Catalysts offer opportunities

Hey team. The much anticipated volatility has began and it is far from over. Let’s re-cap today’s session and see what’s next for the markets!

Impact Snapshot Tomorrow

Non-Farm Employment Change

Employment Cost Index

Federal Funds Rate

Key Earnings: META 0.00%↑ MA 0.00%↑ QCOM 0.00%↑ BA 0.00%↑

Market Evaluation

The world’s largest technology companies saw their losses deepen in late trading hours after MSFT 0.00%↑ results raised concerns that the AI frenzy driving the bull market might be overextended.

A sharp sell-off in Big Tech has pulled the Nasdaq 100 Index down by 9% from its peak, putting it on the brink of a correction.

U.S. consumer confidence unexpectedly rose in July, but remained in the tight range of the past two years amid lingering worries about inflation and higher borrowing costs.

Job openings in the U.S. dipped again in June and the number of people quitting fell to a nearly four-year low as the labor market continued to cool, paving the way for the Federal Reserve to cut interest rates soon.

According to the CME Fedwatch tool, the market is betting on a slight chance that the Fed will cut rates by at least 25 basis points at the end of its policymaking meeting on Wednesday, but it is completely pricing in a cut for the U.S. central bank's September meeting.

If the Fed does not signal a September rate cut, markets could get a bit ugly given recent tech weakness especially if earnings underwhelm.

Sierra Charts Suite

Adding confluence involves around understanding what other market participants are doing as well. Today’s pivot we’ve shared at 5527 as the first upside target was a key imbalance area where previous strong market participants initiated aggression and when the market retraced back towards that area, the stepped in and absorbed buyers leading into downside continuation. Our footprints on the Sierra Suite are highly customised to show those imbalances and much more.

Markets Breakdown

The much anticipated volatility began today as the slew of economical releases and megacap earnings continue throughout the week.

In today’s market report posted here , the first upside reference we’ve highlighted for the bulls to claim was 5527.

The market opened up, moved towards this reference and saw a complete rejection that rotated us all the way towards the other end of balance.

This was a very typical reaction which we’ve highlighted on Sunday’s report on the balance guidelines.

Market attempts to find acceptance but fails, leading to a complete rollover towards the other end of balance.

The bottom of the session ended up being last Thursday’s lows and the market has not broken out from the multi-day balance range which is now a 5-day balance.

As the market continues to range within the balance, the same guideline rules apply.

Look above/below and Go: Prices move above/below the balance highs/lows and find acceptance for continuation higher/lower. The destination target is double the balance area.

Look above/below and Fail: Prices move above/below the balance high/low but fail to find acceptance, making a reverse back inside the balance with destination target the other end of that balance.

ES

Some references we’ll be looking going forward:

Upside Levels: 5482/5496/5511

Downside Levels: 5423/5411/5385

That’s all we got!

Like this post, share it with a friend.

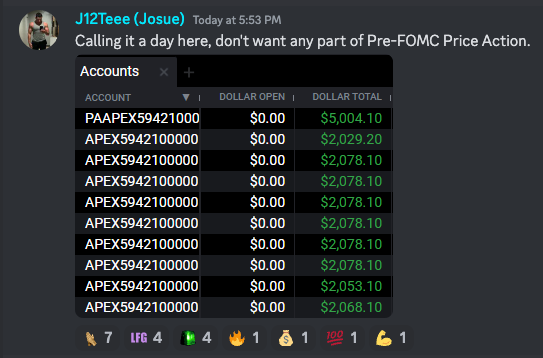

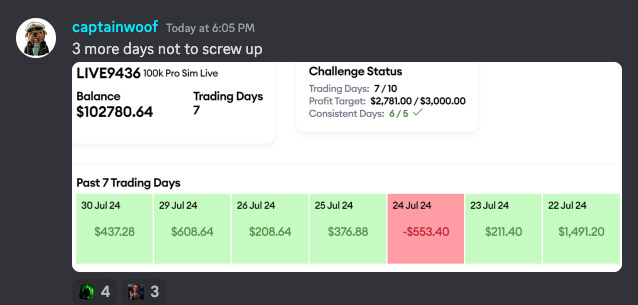

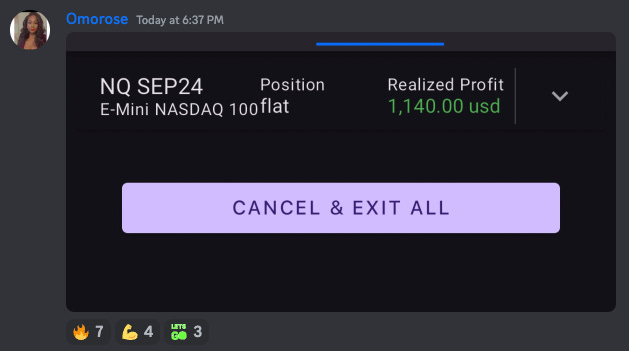

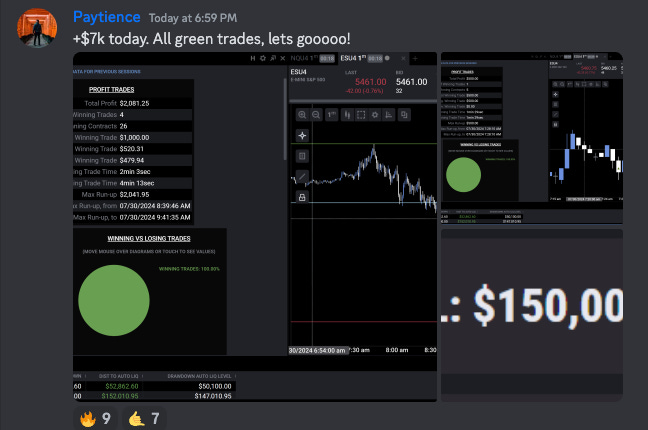

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.