Back to value

Hey team. Thursday’s session saw an 80-point rejection off of today’s first upside reference shared this morning. Let’s jump in and re-cap today’s session in detail!

Impact Snapshot

Weekly jobless claims inline with expectations

Fed Chair Powell Speaks Tomorrow - 10:00am

Market Evaluation

U.S. stock indexes fell on Thursday as Treasury yields increased, driven by diminishing recession concerns and the gathering of global central bank officials at the Jackson Hole Economic Symposium.

The moves reflected pared bets on aggressive Federal Reserve rate cuts ahead of Powell’s Friday comments.

The market is no longer debating whether the Fed will cut rates, but rather by how much and how many times they will cut before the year ends.

Jobless claims data showed the labor market is cooling only gradually rather than rapidly slowing amid elevated rates.

US manufacturing activity shrank at the fastest pace this year while existing-home sales increased for the first time in five months.

The highlight of the week is Fed Chair Jerome Powell's speech on Friday morning.

Investors are eagerly anticipating his insights on whether inflation has eased enough to support an interest rate cut next month, and whether concerns about increasing unemployment might lead to a significant reduction in borrowing costs.

Markets Breakdown

Thursday’s session offered another tick-perfect rejection off of the flip zone we’ve shared since 6:48am ET on our X. (read it here).

The role of having references is to observe how the market reacts when it reaches zones that we define as important and tone-changing.

There is no “long/short” this level and most retail traders don’t stick around long enough to find out.

You don't truly 'know' where resistance or support is until after the fact. You can speculate and assign probabilities of reversal, but until it actually occurs, it's only a possibility with many variables at play that can change at a moment's notice.

What we like doing is building a framework of potential scenarios and define some areas of importance that could turn the tides on market context.

How did it get here? Was it high confidence on high volume or was it low volume upside continuation signalling potential weakness? These are some of the questions we’re asking when we observe levels.

Despite the fact that we posted the morning brief at around 7:00am ET, when no news or no “FED speakers” could have possibly reported anything, we were still looking at the same exact thing.

Being prepared means you’re not surprised when something does happen and you’re ready to act on a moment’s notice when it does happen.

ES

Some references we’ll be looking going forward:

Upside Levels: 5614/5626/5648

Downside Levels: 5570/5561/5545

That’s all we got!

Like this post, share it with a friend.

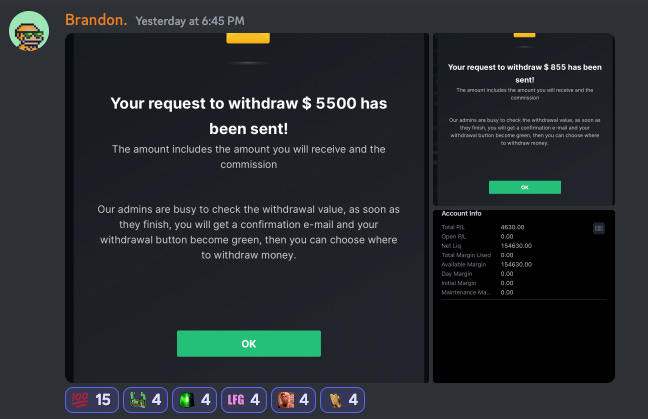

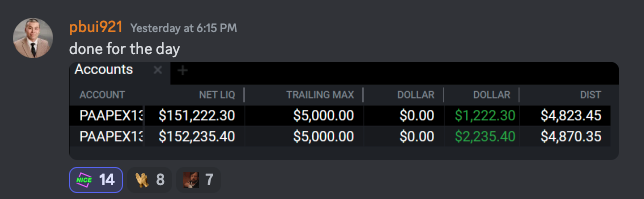

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.