AI Drag

U.S. stocks edged lower on the week as investors digested an expected FOMC decision alongside another round of off-cycle earnings reports.

Impact Snapshot

Nonfarm Payrolls - Tuesday

Unemployment Rate -Tuesday

CPI Inflation - Thursday

Consumer Sentiment - Friday

Macro Viewpoint

The S&P 500 fell 0.6% this week, pressured by weakness in communication services and technology as investors grew more cautious around the AI-driven rally.

Tech and AI stocks saw sharp pullbacks after Broadcom’s comments reignited concerns about stretched valuations, triggering a broad selloff across the sector. The Nasdaq dropped 1.9%, marking one of it’s steepest weekly decline in months.

On Wednesday, the Federal Reserve cut its benchmark interest rate by 25 basis points, citing ongoing concerns about labor market conditions.

Looking ahead, attention turns to economic data, including the government’s delayed November employment report, which will also incorporate revised figures from October.

Prime Intelligence

Historic Year

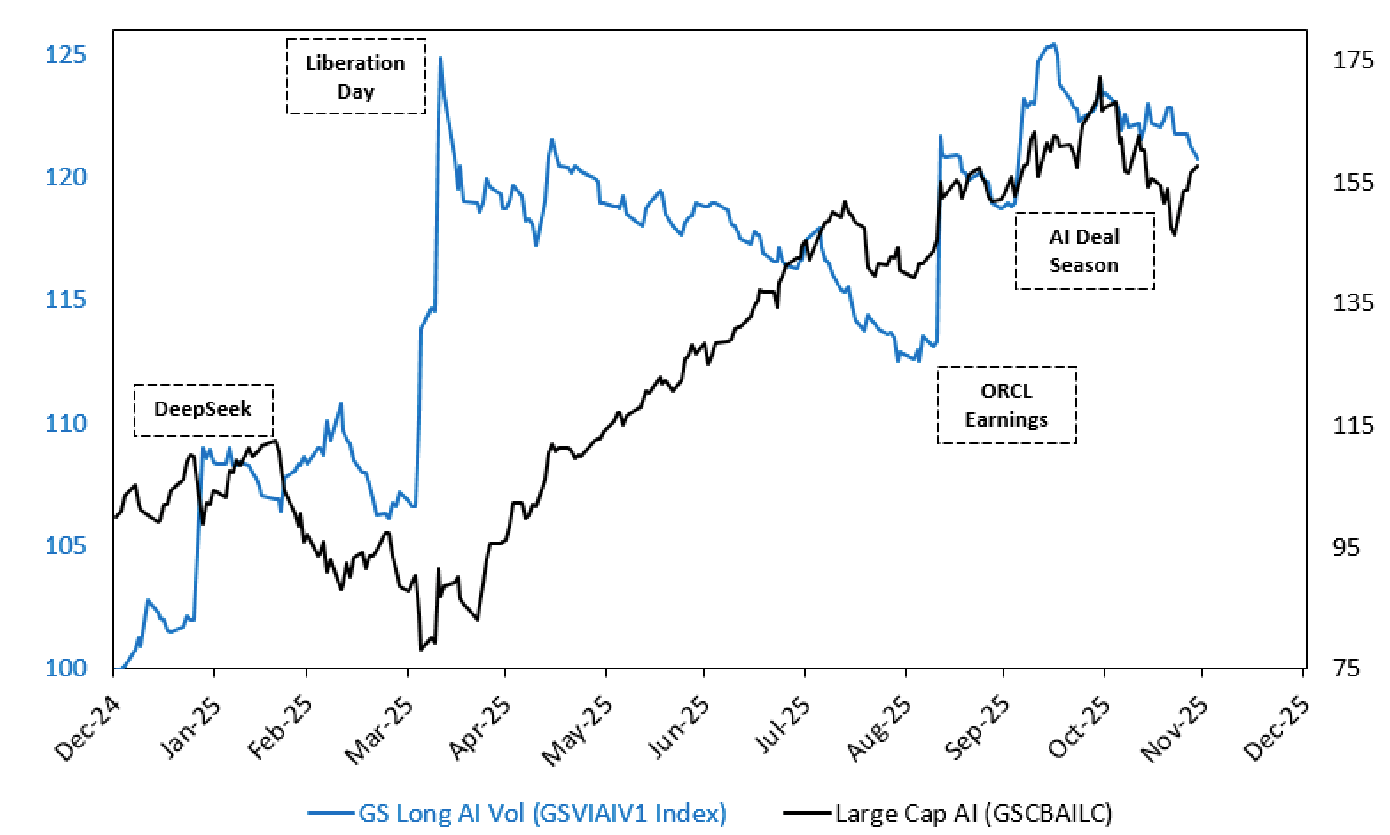

The week before President Trump’s inauguration marked a high point for American AI companies, with stocks surging and investor confidence near its peak.

Then came the “DeepSeek Monday”, a sudden reality check that rattled the widespread belief in unchallenged U.S. dominance in artificial intelligence.

Markets sold off sharply through Liberation Day, reaching stress levels seen only a handful of times in history, comparable to the Global Financial Crisis and Covid. That only lasted one week.

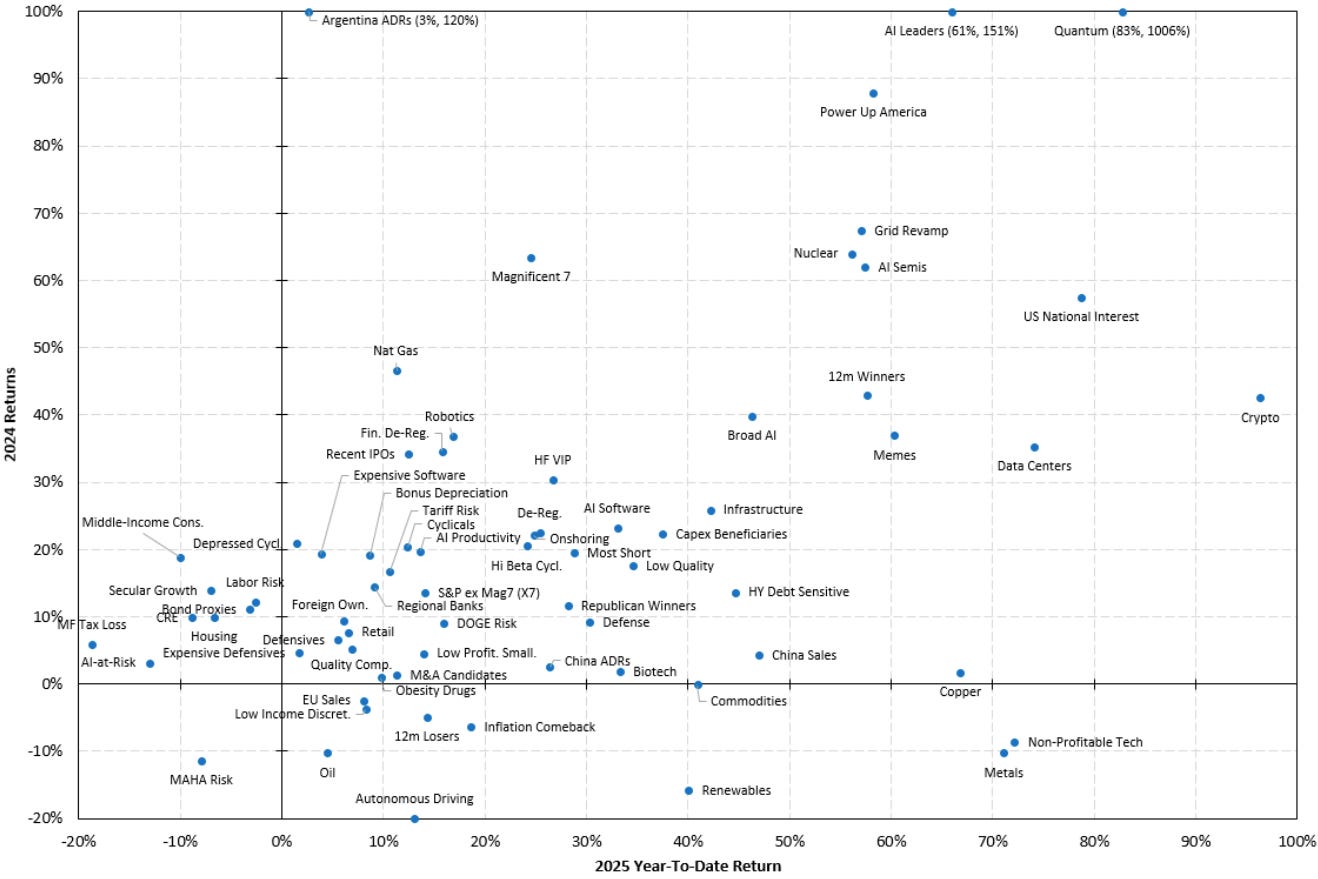

Since then, markets rallied and started pricing in rate cuts mid-summer onwards. While at the index level it looks like things may be starting to calm down into year end, it’s worth highlighting that volatility in factors is currently extremely elevated. This is how we are ending things relative to the prior year:

The Market Brief

📰 In today’s brief, we break down institutional fund flows and market positioning to get a clearer picture of what may come next.

Is Friday’s selling the start of something more significant, or does the market still have room to move higher?