Are we losing momentum?

Hey team.

We've got another market brief on $ES for you.

Let’s discuss today’s session and look at some of the references to trade in the overnight.

Market Evaluation

The May stock rally faced hurdles on Tuesday, as investors were divided on whether the market could maintain its upward momentum amidst various economic factors.

Stocks have been trying to make a comeback after April’s rout, with gains fueled by prospects of Federal Reserve rate cuts and solid earnings.

Investors are capitalizing on the momentum from late last week, buoyed by recent U.S. jobs data that eased worries of an overheating economy.

Fed Chair Jerome Powell's dismissal of an interest rate hike as the central bank's imminent action further fueled investor confidence.

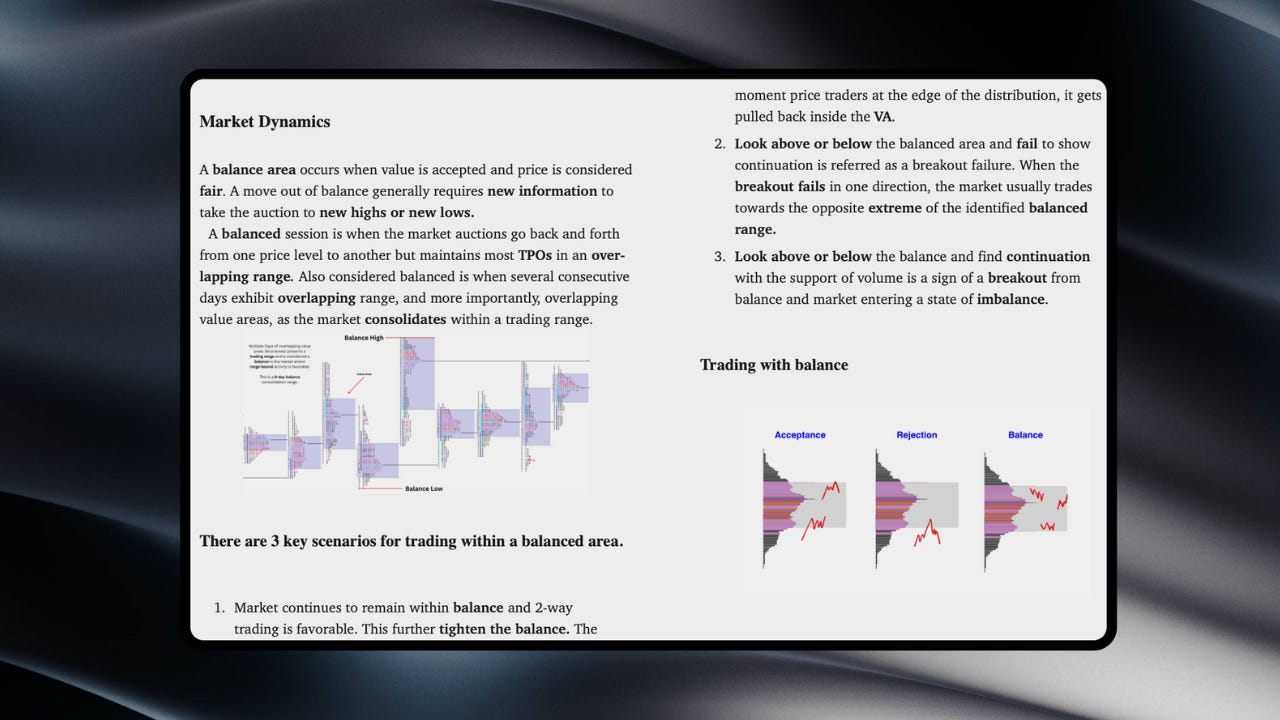

Introductory eBook to Market Profile & Order Flow

If you’re a follower of our market reports and newsletters, you know that we implement market profiles in order to read structure and look for key references in the market.

We’ve written up an eBook that explains all the introductory things you need to know about market profiles, auction market theory and order flow.

Markets Breakdown

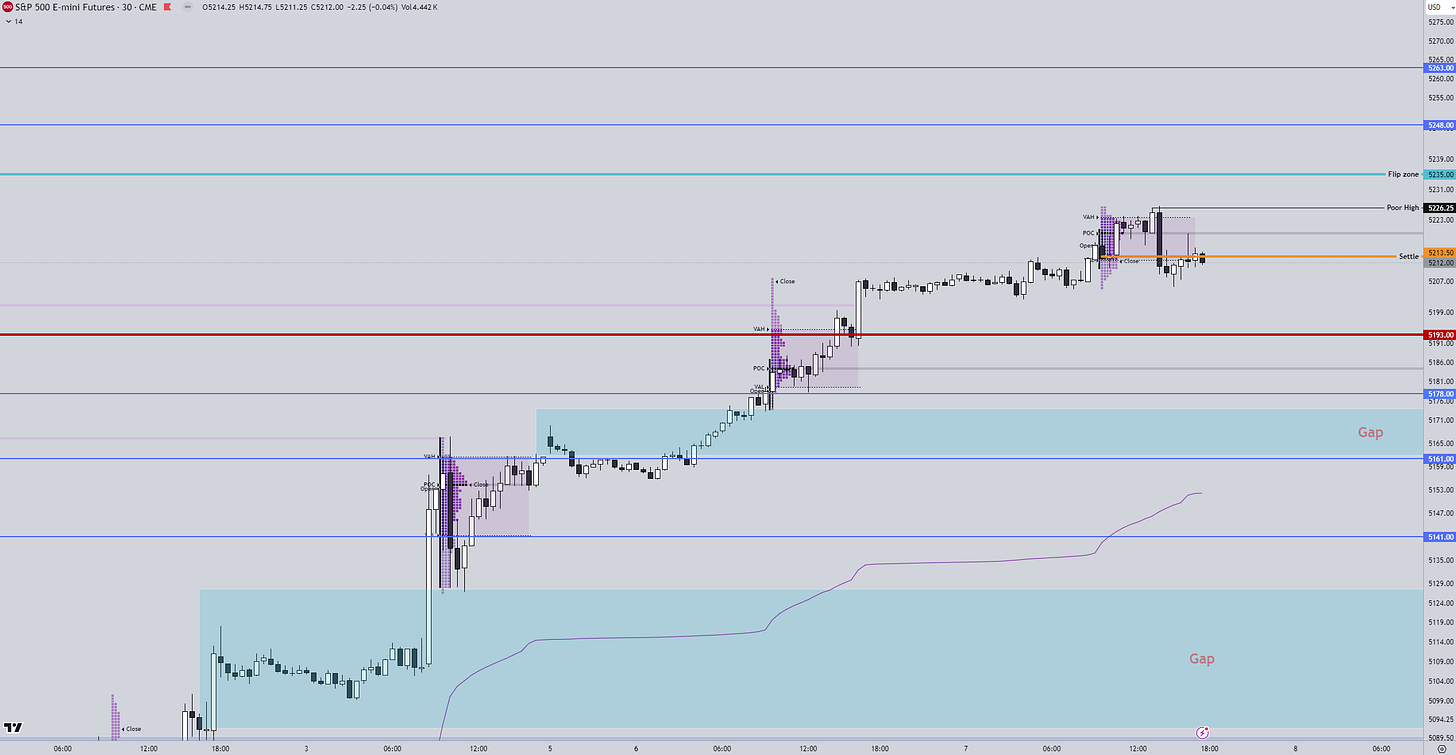

Market struggled to gain any meaningful momentum to the upside today with a pullback towards the settle to wipe the session’s gains.

Aggressive sellers stepped in on the pm hours to push the market lower towards the settle where passive buyers absorbed the move with the session looking at some minor gains.

This has left a poor high towards 5226 that we want to see excess above. While this is a single data point to note, the important thing is that we yet again build value higher.

The market is on a “phase” of imbalance, continuously building value higher.

What we want to monitor heading in tomorrows session is if the closing weakness of today’s close, carry over to the overnight session and potentially start forming a range with overlapping value to the downside on the US session as the market is seeking it’s next balance range.

ES

Some references we’ll be looking thought-out the overnight heading into tomorrow:

Upside Levels: 5235/5248/5263

Downside Levels: 5193/5178/5161

That’s all we got!

Like this post, share it with a friend.

We’ll see you again on the next one!

Oh, if you want access to our premium TradingView, NinjaTrader, or Sierra chart suite, go check them out on our website here.

Also, be sure to check out our one-time purchase products over on our Gumroad here that also include a FREE Trading Handbook!

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.