back to range-bound

Hey team.

We've got another market brief on $ES for you.

Let’s jump in!

Impact Snapshot

Jobless claims jump to highest level in ten months

US producer prices surprise with biggest decline since October

Tomorrow: Consumer Sentiment

Market Evaluation

The S&P 500 and Nasdaq registered record closing highs for a fourth session in a row on Thursday while Treasury yields dropped due to expectations that the Federal Reserve will cut rates this year amid indications of disinflation.

The Fed on Wednesday projected only one rate cut this year after its outlook in March included three quarter-percentage-point reductions.

The producer price index experienced an unexpected decline, marking the largest drop in seven months and indicating a moderation in inflationary pressures.

Several categories contributing to the Fed's preferred inflation measure, the personal consumption expenditures price index, showed softer prices in May compared to the previous month.

Sierra Chart Suite

When the market reaches new all-time highs, identifying points of interest can be challenging without a clear strategy or the appropriate tools.

Yesterday’s market report highlighted a key pullback zone which we identified using our Sierra Suite before the US open. This pivot at 5417 had an unusual buying activity and was a key area to look for potential buying opportunities for rotations to the upside. Despite this being one of the most volatile session of some time, we managed to capture the absolute top and bottom of the whole session within our references. Read the update here.

Markets Breakdown

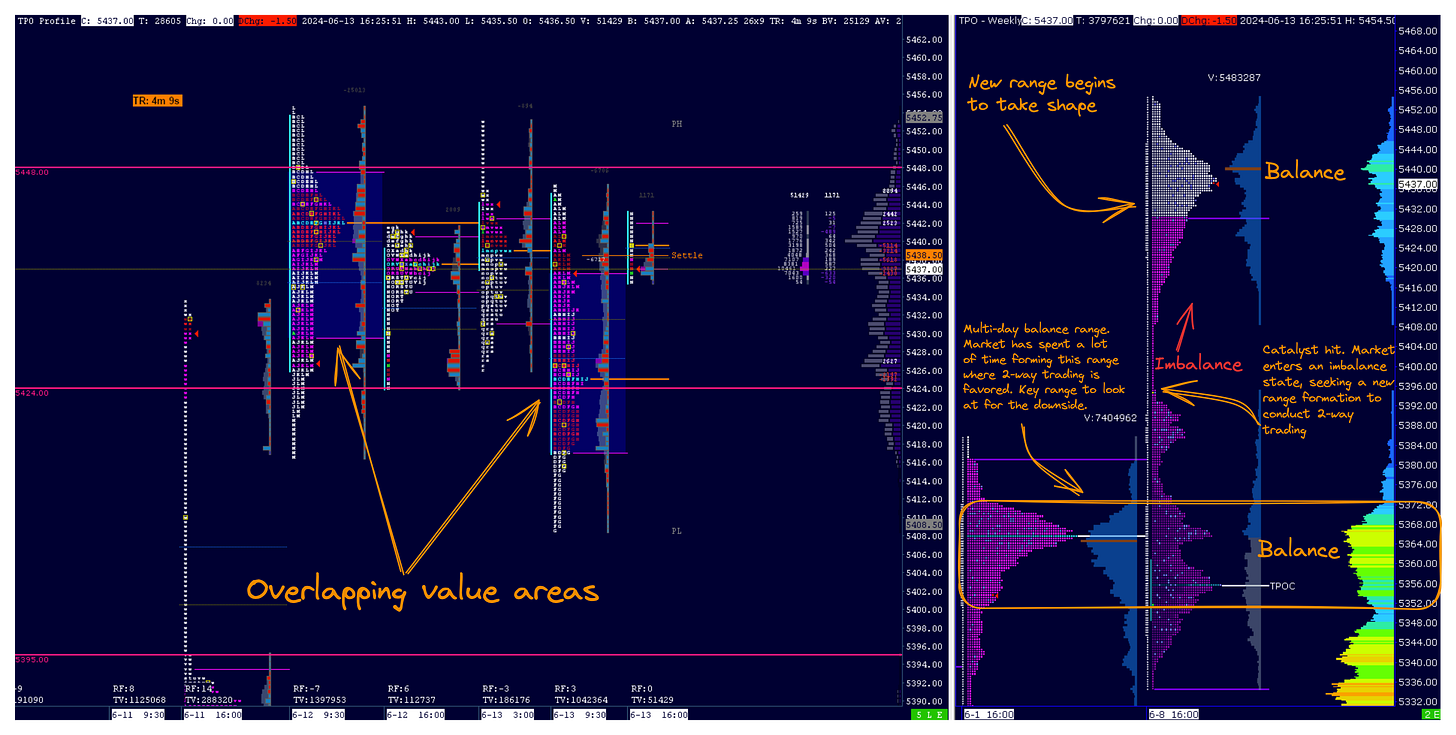

The speculations of today’s market report posted over on X here became reality once again after the market was seeking to form a new balance range.

We always say that the market is creating ranges which can last several days until there is some type of catalyst to break from that range.

After the inflationary reports and rates were conducted on the economical report front, we were looking for range-bound activity within yesterday’s range with overlapping value areas.

The market is now on a 2-day balance range and the best case scenario is to continue building value and establish acceptance above 5400s.

On the chart below we visualise how the market spends time on ranges with a catalyst breaking that balance. We’re likely going to continue the same theme to close the week, with overlapping value areas to further tighten that balance.

ES

Some points of interest we’ll be looking heading in tomorrows US session

Upside Levels: 5448/5472/5485

Downside Levels: 5424/5395/5380

That’s all we got!

Like this post, share it with a friend.

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.