Dead Cat or Tiger

Hey team, we’re heading into a critical dose of tech earnings and a payrolls report next week, with the S&P sitting right in the middle of the YTD trading range.

Let’s recap last week’s events and evaluate what’s ahead for the markets!

Impact Snapshot

JOLTS Job Openings - Tuesday

Consumer Confidence - Tuesday

US Q1 GDP - Wednesday

PCE Inflation - Wednesday

Unemployment Claims - Thursday

Non-Farm Payrolls - Friday

Key Earnings: AAPL 0.00%↑ AMZN 0.00%↑ MSFT 0.00%↑ META 0.00%↑

Macro Viewpoint

The S&P 500 index rose 4.6% this week, led by technology stocks amid better-than-expected earnings from a number of companies.

On one hand, the S&P sits less than 3% from a full retracement of the post-Liberation Day selloff (and the VIX index has been more than halved from the local highs). On the other hand, we’re still 11% off the February highs.

Right now, the principal job of market participants is to weigh the probability of de-escalation versus the probability of recession.

Economic data this week will include Q1 gross domestic product, March personal consumption expenditures, and the closely watched April employment report and unemployment rate.

Too High

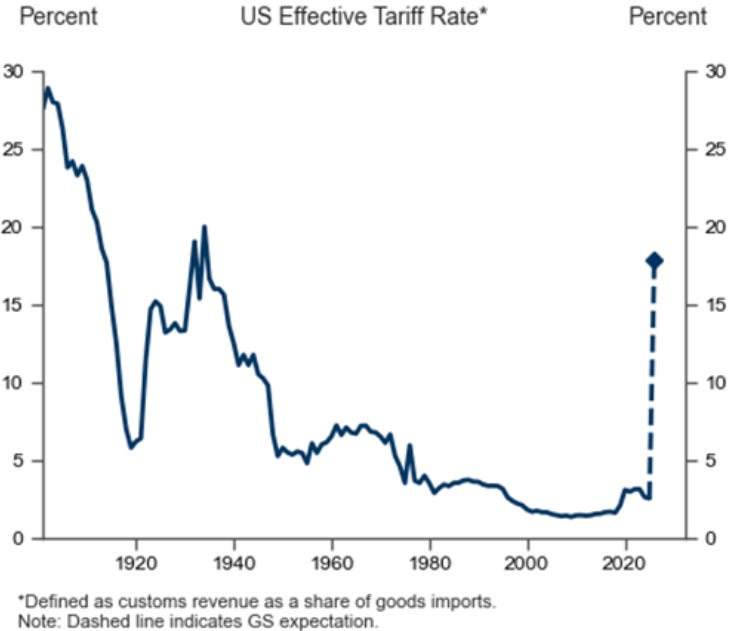

Geopolitical tensions easing led markets higher for the week, but the effective tariff rate is currently the highest it’s been in 100 years.

Difficult to come up with a fundamental bull case from here longer term. Still need to see any of these four conditions met for a sustainable recovery:

Attractive valuations

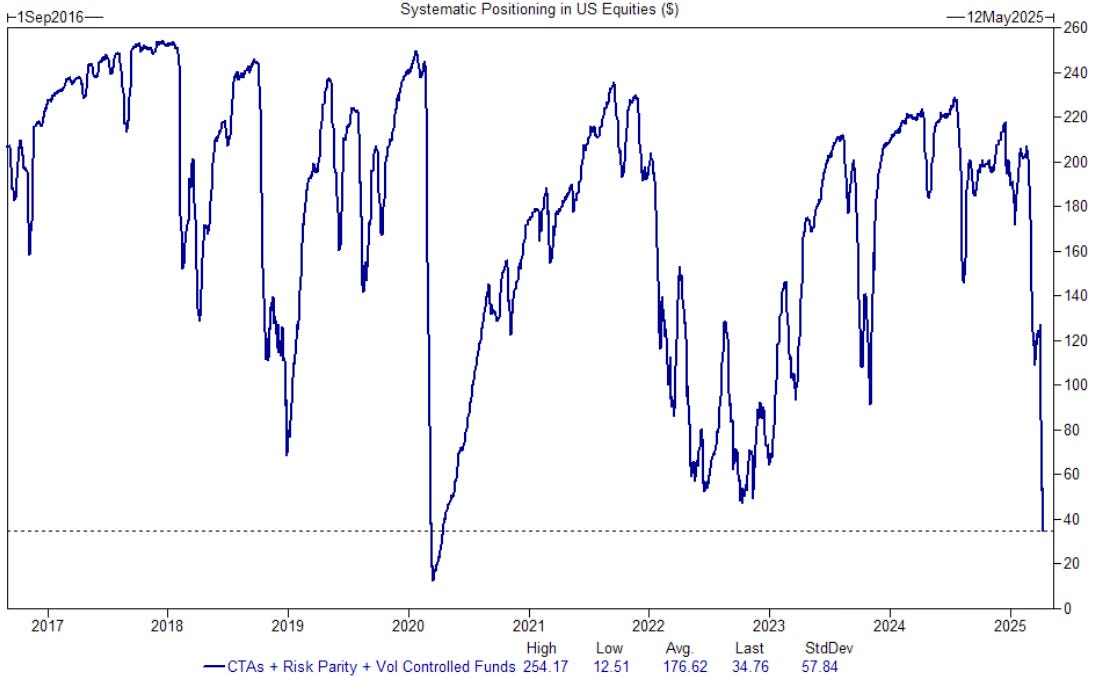

Extreme positioning easing

Policy support

Sense that the second derivative of growth is improving.

Wall St. Prime Intel

The vast majority of data around market “positioning” is based on the highest-frequency market participants. As we entered this week, it was very clear that those shorter-duration market players had sold almost all they could.

In today’s Weekly Brief Research we cover👇:

The latest from Institutional flows

Systematic Flows Monitor

Potential Trigger for Unwinding Shorts

Market Outlook and Technical Analysis

Where these HF market participants positioned next?

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.