Calm before the storm?

Hey team.

We've got another market brief on $ES for you.

Let’s re-cap today’s session and see what’s next for the markets!

Impact Snapshot

US Consumer Confidence Weakens Slightly in June

Market Evaluation

A rebound in NVDA 0.00%↑ shares led the S&P500 and Nasdaq Composite higher on Tuesday, a day after a sell-off in the chipmaking giant.

On Monday we’ve seen some rotation into some of the value areas of the market like financials, energy, and utilities.

This is a classic end of quarter re-balancing by portfolio managers.

Consumer confidence edged lower in June as did the near-term outlook for business conditions

The biggest event on investors radar for the week is Friday's personal consumption expenditures (PCE) price index report, the Fed's preferred measure of inflation.

Markets Breakdown

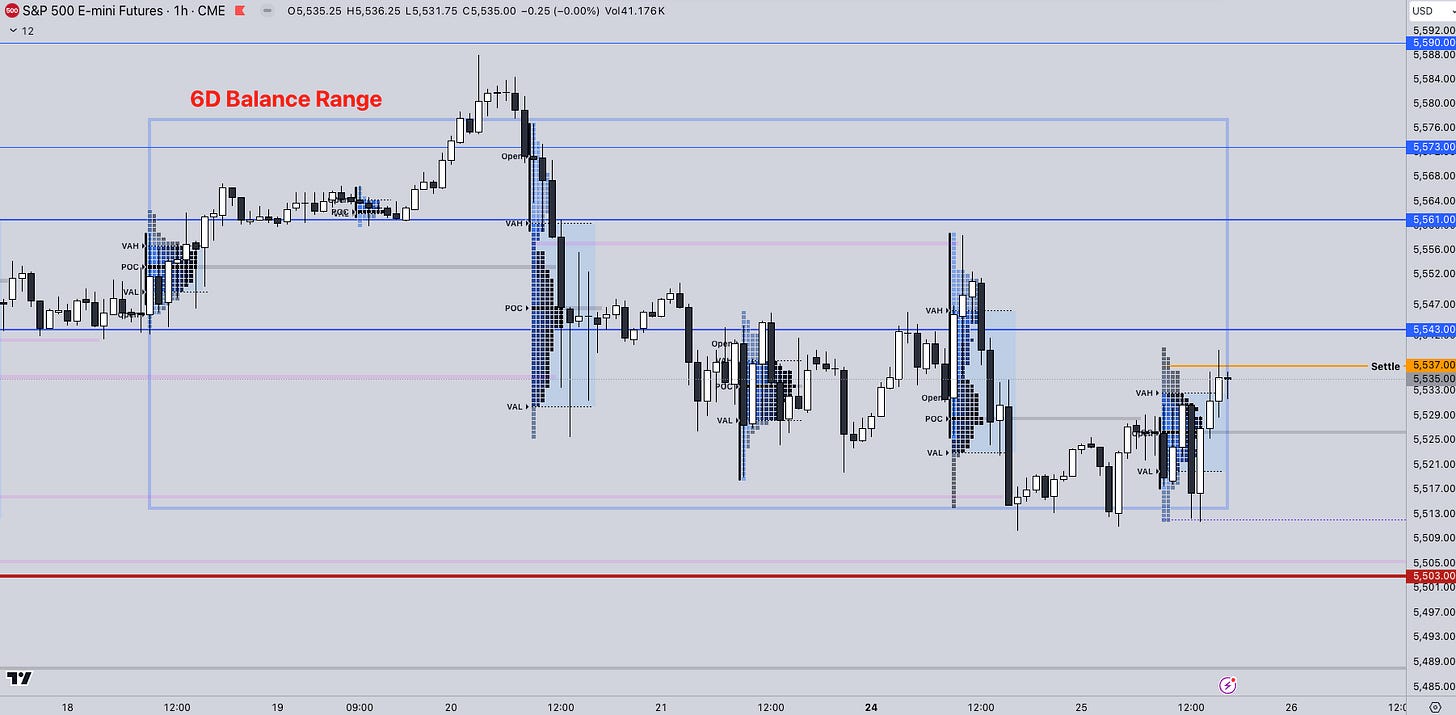

Our market evaluation today was seeing a market that was going to stick to it’s range bound environment rather than being too quick to look for a break on a day with absence of catalysts to drive such a move.

This morning on our market report (read it here), our expectations for the market was the continuation of the range-bound environment that we’ve been seeing in what was a 5-day balance range and refrained from counting on directional moves for the day.

This played turned out to be the exact market moves we’ve seen all day with the session seeing range-bound activity which was contained within the settle & flip zone pivots (read update here).

Markets range/balance until there is some type of catalyst to drive big directional movements, which also usually leave gaps. These can be any type of fundamental information such as economical reports, political events etc.

We’re going to be getting both to close the week so it will not be unusual to start seeing some volatility entering the market starting tomorrow.

ES

Some key areas we’ll be looking thought the Globex session:

Upside Levels: 5543/5561/5573

Downside Levels: 5520/5503/5482

That’s all we got!

Like this post, share it with a friend.

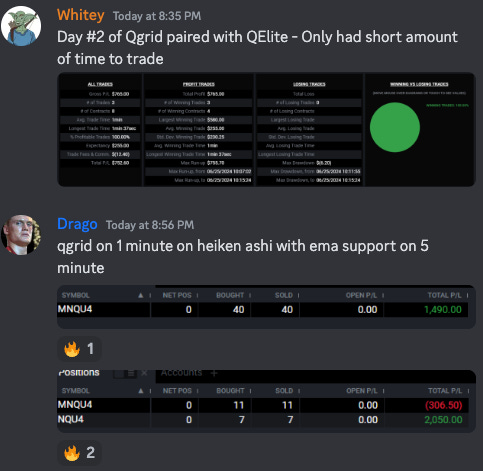

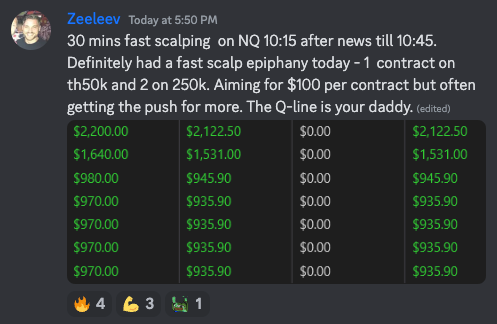

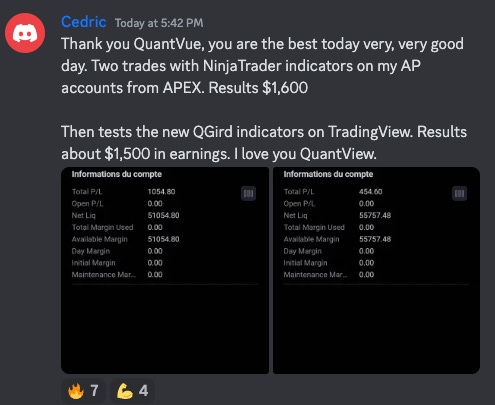

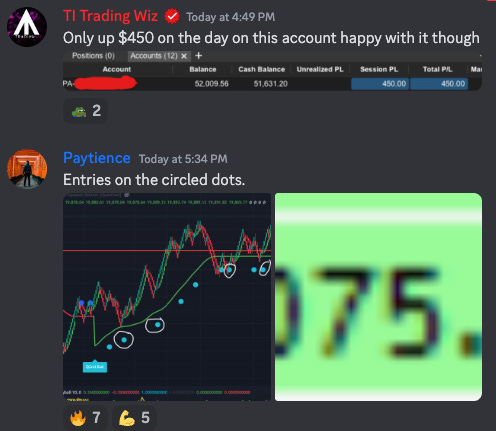

Oh… here’s some incredible QuantVue Pro Member results from this wee

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.