Diversification - The best kind of sell off.

Hey team.

We’re back with another market report, sharing our insights for the markets.

Let’s jump in!

Impact Snapshot

US inflation falls to 3%, lower than expectations.

Investors rotate out of Big Tech.

Tomorrow: PPI Inflation - 8:30am

Earnings Premarket: JPM 0.00%↑ C 0.00%↑ WFC 0.00%↑

Market Evaluation

Traders anticipating that the Federal Reserve will soon be able to cut interest rates have sparked a big rotation away from the tech megacaps that have driven the stock market's bull run.

Investors rotated into smaller companies after softer-than-expected inflation data fed bets the Federal Reserve will cut interest rates in September.

The Russell index of smaller companies outperformed the Nasdaq by 5.8%, marking its best performance since November 2020.

Despite the S&P 500 dropping nearly 1%, almost 400 of its constituent stocks saw gains.

The June CPI inflation report might provide the Fed with the confidence to start preparing for a rate cut in the coming months, with September being the most likely date.

Tomorrow will see another volatile overnight with the much anticipated PPI inflation at 8:30am paired with a slew of bank earnings.

Sierra Suite

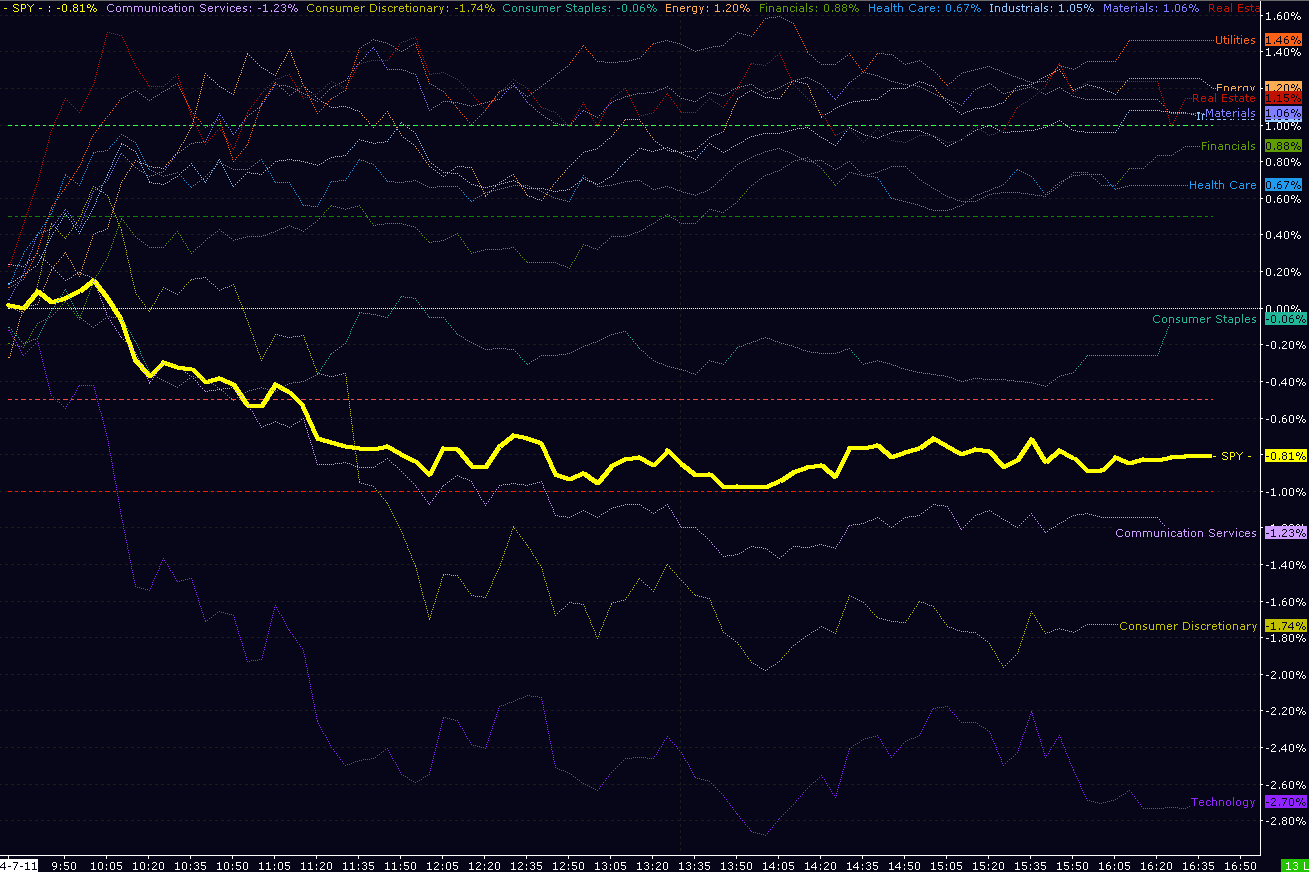

Using our Sector Tracker, included as a bonus chart with the Sierra Suite, we can visualize the sentiment from the above evaluation. It highlights a rotation toward defensive sectors like utilities. This is a common re-balancing process from portfolio managers, not pulling money away from the markets.

Markets Breakdown

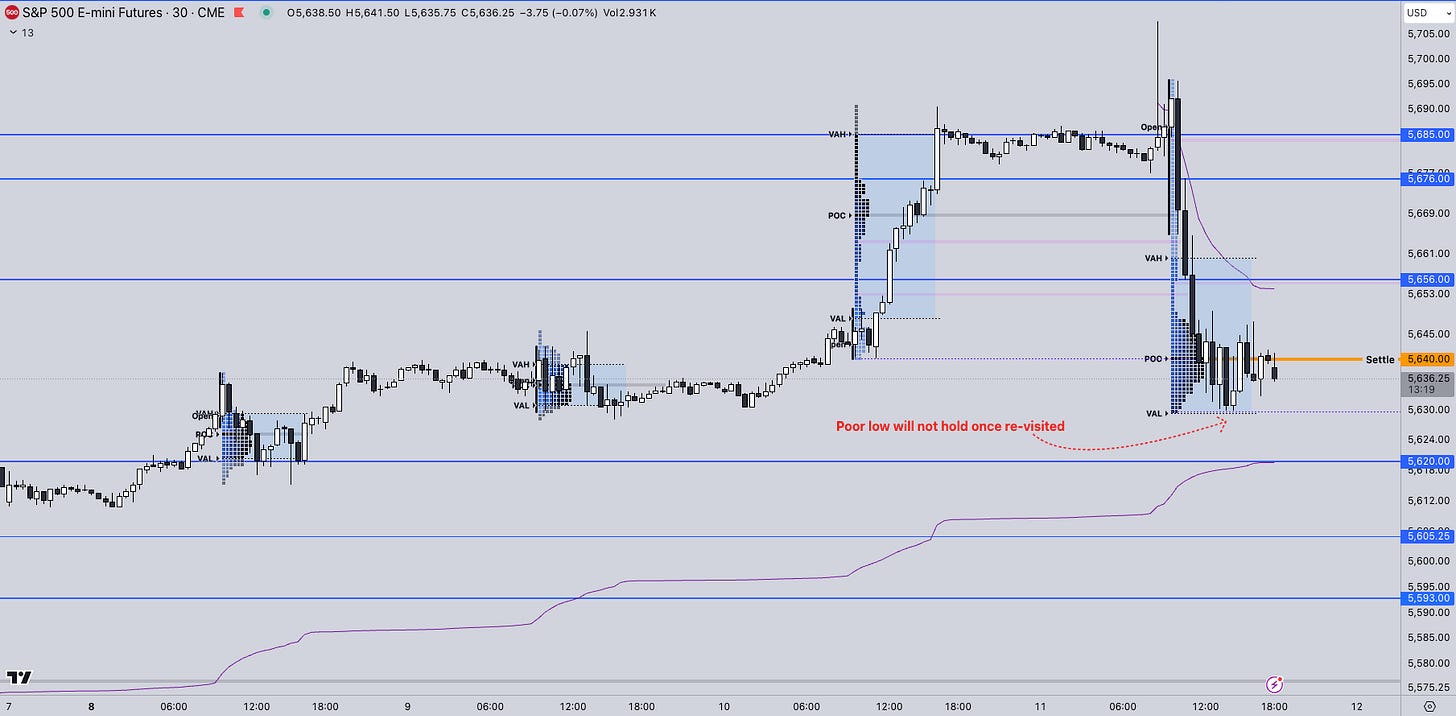

This morning we’ve given clear warnings of the consequences that would take place if this session lost the settle prior to the US open. Read the pre-market report here.

When a big rejection that takes place, often at critical areas such as acceptance of 5700s, we need to look at how much confidence and conviction does the market really have to the upside to get a re-claim .

When you reject and retrace such an advance with high conviction, the odds favour an aggressive move and rotational activity.

Our make or break pivot in that case which was going to determine that was the settle at 5688.

As we’ve written in that report, the consequences of losing that would see a complete roll-over to the other side with a full completion of the bearish plan which was seeing a clear of the poor low from Wednesday at 5640.

Moving forward, today’s sell off had signs of diversification, not money getting off the market.

PMs rotating capital from tech towards more defensive sectors and small-caps that will greatly benefit from rate cuts is the best kind of pullback you can get.

We’ve mentioned this many times in the past but it’s always something you’ll wanna keep in mind. Worst thing to do is try to fade and stand in front of a trend once it get’s going.

You’ll know the lasting all time high, well after the fact.

ES

Some references we’ll be looking going forward:

Upside Levels: 5656/5676/5685

Downside Levels: 5620/5605/5593

That’s all we got!

Like this post, share it with a friend.

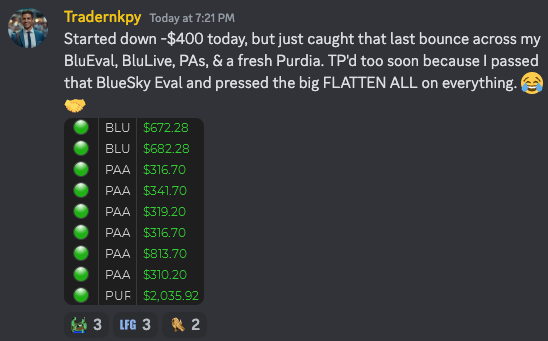

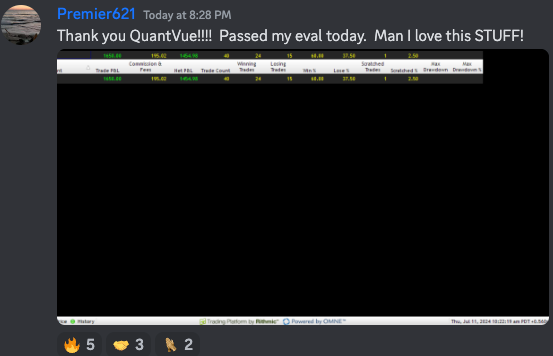

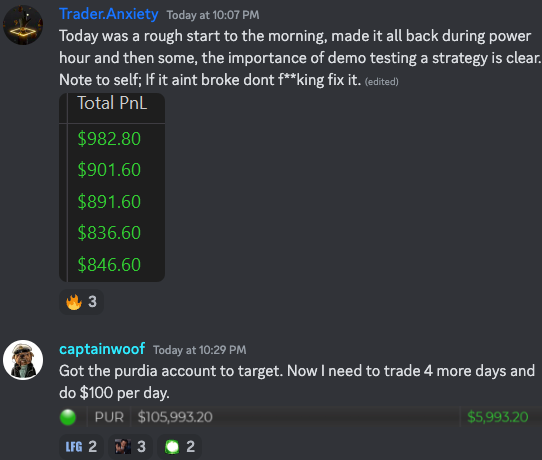

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.