The Market Brief

U.S. futures are lower during early trading at the end of a dizzying week that has delivered one of the toughest tests yet for the post-April AI-fueled rally amid growing valuation skepticism.

Impact Snapshot

🟥 Consumer Sentiment - 10:00am

🟥 Inflation Expectations - 10:00am

Macro Viewpoint

NDX experienced its third pullback of over 100 bps in the last six sessions, with under-the-hood price action feeling increasingly unsettled. Rising AI skepticism, fueled by recent discussions around a potential “federal bailout” of AI infrastructure spending, has added to the tension.

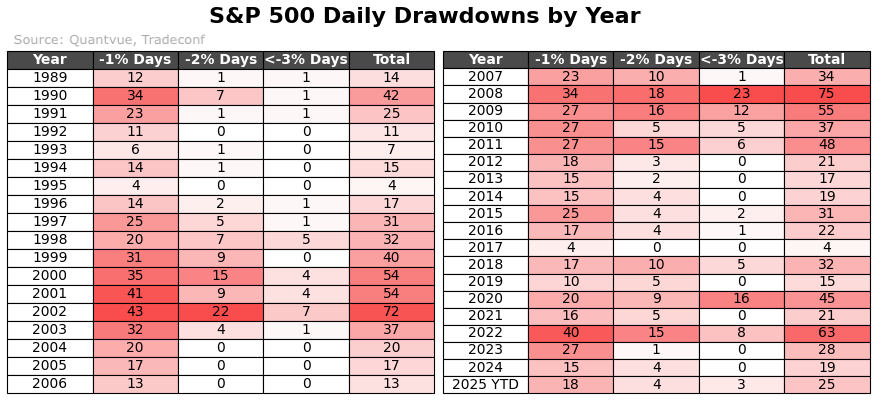

The S&P 500 also fell 1.1% yesterday, marking the 25th daily decline of more than 1% in 2025. This is within normal market behavior, as the average year typically sees 29 such declines.

What is abnormal is the vertical advance over the last 7 months w/o ANY major pullbacks..

Prime Intelligence

We were early to warn about the extreme narrow breadth and highlight the risks associated with it on Oct-30. A day prior to that, the index was at ATHs. 👇

At the end of that post we’ve warned about the risks associated with this..“The risk with such a concentrated advance is clear: if the leading stocks lose momentum and correlations rise, the broader market could quickly feel the impact.” Guess where we find ourselves now.

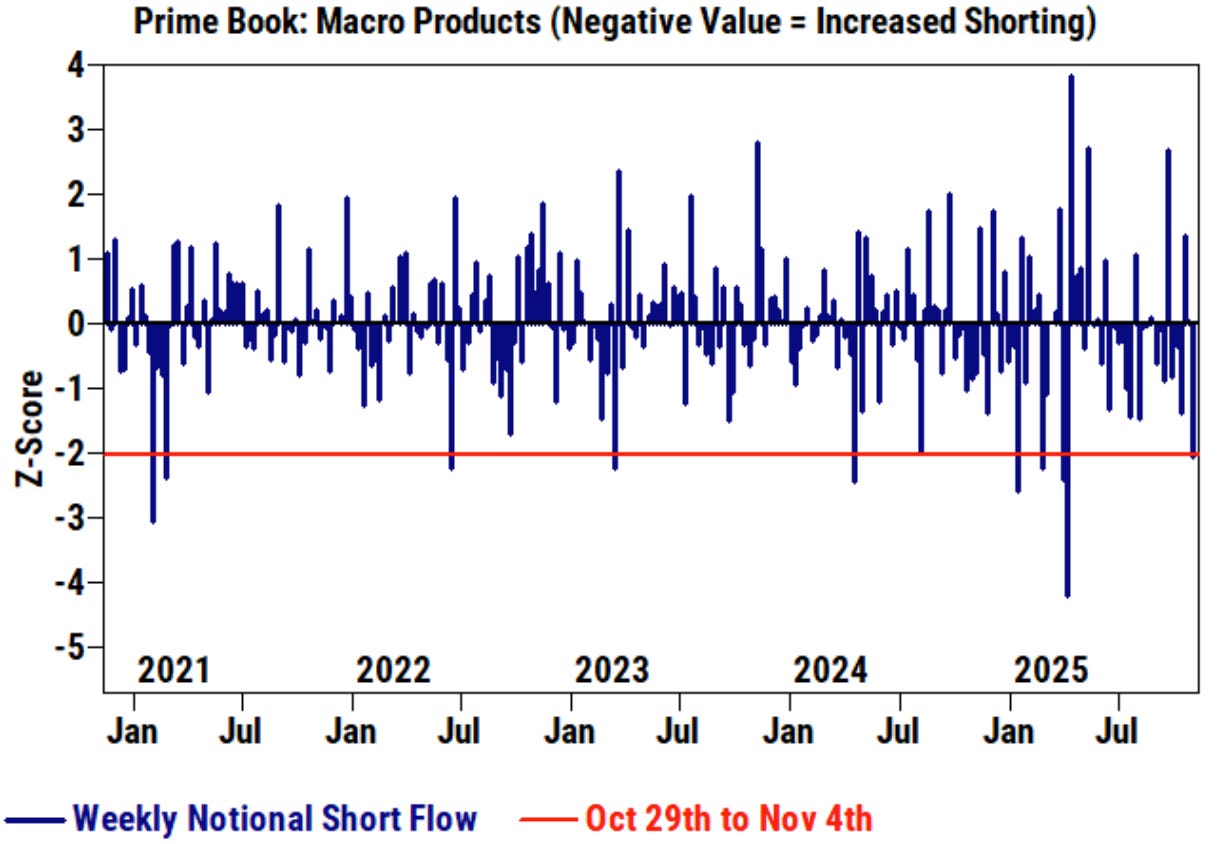

But.. amid this recent volatility, we’ve really seen no major signs of de-grossing(yet). The level of shorting over the past week until now is among the most extreme (ex-April) we’ve seen in several years.

Flows remain risk-on: single-stock demand continues to be strong, though the uptick in hedging has been notable.

This likely reflects more short-term nerves rather than a true shift in views. Investors feel a bit more uneasy even though the fundamental setup hasn’t changed much.

📰 In today’s brief, we’re covering the positioning of Systematic Funds and Market Makers and answer the question: Have we entered the point of no return here, or could this be a BTD opportunity? Let’s find out!👇