Bracing for volatility ahead

Hey team.

We've got another market brief on $ES for you.

S&P500 and Nasdaq closing higher to fresh records as the market is anticipating the key earnings of NVDIA.

Let’s recap today’s session and see what’s next for the markets!

Impact Snapshot Tomorrow

FOMC Meeting Minutes - 2:00pm

NVDA 0.00%↑ Earnings - Afterhours

Market Evaluation

Stocks climbed to another record high in anticipation of the results from Nvidia, the prominent chipmaker central to the artificial intelligence revolution driving the bull market.

Fed comments today said that a continued softening in data over the next three to five months would allow the central bank to consider lowering borrowing costs at the end of 2024.

April consumer price figures were a reassuring signal price pressures are not accelerating and suggest progress toward the central bank’s 2% goal has likely resumed.

The main focus will shift on the PM hours tomorrow with FED FOMC minutes at 2:00pm and the key earnings of NVDA 0.00%↑ after the close.

How to use the New Volume Footprint on Tradingivew

Markets Breakdown

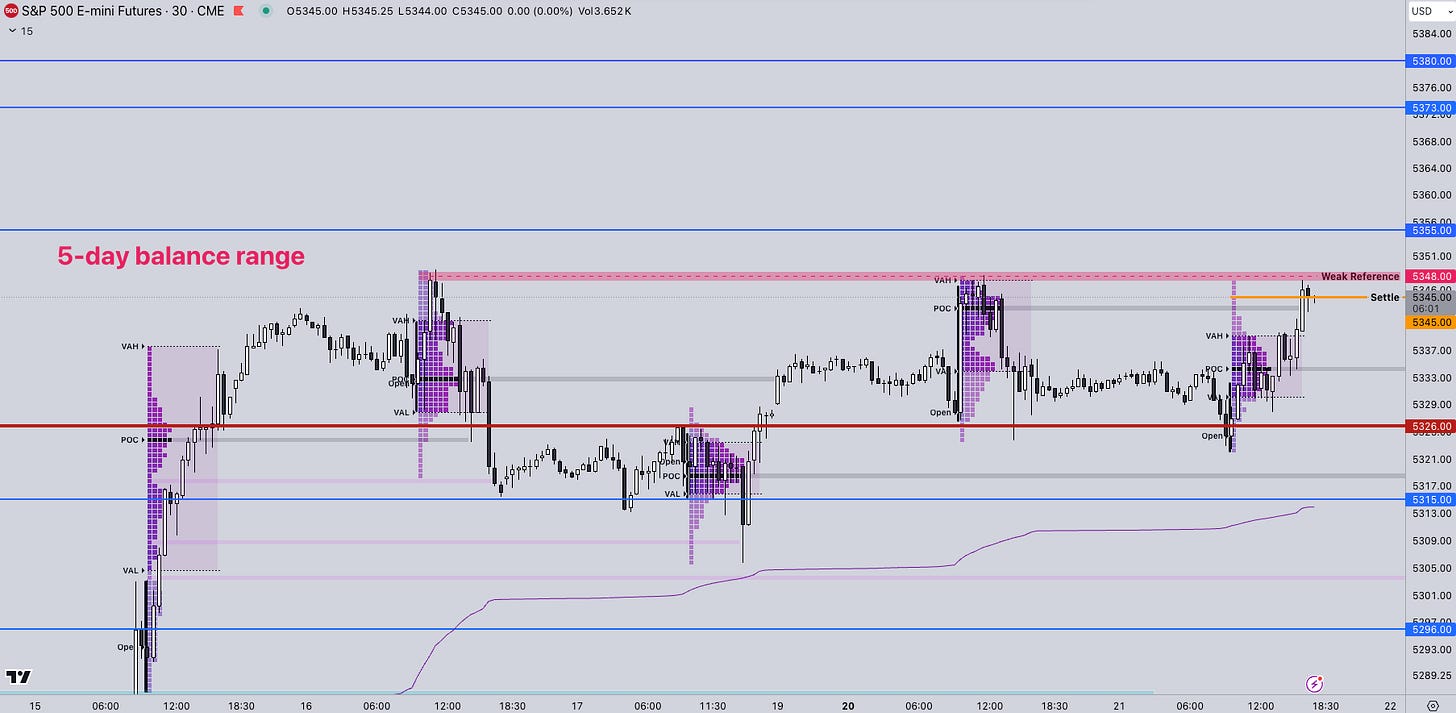

Markets likes to balance prior to key economical reports/upcoming catalysts and we’ve been experiencing precicely that with a 5-day balance formation.

Market is bracing for a spike in volatility tomorrow with those “catalysts” that can drive markets in an imbalance state such as the NVDA 0.00%↑ earnings.

Today the session traded with low confidence and managed to close just below the weak reference we’ve been showcasing since yesterday as a “poor ATH” at 5348.

The more times you poke a point of interest the weaker it becomes. It will not be unusual to see the market attempt to break above this level within the overnight session.

We’ll exercise caution with shorts around this area as the market will likely spike higher the moment we poke above this reference going into the US open tomorrow.

As we often say, it’s better to be a bit late to move than being too early.

ES

Some references for navigating the overnight going into tomorrow:

Upside Levels: 5355/5373/5380

Downside Levels: 5326/5315/5296

That’s all we got!

Like this post, share it with a friend.

We’ll see you again on the next one!

Oh, if you want access to our premium TradingView, NinjaTrader, or Sierra chart suite, go check them out on our website here.

Also, be sure to check out our one-time purchase products over on our Gumroad here that also include a FREE Trading Handbook!

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.