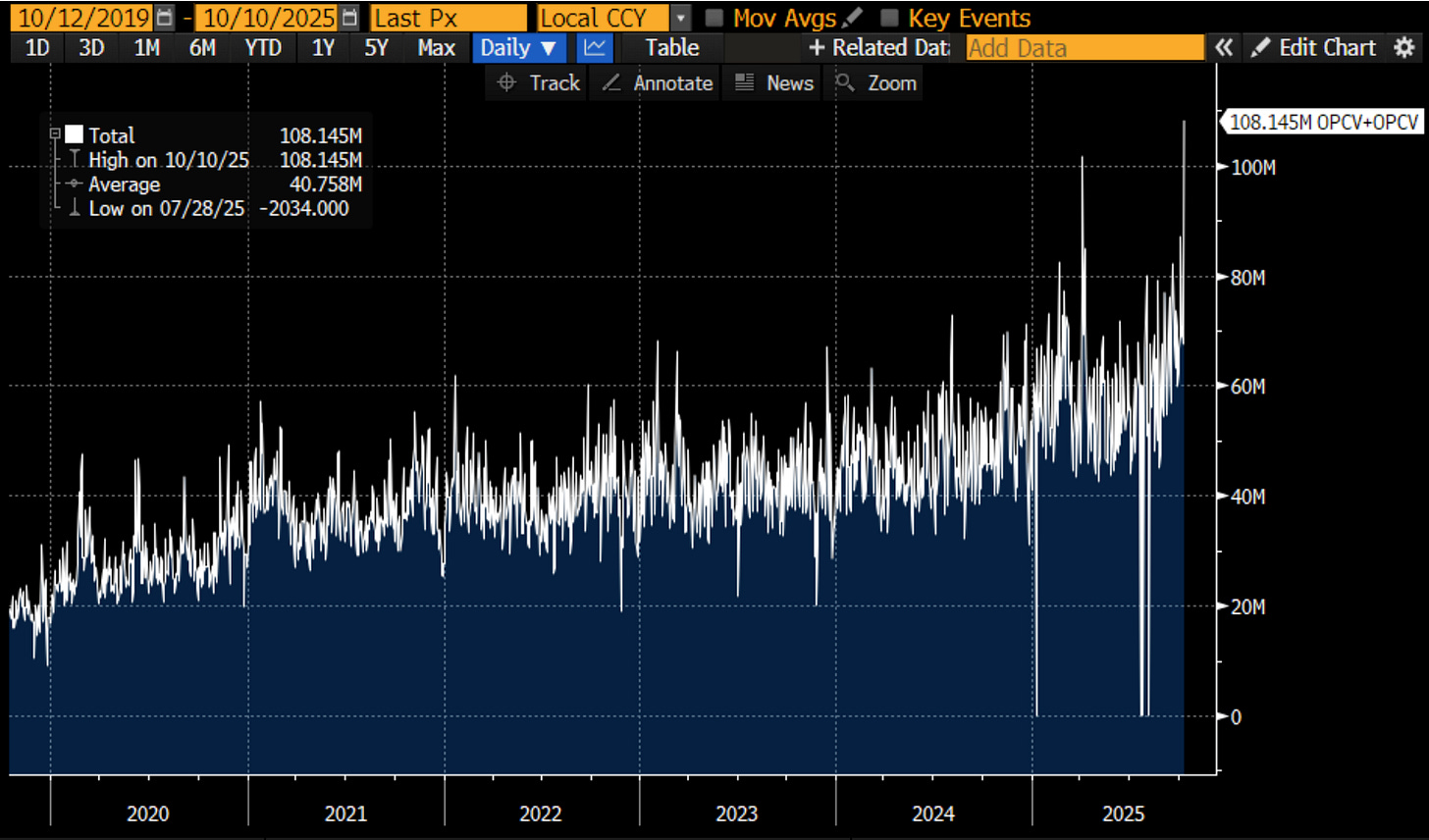

Total U.S. options volume hit a new all-time high, eclipsing 100mm contracts for just the second time (April 4th was the other when the market fell -5.97%.)

We’ve put together a recap report of last week’s Substack releases, which you can download below. ALL CONTENT in this report, including all the charts and context, was shared prior to Friday.