A week of volatility

Hey team. Another row of economical released paired with mega-cap earnings will see another emotional week ahead with a lot of expected volatility.

Let’s re-cap last week and see what’s next for the markets!

Impact Snapshot

Consumer Confidence - Tuesday

JOLTS Job Openings - Tuesday

ADP Non-Farm Payrolls - Wednesday

Employment Cost Index - Wednesday

FED Rate Decision - Wednesday

Unemployment Claims - Thursday

ISM Manufacturing PMI - Thursday

Non-Farm Payrolls - Friday

Unemployment Rate - Friday

Key Earnings: MSFT 0.00%↑ META 0.00%↑ AAPL 0.00%↑ AMZN 0.00%↑

Market Evaluation

The S&P 500 recouped part of its losses on Friday but still ended the week down by approximately 1.5%.

This marks the second consecutive week of decline for the S&P500, driven by significant sell-offs in TSLA 0.00%↑ and GOOGL 0.00%↑ following their earnings reports.

U.S. consumer spending growth slowed last month, while the Fed's preferred inflation metric remained steady on an annual basis.

The economy grew at a stronger-than-expected rate in Q2, driven by accelerated consumer spending and cooling inflation.

According to the CME FedWatch tool, markets broadly anticipate that the central bank's monetary policy committee will keep interest rates unchanged next week and implement a 25-basis-point cut in September.

Next week's economic calendar will feature a slew of economical reports with the key focus being the jobs data and Fed’s rate decision followed by the press conference.

Markets Breakdown

When the market goes higher for a substantial period of time, it usually take a catalyst to break from that continuation.

Geopolitical uncertainty surrounding the US election combined with underwhelming earnings offered that catalyst last week which saw the market experiencing a sell off not seen since last year.

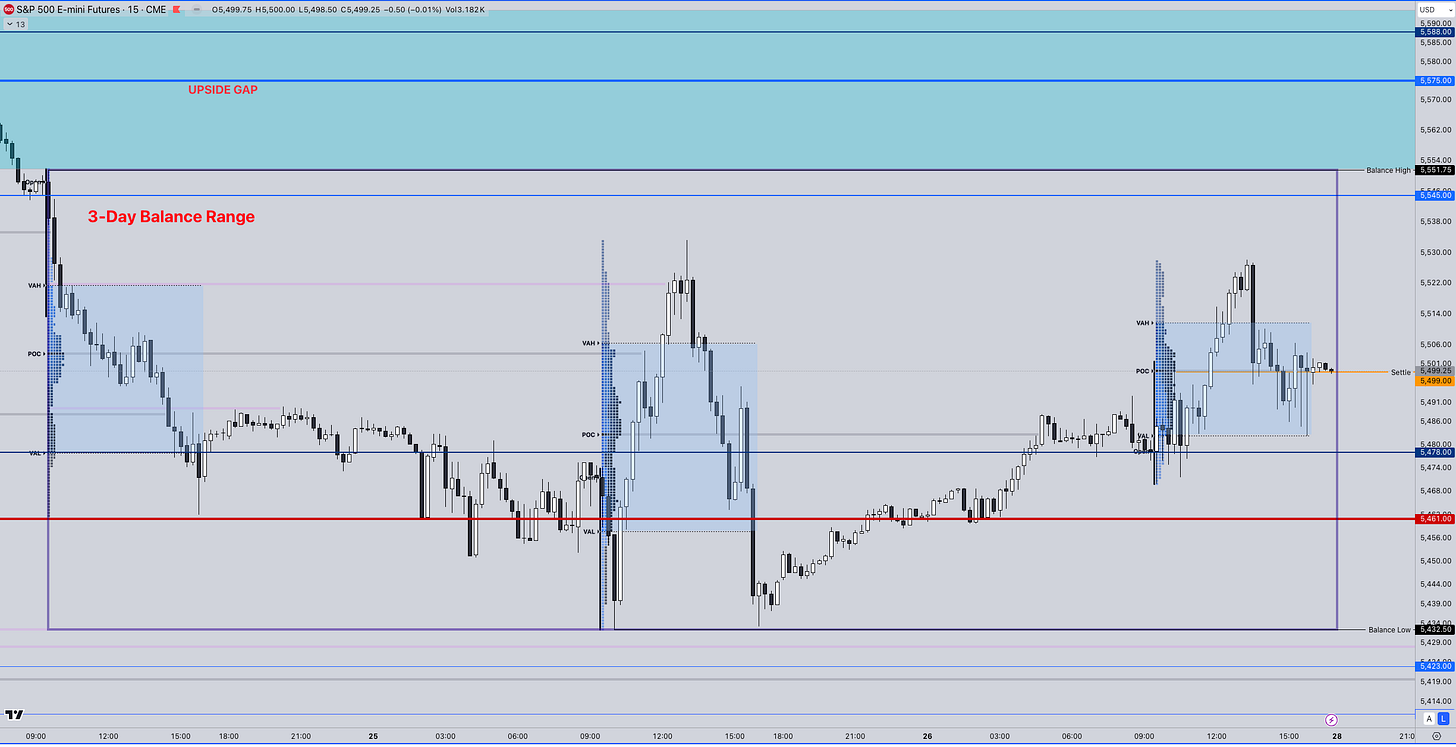

After Wednesday’s sell off, the market has formed a 3-day balance range with overlapping value and Friday ending with an inside day relatively to Thursday.

When the market is balancing and forming ranges, it’s an indication that it’s awaiting additional information prior to beginning it’s next directional move.

Next week has everything that the market needs to get that additional information with mega-caps reporting earnings as well as key economical reports.

The main focus will be the balance formation range we’ve got and how the market will react to the upcoming catalysts.

Balance Guidelines we will closely monitor heading into the next week:

Look above/below and Go: Prices move above/below the balance highs/lows and find acceptance for continuation higher/lower. The destination target is double the balance area.

Look above/below and Fail: Prices move above/below the balance high/low but fail to find acceptance, making a reverse back inside the balance with destination target the other end of that balance.

Balance rules indicate that the outcomes are quite limited. You don’t know exactly what is going to happen but at least you have a framework of different scenarios of what is potentially going to happen so you you’re. This ensures that:

You won't be surprised when an outcome occurs

You'll be prepared to act quickly when it does.

ES

Some references we’ll be looking going forward:

Upside Levels: 5545/5575/5588

Downside Levels: 5478/5461/5423

That’s all we got!

Like this post, share it with a friend.

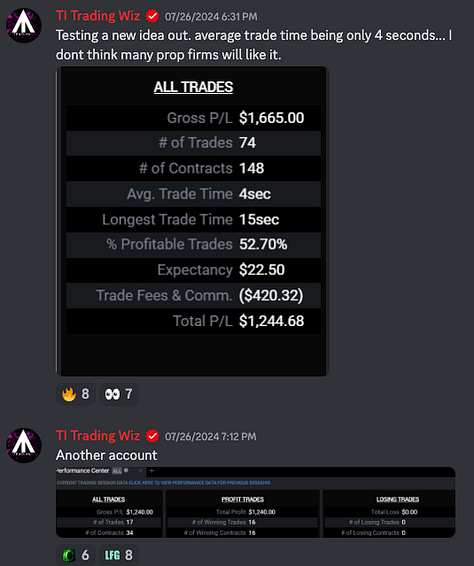

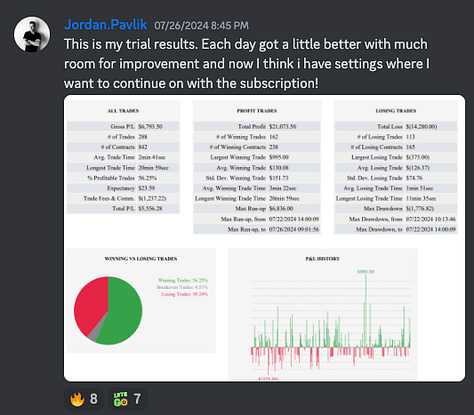

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.