Field of Vision

Hey team. The US stock market's strongest two-year rally since the dot-com bubble is approaching its next significant challenge, as companies begin reporting quarterly earnings next week.

In today's article, we explore the importance of market preparation for traders and how adjusting to the market's unique nuances can make a real difference.

Impact Snapshot

PPI Inflation - Tuesday

CPI Inflation - Wednesday

Retail Sales - Thursday

Unemployment Claims - Thursday

Quarter earnings season kicks off on Wednesday.

Macro Viewpoint

The S&P 500 index declined by 1.9% this week after stronger-than-expected December job growth data dampened hopes for interest rate cuts in the near future. This marks the second straight weekly loss for the S&P 500.

In December, Federal Reserve Chair Jerome Powell stated that the labor market no longer needed to soften further for inflation to continue its downward trend.

At that point, all signs suggested a cooling yet robust labor market that Powell believed would gradually bring inflation under control. But the December jobs report, released Friday morning, told a different story.

Unexpectedly strong job growth in December, coupled with a decline in the unemployment rate to 4.1% from November's 4.2%, signaled a resilient labor market as 2024 came to a close. This outcome has underscored the Federal Reserve's cautious stance on implementing interest rate cuts this year.

Looking ahead, investors will turn their attention to inflation data next week. The December producer price index is set for release on Tuesday, followed by the December consumer price index on Wednesday.

Being Prepared

Most traders that begin their journey in the space want to know where to get in and out of the market. This is not how markets work, and if it were that simple, such system would be arbitraged away in moments. It would have been bought by some serious fund overnight.

The power of what we do on our Substack lies in understanding the complexity of these markets through market-generated information, in order to build confidence and form a bias toward market structure and direction.

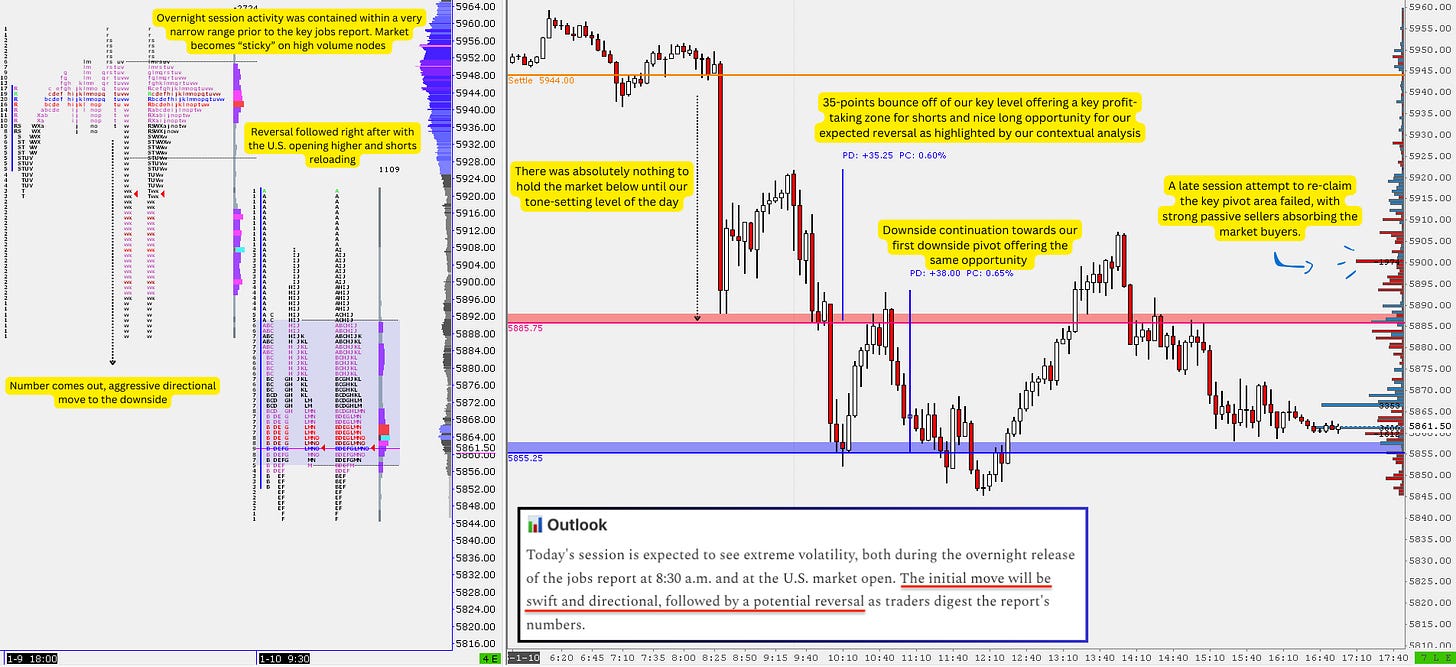

The picture above shows how Friday’s session unfolded, along with some of the context and market references we provided before the fact during the overnight session prior to the Jobs report.

At the time we released our latest Substack, the market was ranging around the settle in anticipation of the Jobs number at 8:30 a.m. As highlighted in our contextual analysis, we anticipated a volatile initial move that would result in range extension, followed by a reversal.

Despite the market being over 50 points away from our first downside pivot, and without possibly knowing the report’s outcome, we understood that there was absolutely nothing else to the downside to contain the market, as the underlying structure was horrible.

Right after the report, the market experienced a sharp directional move that targeted this exact reference area, followed by a 30-point reversal before the session continued.

Trading pivots aren’t as valuable without market narrative. There are enough things we never thought about, didn’t imagine, come out of nowhere. If we can be prepared for those that are expected, it’s easier to handle the unexpected.

Market structure and the interpretation of it in the right way relates to odds based trading. Your ability to understand some of these recurring nuances we showcase throughout our reports will help you see things that most traders don’t.

It will help you build what we call, field of vision.