1%

Hey team, A slew of economic reports, combined with tech heavyweight company earnings, will set the stage for the-most volatile week we’ve seen this year.

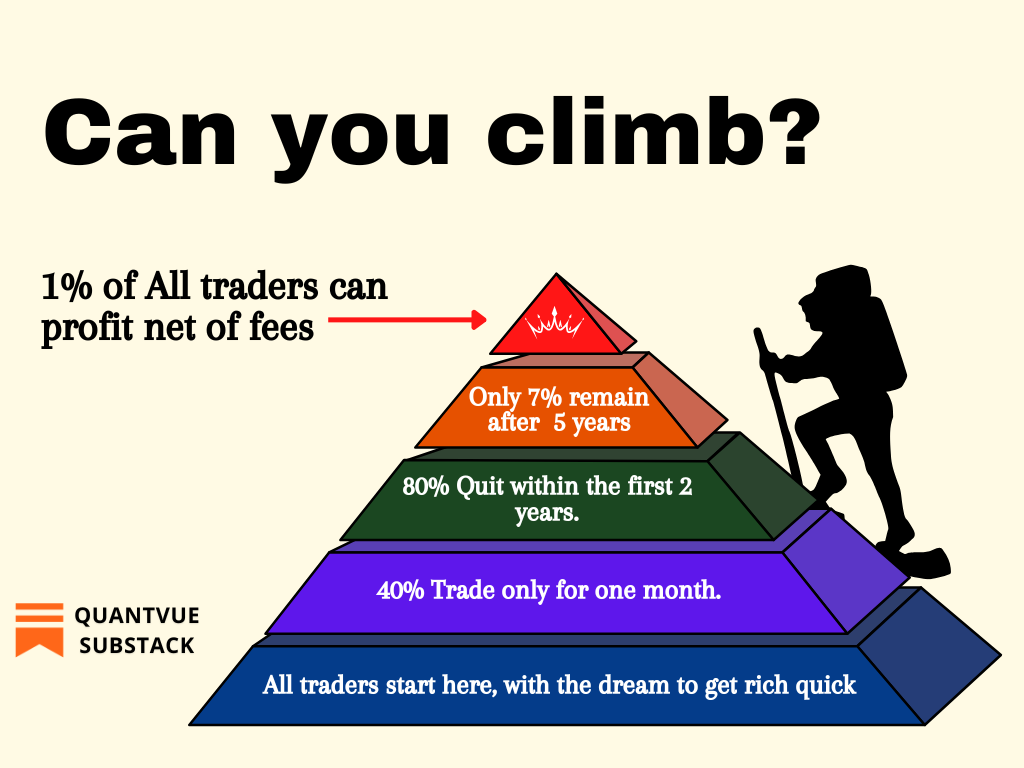

Today’s article uncovers the reality of what it takes to become a long-term, profitable trader and how the social media space distorts your perception of what the top 1% truly looks like.

Impact Snapshot

Consumer Confidence - Tuesday

Federal Funds Rate - Wednesday

Q1 GDP - Thursday

Unemployment Claims - Thursday

Core PCE Inflation - Friday

Key Earnings: MSFT 0.00%↑ META 0.00%↑ TSLA 0.00%↑ AAPL 0.00%↑

Macro Viewpoint

The Standard & Poor's 500 index climbed 1.7% over the past week, buoyed by stronger-than-anticipated quarterly earnings and growing optimism surrounding potential tax and regulatory cuts under the Trump administration.

There is rising investor confidence that the new president will move forward with his promises to reduce taxes and ease regulatory burdens.

At the end of a relatively light week for data, traders are predicting the Federal Reserve will maintain current borrowing rates at its January 28-29 meeting, while anticipating the first rate cut to come in June.

Looking ahead, investors are preparing for a busy week packed with critical inflation and economic growth reports, alongside the Fed meeting, as they continue to monitor potential policy announcements from the Trump administration.

The upcoming earnings season is also expected to bring reports from major corporate heavyweights, setting the stage for what could be this year's most volatile week for the markets.

Why Most Traders Lose

Most traders begin their journey in the space, blinded by the scheme of “get rich quick” and a quick “100% working” strategy that the next lambo influencer advertises to them.

The majority of trading decisions people make are not based on sound research, tested trading methods, or their trading playbook, but on emotions, the need for entertainment, and the “hope” of making a fortune in no time.

Unprofitable traders tend to sell winning trades while holding on to their losing ones longer. Your success is going to come from letting those winners run towards their true profit zones while cutting those losing trades down as small as possible.

What most people always forget is that trading is a profession and requires skills that need to be developed over the years.

If the accumulated wealth of billions in some of these senior funds doesn’t have a 100% strategy to beat the natural randomness that comes with the markets, your Lambo influencer sure doesn’t.

This is NOT how markets work, and if it were that simple, such a system would be arbitraged away in moments. It would have been bought by some serious fund overnight and applied to their HFT short-term strategy algos the next day.

It’s a very small universe of those who make it to long-term profitability in these markets. But guess what? It’s a pretty small universe for heart surgeons who want to do heart surgery on you.

There is as much money there as there is here, so there are NOT going to be a lot of people who make it and can do that competition.

Nuances matter. If you’re having heart surgery, do nuances matter? You better believe they do.

On our daily Substack, we help you build a better field of vision for the market and explore these types of nuances that can truly make a difference in helping you understand the market environment and see things that most people don’t.