Danger Zone

Hey team. US equity indices saw modest changes last week as investors continue to digest the ongoing developments in US trade policy, the Fed, and a long tail of Q1 earnings.

Let’s re-cap last week’s events and see what’s ahead for the market

Impact Snapshot

CPI Inflation - Tuesday

PPI Inflation - Thursday

Retail Sales- Thursday

Unemployment Claims - Thursday

Fed Chair Powell Speaks- Thursday

Consumer Sentiment - Friday

Macro Viewpoint

Concerns about the Trump administration's tariff policies have weighed on the stock market.

Those worries were underscored on Wednesday as Federal Reserve Chair Jerome Powell, speaking after the central bank's policy-setting committee left interest rates steady, said: "If the large increases in tariffs that have been announced are sustained, they're likely to generate a rise in inflation, a slowdown in economic growth and an increase in unemployment."

Next week's economic indicators will start showing the early impact of April's tariff announcements, including the US CPI and retail sales reports.

The focus will also be on any potential progress in any trade talks. Meanwhile, central bank speakers include Fed Chair Powell on Thursday.

Wall St. Prime Intel

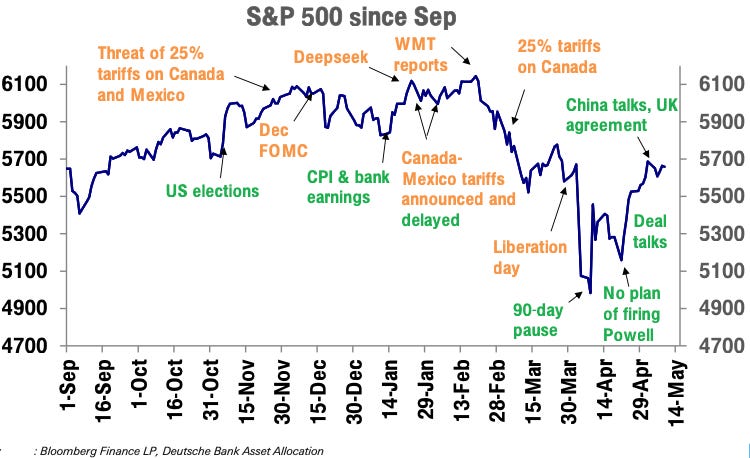

The 90-day pause, the announcement that there was no intention of firing the Fed chair, and a steady stream of news about trade talks drove the S&P 500 higher over the previous three weeks, but it has largely gone sideways over the last week, even as we have received confirmation of trade talks.

In today’s Weekly intelligence we share👇:

How is the market likely to react to the tariff deals?

Where are hedge funds and asset managers positioned?

Latest CTA updates

Technical market perspective

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.