can tech keep carrying?

Hey team.

We've got another market brief on $ES for you.

Let’s discuss today’s session and see what’s next for the markets!

Impact Snapshot

Jobless claims stay near a 10-month high

Market Evaluation

Stocks retreated after a rally to all-time highs spurred calls for a near-term pullback amid signs of buyer fatigue.

Bullish momentum remains intact for the S&P 500 and Nasdaq, but near-term overbought conditions coupled with deteriorating breadth make equities vulnerable to a pullback or correction.

While the S&P 500 has set 31 new records this year, few of its members outside of technology have participated in the advance.

Investors evaluated recent economic data and commentary from Federal Reserve officials to determine the timing of interest-rate cuts this year.

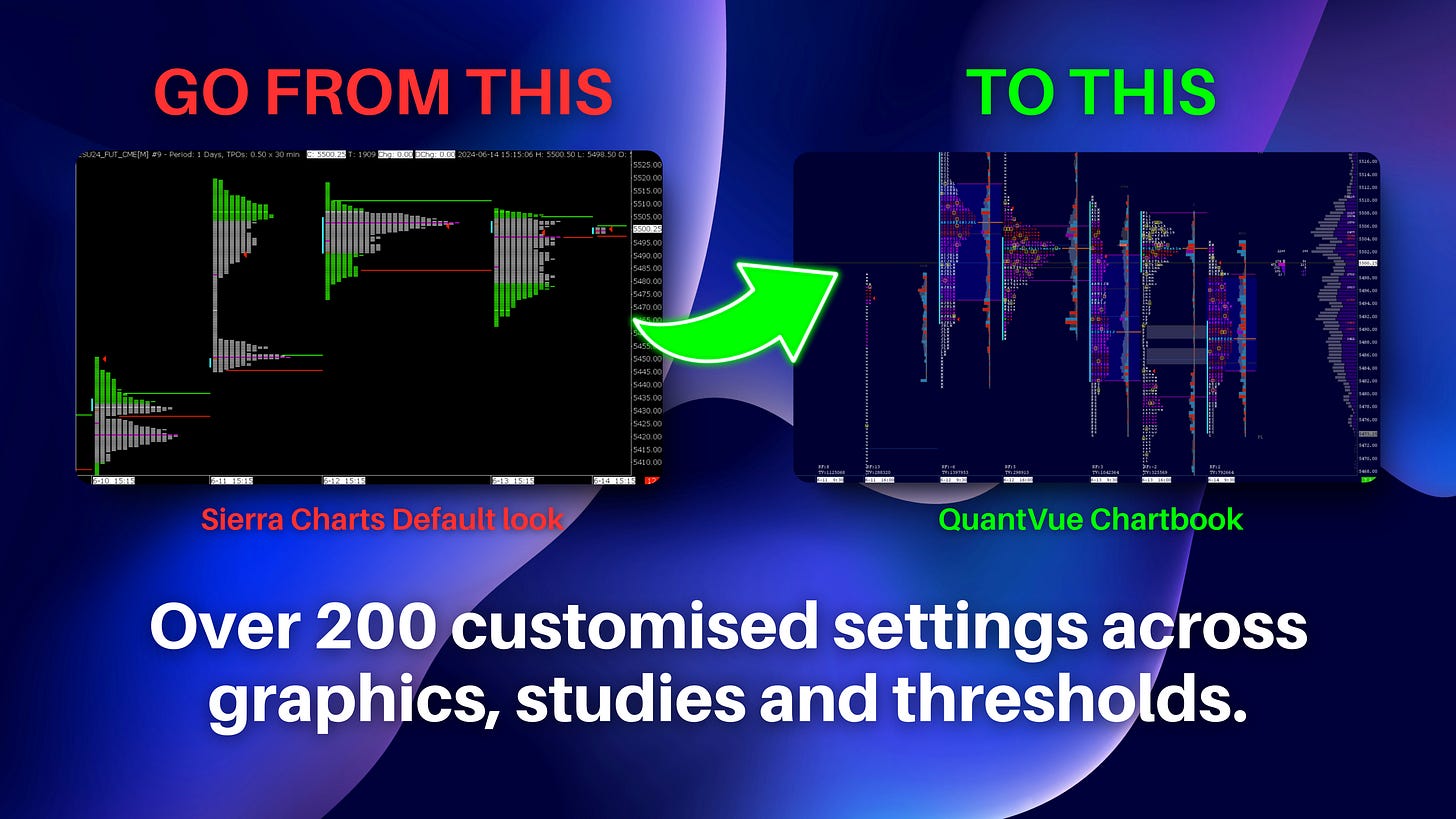

Sierra Chart Workshop

We’re now offering individual chartbooks specifically tailored around each future market for the Sierra Charts platform. Check them out!

Markets Breakdown

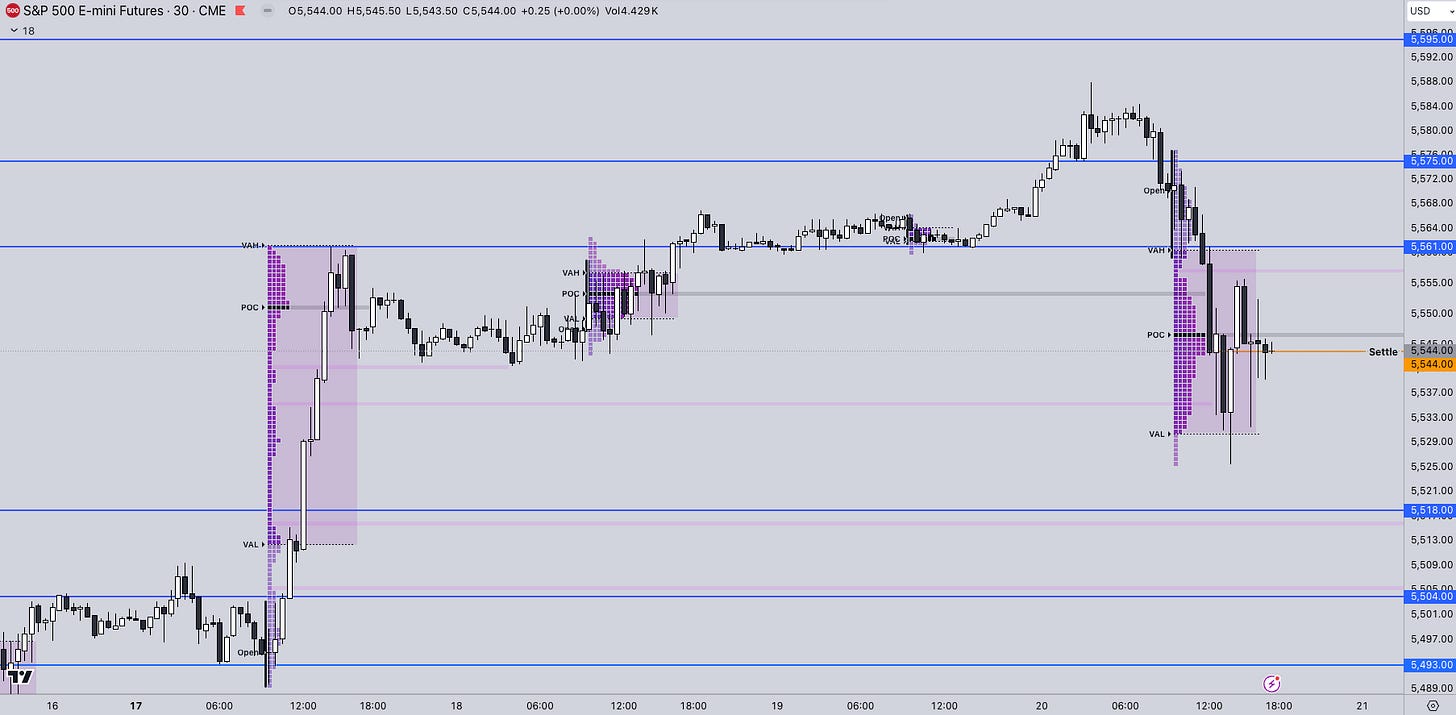

Today was a typical bull trap with the market wiping the overnight extension with a pullback right back into balance.

Our view this morning posted on X here gave clear warnings that this market was over extending to the upside with absolute no confirmation of acceptance of higher prices.

Market followed up with an initial pullback & bounce off of the pivot at 5564 then settle before we rotated back inside Monday’s value, completing our bearish scenario for the day. Read the update here.

Heading into the weekly close, the market has now established a 2-day balance range inside and Thursday’s session has left a double distribution.

Monday’s range has still left a lot of single prints and like we’ve said previously, market likes to return to fill these back in at some point.

Any meaningful continuation will want to see acceptance back inside the upper distribution with a flip of the key resistance 5561 as support for upside follow up while on the downside, we still got plenty of room to rotate lower to fill these single prints with support at the highs of the previous range.

ES

Some points of references going into weekly close:

Upside Levels: 5561/5575/5595

Downside Levels: 5518/5504/5493

That’s all we got!

Like this post, share it with a friend

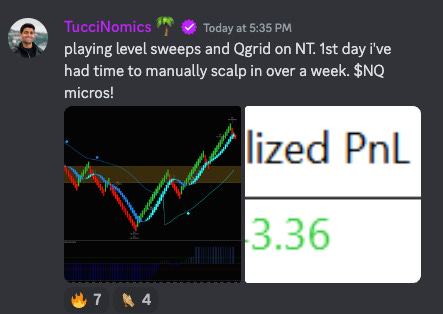

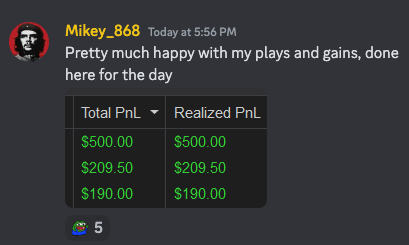

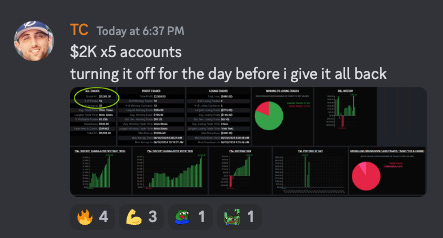

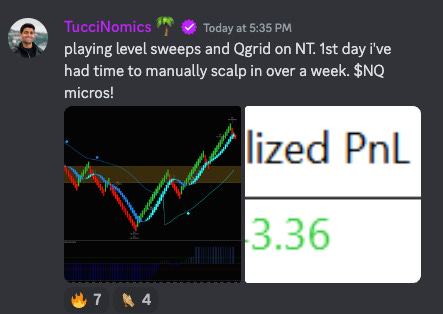

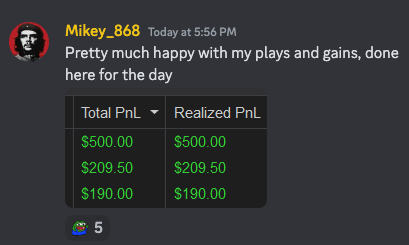

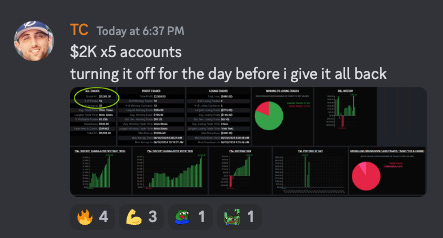

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.