Consolidating gains

Hey team.

We've got another market brief on $ES for you.

Let’s jump in!

Impact Snapshot

Powell Highlights Job Risks While Sidestepping Rate-Cut Timing

Market Evaluation

The S&P 500 notched the 36th record close of the year so far in 2024.

U.S. Federal Reserve Chair Jerome Powell informed lawmakers that additional positive economic data would reinforce the case for rate cuts.

Powell avoided providing a timeline for rate cuts but highlighted mounting signs of a cooling job market, as government data showed unemployment rising for the third consecutive month.

Fed Chair Powell is set to make another speech tomorrow at 10:00am.

Inflation data is also due this week, including Thursday's consumer price index and the producer price index reading on Friday.

Markets Breakdown

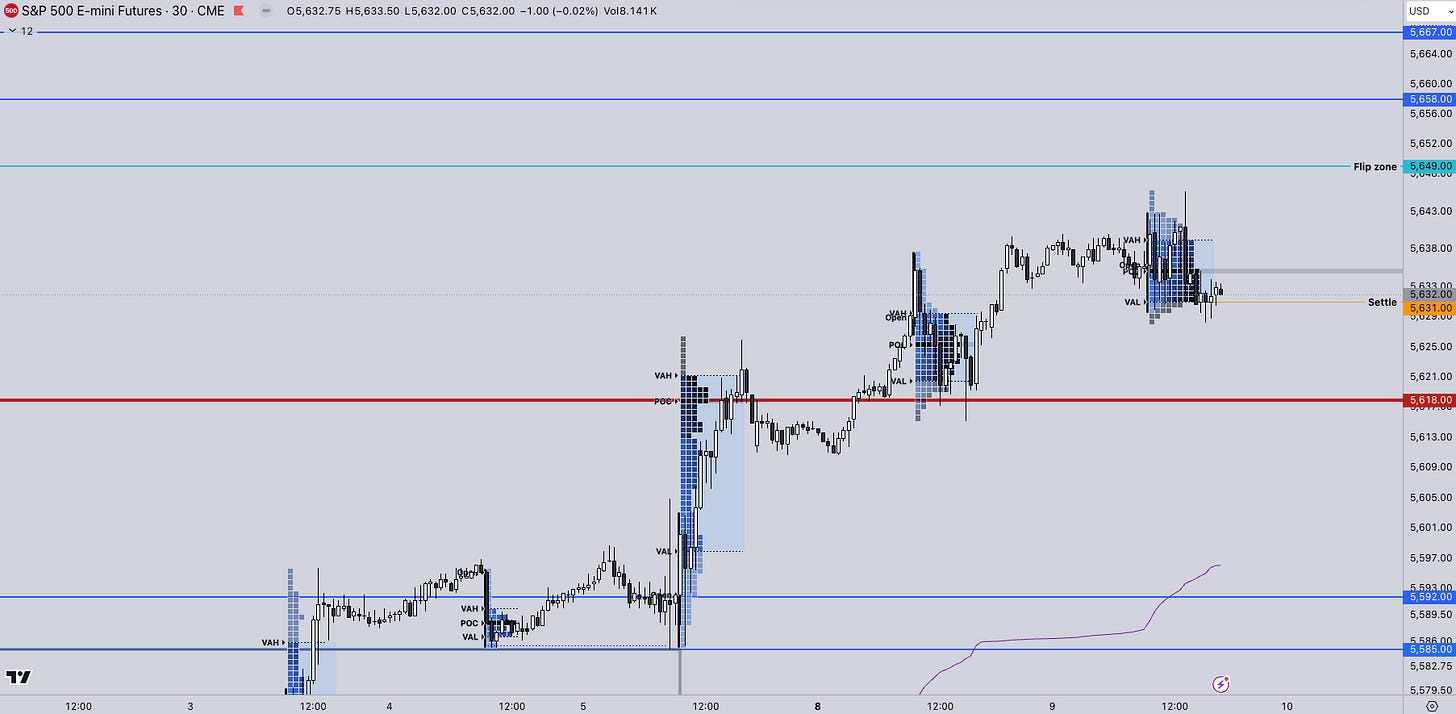

Our pre-market report posted here, highlighted two key objectives. Clearing the poor high made in overnight and containing activity above the settle.

We saw the market clearing up the overnight poor high at 5640 right at the open with some excess above followed by a session that saw range-bound activity without any major directional movements.

The US session also made a poor high on the B and C periods which we’ve highlighted live with an update on X during the session that was later cleared up with a proper excess.

Heading into tomorrow’s session, it will not be unusual for the market to try and consolidate the gains in anticipation of the key inflation reports for the weekly close.

We have overlapping value areas to the upside with clear signs of slower momentum so a re-visit lower to begin ranging and forming a balance area will be a key thing that we’ll be watching for.

As always, we’ll update our views during the market report pre-market.

ES

Some references we’ll be looking going forward:

Upside Levels: 5649/5658/5667

Downside Levels: 5618/5592/5585

That’s all we got!

Like this post, share it with a friend.

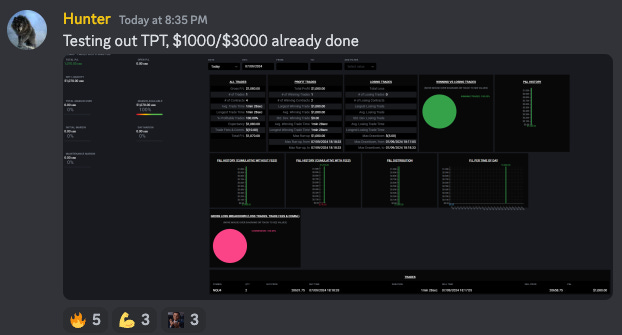

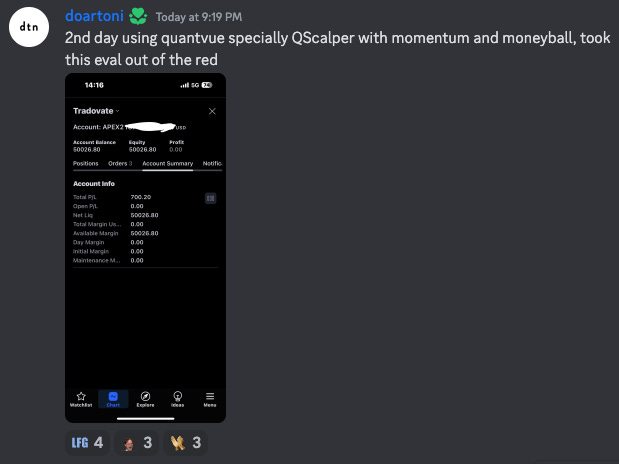

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.