A Change In Tone

Hey team.

In this report we share insights of the last two session and what we’ll be looking moving forward.

Impact Snapshot

Gross domestic product rose 2.8%

PCE Inflation - Friday

Market Evaluation

A fresh wave of selling in the world's largest technology companies weighed heavily on the stock market, overshadowing economic data that boosted confidence in the Federal Reserve's ability to achieve a soft landing.

As the S&P 500 continuously set new records in the first half of the year, some investors became worried that only a small number of companies were contributing to the rally.

Recently, segments of the market beyond big tech have surged, fueled by confidence that the Fed is controlling inflation without harming the economy, and will soon be able to reduce interest rates.

US economic growth surpassed forecasts in the second quarter, demonstrating that demand is resilient despite higher borrowing costs.

Although growth accelerated from the first quarter, it still represents a slowdown compared to last year.

This is promising for the Federal Reserve, which aims to achieve a soft landing for the economy and is likely to begin cutting interest rates as early as September.

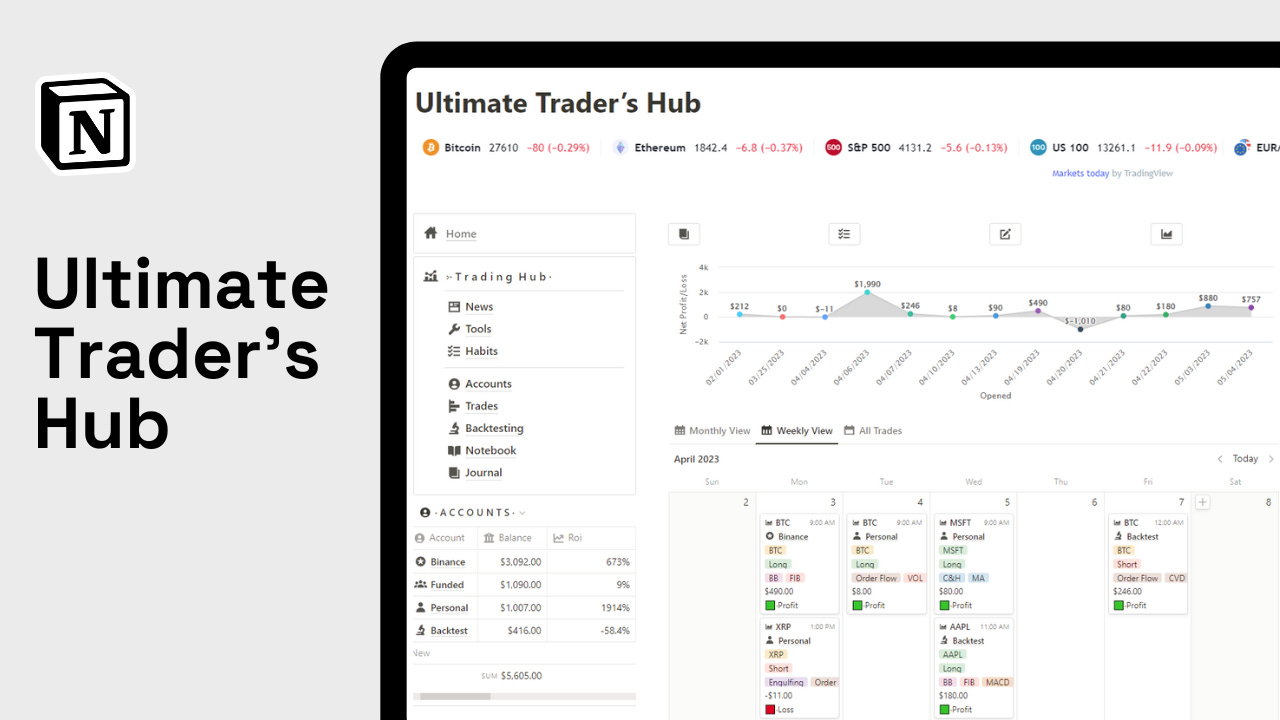

Trading Journal

One of the best ways to improve at anything, including trading, is by backtesting and keeping track of what you’ve done. Seeing what went right or wrong helps you get better.

Our trading journal lets you track, tag, and backtest your trades all in one place. No monthly subscriptions—just one payment for lifetime access. (Made in Notion)

Markets Breakdown

Unique days can happen for several reasons.

First of all, there is no such thing as an overbought or oversold market. A market can rally until there is something that triggers a shock, it’s what we call a “catalyst”.

These catalysts usually have to do with geopolitical events, missed earnings, global disasters or economical releases.

In this case, the triggering point of Wednesday’s selloff had a lot to do with missed earnings from tech.

Tech is holding far more weight than any other sector of the S&P so despite the fact that there are hundreds of stocks that make up the index, anything that affects the “Magnificent 7” could drag the whole market down.

What followed was S&P 500 losing over $1 trillion in market cap, SPY 0.00%↑ closed down 2%+ for the first time in 356 days on top of it being the worst day since December 2022 and QQQ 0.00%↑ had it’s worst day since October 2022.

When an emotional session is underway, market references and s/r for the short term don’t hold weight.

It’s like everyone trying to get off of the same door at the same time.

Although unique sessions can happen, it would be foolish to step in the market every morning, having an expectation that the ES can go up or down 2.5% or NQ can give you 3% daily sessions.

You would sit there holding a trade and expecting unrealistic targets to book profits.

When you notice a unique session is underway, the best way to preserve your capital is focusing on momentum. If lower prices bring in higher highs in volume, you don’t want to stand in front of it.

ES

Moving forward, we keep building value to the downside with the bearish momentum not showing signs of easing up as of today’s close. The market certainly has more room to break to the downside. We’re on a “no man’s land” area right now where acceptance of lower prices below 5400s can see a more serious downtrend.

Some references we’ll be looking going forward:

Upside Levels: 5463/5490/5513

Downside Levels: 5423/5411/5385

That’s all we got!

Like this post, share it with a friend.

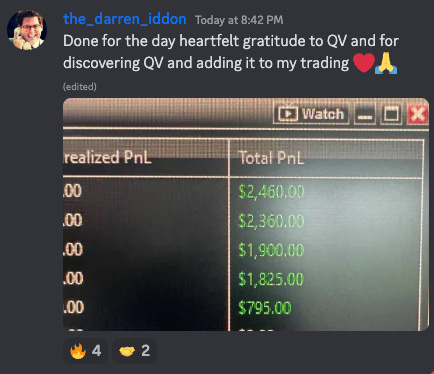

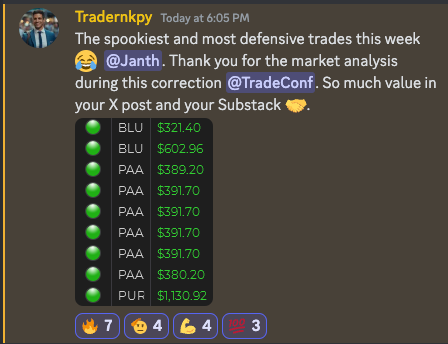

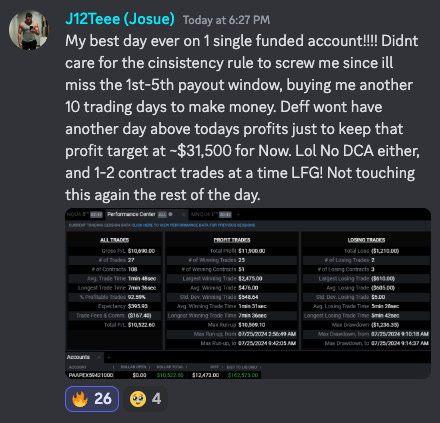

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.