Charging Horse

Wall Street wrapped up the closely watched Federal Reserve week with stocks hitting new record highs, fueled by expectations of additional rate cuts and a brighter corporate earnings outlook.

Impact Snapshot

Services PMI - Tuesday

Fed Chair Powell Speech - Tuesday

Q2 GDP - Thursday

Unemployment Claims - Thursday

PCE Inflation - Friday

Macro Viewpoint

Despite calls suggesting the market could use a short pause after the S&P 500’s nearly $15 trillion surge since April lows, optimism has largely remained in control.

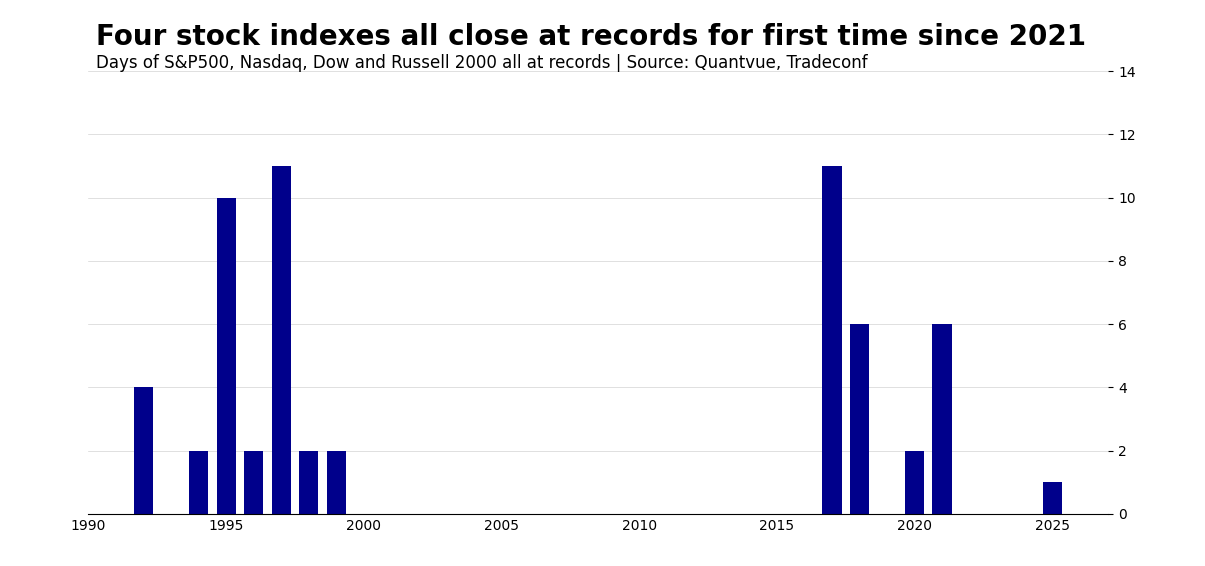

The S&P 500, Nasdaq 100, Dow, and Russell 2000 all finished up on the week, charging to record closing highs on Thursday for the first time since 2021, as the equity market rally broadened out post-FOMC.

This is a rare occurrence seen on just 25 other days this century.

Last week, US equities saw the largest net buying in 12 weeks, driven by long buys in Single Stocks and, to a lesser extent, short covers in Macro Products. Nine of eleven sectors were net bought.

Trading volume spiked into the close on Friday amid a $5 trillion triple-witching options expiry. About 27.7 billion shares changed hands on US exchanges, the third-busiest day ever.

S&P 500’s relentless momentum enters overbought territory, with technicals tougher next week as investors anticipate a pullback to enter that just hasn’t materialized, missing one of the greatest recoveries ever.

Prime Intelligence

In today’s Prime Intelligence, we share our latest insights on the state of the market. Volatility is risk, but also opportunity. This forecast of forward returns we’ve done since July remains one of the best opportunities we’ve seen in the market to date.👇

Much like our forecast for volatility compression to follow after April’s sell-off that we shared months ago in our posts, we share opinions backed by data, reducing the reliance on subjective judgment.

Does the market have more room to run? What does the positioning of discretionary and systematic hedge funds look like?

We answer these questions and share in-depth insights in today’s brief👇