Achieving Excellence

Hey team. U.S. stocks have declined for the third consecutive week, marking their worst weekly performance in six months.

Today's article explores what it truly takes to achieve excellence in any field.

Impact Snapshot

JOLTS Job Openings - Tuesday

CPI Inflation - Wednesday

PPI Inflation - Thursday

Unemployment Claims - Thursday

Consumer Sentiment - Friday

Inflation Expectations - Friday

Macro Viewpoint

U.S. stocks have declined for the third consecutive week, marking their worst weekly performance in six months.

The S&P 500 index dropped 3.1% over the week, turning negative for the year as concerns over tariffs and a weaker-than-expected February jobs report weighed on investor sentiment.

Investors are increasingly concerned about the economic effects of the Trump administration's tariff policies and potential job cuts.

Earlier in the week, the administration announced plans to impose 25% tariffs on Mexico and Canada but later decided to delay some of them by a month.

Economic data next week will feature the February consumer price index and producer price index, two closely watched inflation readings.

Excellence

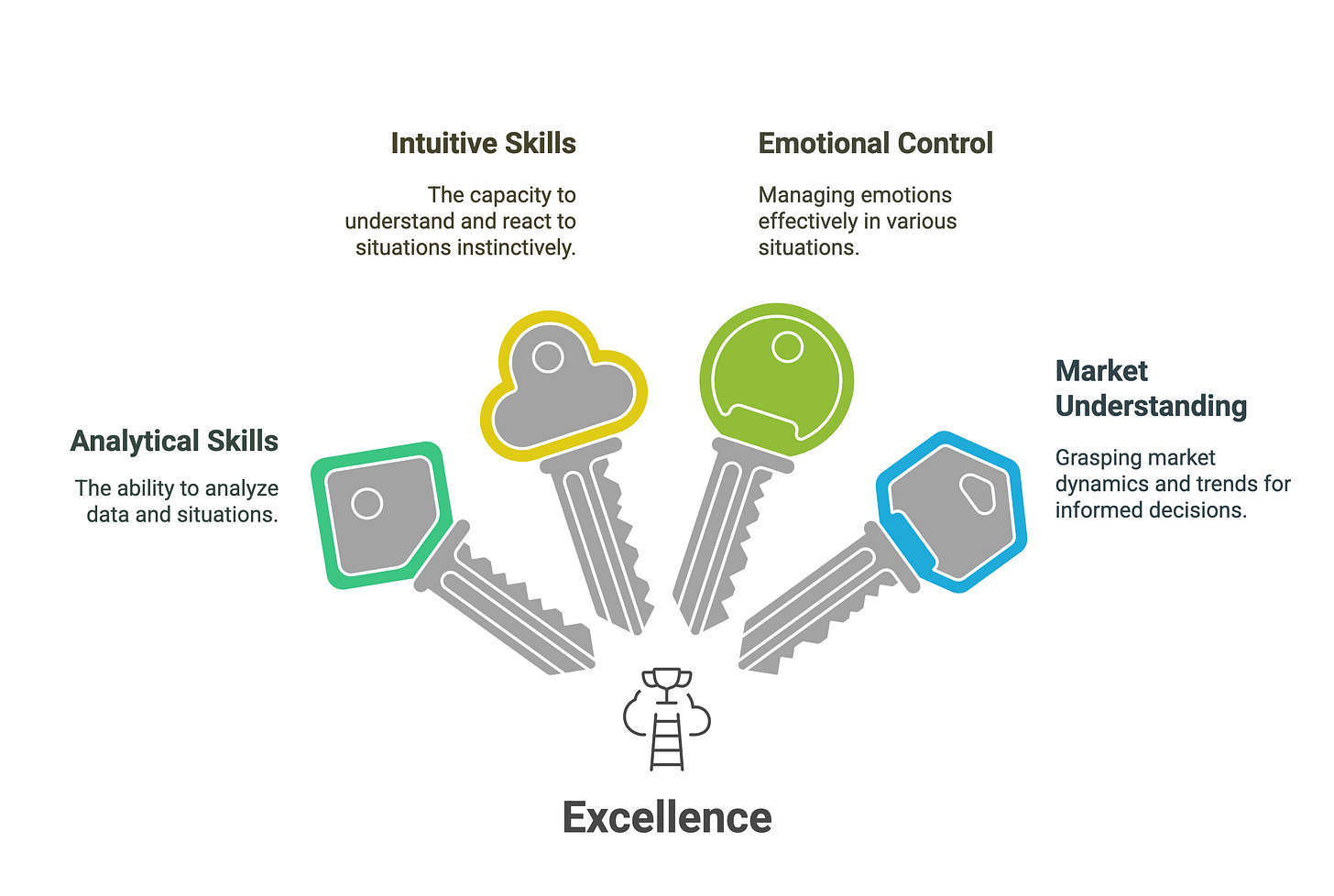

Excellence in any field, whether it’s surgery, sports, or futures trading, can only be achieved by balancing the analytical and intuitive powers of your brain.

Take soccer as an example. You could have an amazing right foot, be a great dribbler, and know how to shoot the ball just right, but if you’re lacking peripheral vision—which allows you to anticipate defenders' movements and find gaps in the defense—you’re missing a critical skill that makes you an all-around good player.

Becoming a proficient trader is no different. You could have the best trading strategy, be the fastest at executing it, and be extremely disciplined, but if you lack market understanding and analytical skills, you’re trading with tunnel vision.

Trading, like any worthwhile pursuit, is a lifelong journey. Imagine being offered a one-week course on how to become an expert surgeon or F1 driver.

There is no finish line, no promised land where you’ll always make the right trading decisions.

There is only the process of seeking opportunities in an ever-changing market structure and the process of making decisions free from the influence of emotional states that have been hard-coded in every human being for thousands of years.

Subscribe to our Market Brief and develop better context, create a robust entry model by understanding all the market nuances we share on a daily basis.