Big swings ahead

Hey team. The all-important NVDA earnings are upon us, with the market expecting high volatility as we approach the market close tomorrow.

Let’s recap today’s session and see what’s next!

Impact Snapshot

NVDA 0.00%↑ Earnings - Wednesday afterhours

US Consumer Confidence Rises Slightly in August

Market Evaluation

The S&P 500 closed higher on Tuesday with traders anticipating the upcoming economic data later in the week that may offer insights into the potential direction of interest rate cuts.

Market is awaiting Nvidia’s results for clues on whether the artificial-intelligence euphoria that’s powered the bull market has more room to run.

U.S. consumer confidence reached a six-month high in August, driven by more positive perceptions of the economy and inflation, which outweighed declining optimism about the labor market.

Investors will look to July Personal Consumption Expenditure data due on Friday for additional hints at the potential pace of rate cuts.

Markets Breakdown

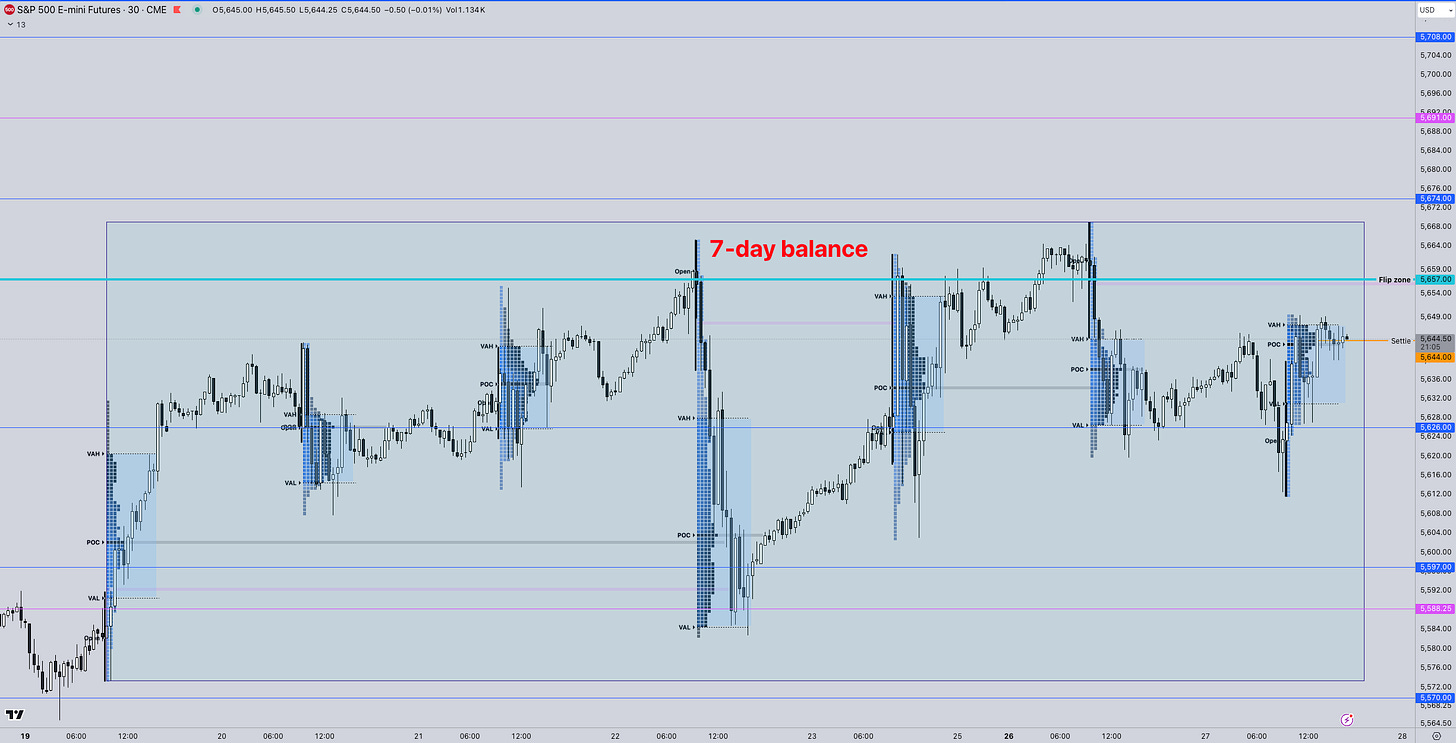

Market has aligned with our expectations of remaining well within it’s balance range and rotating from balance high to lows in anticipation of Wednesday’s catalyst.

As we say, markets balance/form ranges until there is a catalyst to break from that balance range.

Monday was a look above and fail, with a textbook bearish follow up exactly as we’ve written it, with the final destination towards the mid balance. Read update here.

The carrying weakness from Monday’s session showed up on Tuesday’s overnight with the market seeing a pullback that bounced exactly on our pivot from today’s market plan. Read it here.

When market is approaching a reference point, you want to see it accompanied by higher volume on the way there.

The market lacked momentum to break key support and bounced back towards the balance highs. Read update here.

Heading in Wednesday’s session, the same exact balance guidelines are applicable. If the market fails to get meaningful continuation above balance highs, we’re likely going to see a complete rollover towards the balance lows.

ES

Some references we’ll be looking going forward:

Upside Levels: 5657/5674/5691

Downside Levels: 5626/5597/5588

That’s all we got!

Like this post, share it with a friend.

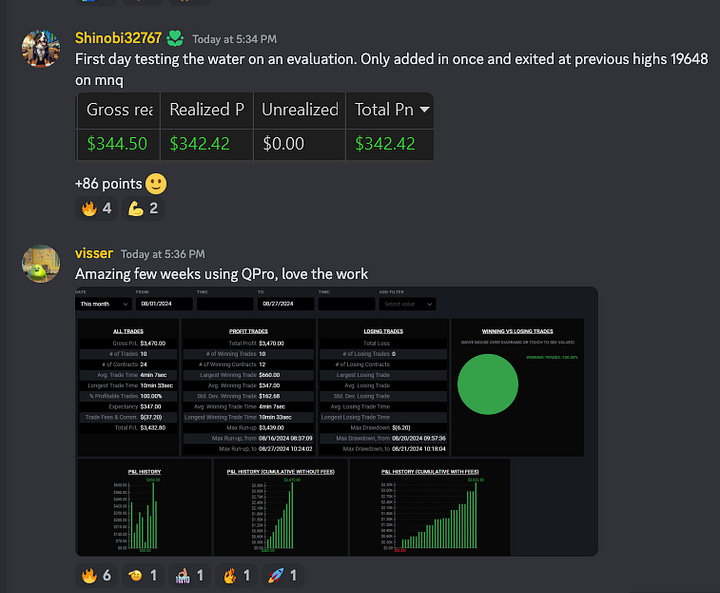

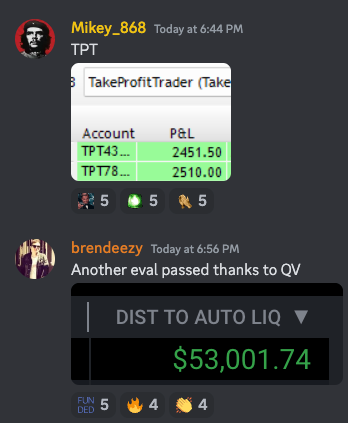

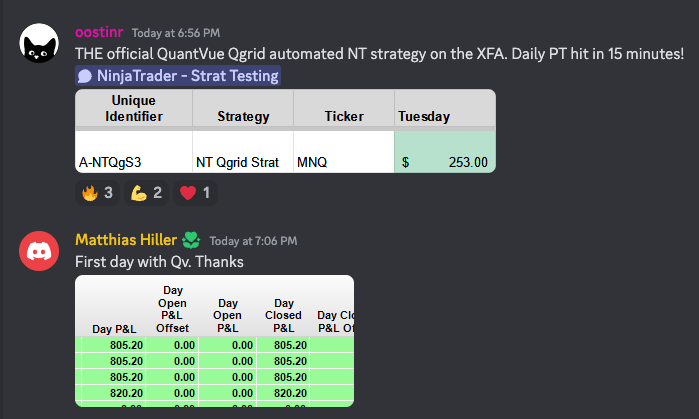

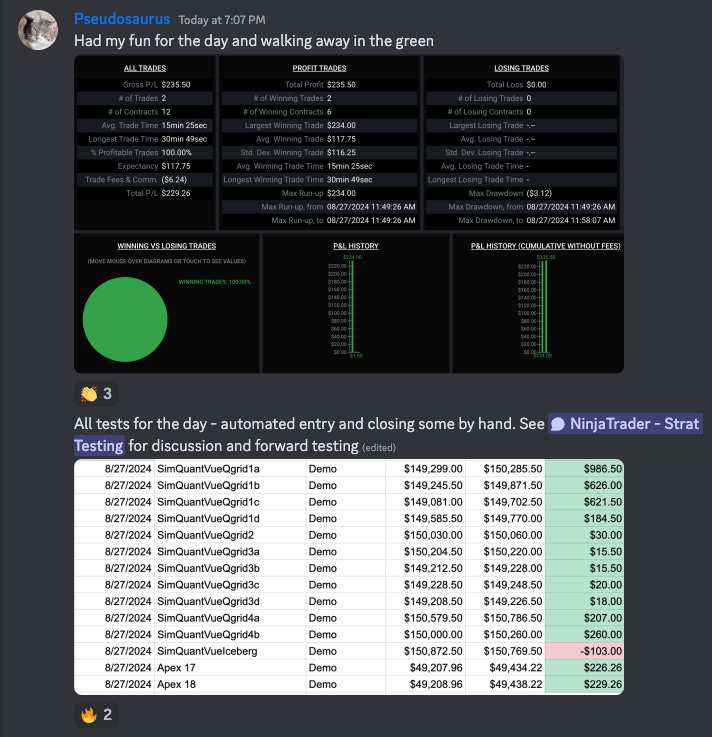

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.