Buckle up

Hey team.

The much anticipated CPI and interest rates will shape for a volatile session tomorrow. Let’s look at all the things that we’ll be focusing on.

Impact Snapshot

CPI Inflation - 8:30am

Fed Interest Rate Decision - 2:00pm

FOMC Press Conference - 2:30pm

Market Evaluation

The S&P 500 and Nasdaq ended higher on Tuesday, helped by sharp gains in shares of AAPL 0.00%↑ while investors were also anticipating the upcoming consumer price index data and a policy announcement from the Federal Reserve.

With the Fed widely expected to hold borrowing costs at a two-decade high on Wednesday, there’s less certainty on officials quarterly rate projections, known as the “dot plot.”

FOMC members will release updates to their Summary of Economic Projections, which could be influenced by the CPI report.

Market participants have adjusted their outlook on the Federal Reserve's rate cut timeline, now estimating a roughly 50% probability of the first rate cut occurring in September, based on the CME's FedWatch tool.

Markets Breakdown

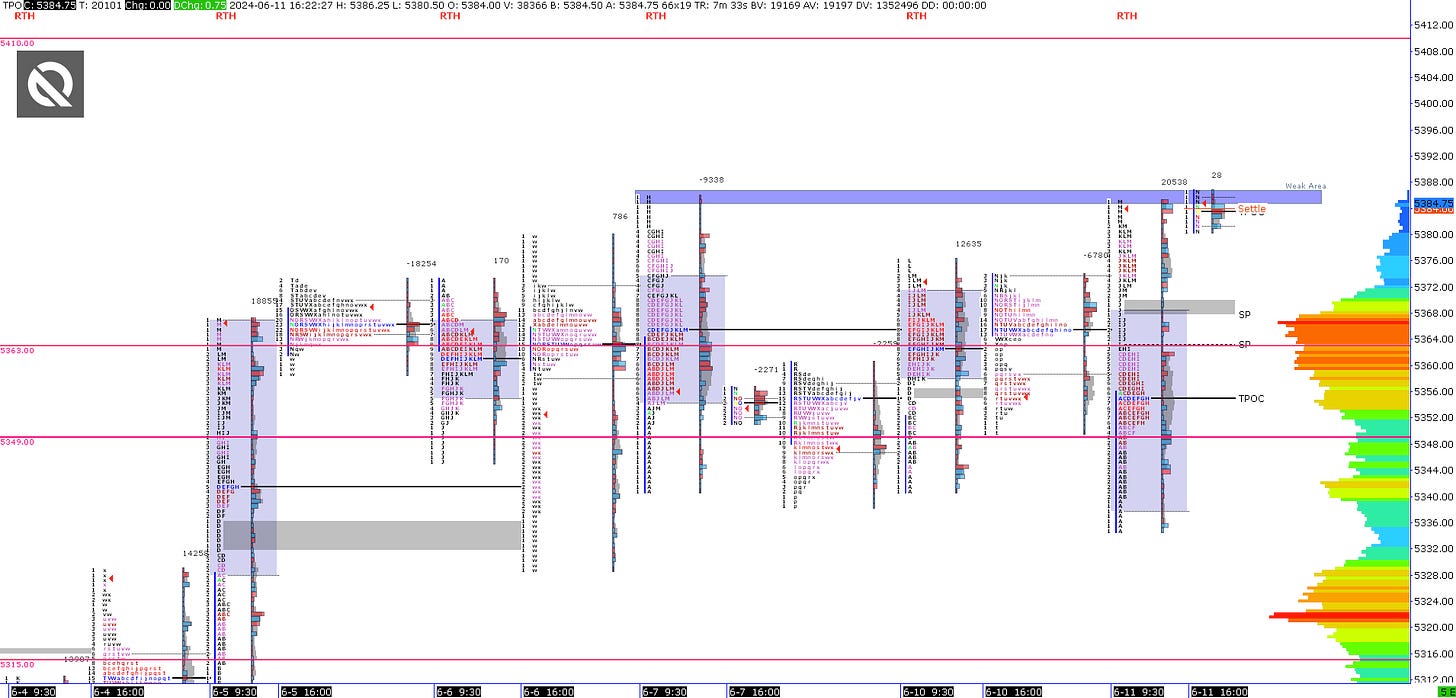

Following up on our last newsletter, our expectations of the market remaining within balance in anticipation of Wednesday’s catalysts couldn’t have been more accurate.

Both Monday and Tuesday saw rotational activity within the balance formation that took place last week. Expectations for range-bound activity help us refrain from trading on unfavorable positions.

Early this morning on our market report posted here we were looking for yet another rotational activity with the bottom landing on our key pivot at 5333 for rotations to the upside. Read updates here.

Heading in tomorrows session there are two nuanced areas we’ll be focusing on.

Containing activity inside the upper distribution left in today’s US session is a sign of strength for continuation.

The overlapping highs of Friday and Today’s US session has left a “weak area” that we will be exercising caution with shorts until we get clear rejection signs. The more times you poke a reference, the weaker it becomes.

ES

Some point of references we’ll be using heading into tomorrow’s US open:

Upside Levels: 5411/5418/5436

Downside Levels: 5363/5349/5315

That’s all we got!

Like this post, share it with a friend.

We’ll see you again on the next one!

Oh, if you want access to our premium TradingView, NinjaTrader, or Sierra chart suite, go check them out on our website here.

Also, be sure to check out our one-time purchase products over on our Gumroad here that also include a FREE Trading Handbook!

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.