Finding Your Edge

Hey team. Last week, we saw the uptrend continue, but this momentum may be tested by next week’s inflation reports, which could challenge the market's strength.

In today’s short article, we cover how you can develop your own edge in the market.

Impact Snapshot

CPI Inflation - Wednesday

PPI Inflation - Thursday

Unemployment Claims - Thursday

Macro Viewpoint

The S&P 500 was on track for its third consecutive weekly gain on Friday, lifting its year-to-date growth to over 27%.

This optimistic outlook for stocks is bolstered by expectations of additional Federal Reserve interest rate cuts, even as the economy continues to show resilience.

Market confidence in a rate cut at the Fed’s next meeting solidified following the November payroll report, which revealed a gain of 227,000 jobs alongside a slight uptick in the unemployment rate to 4.2%.

Looking ahead, an upcoming inflation report will challenge the momentum of the record-breaking U.S. stock rally and provide critical data that could influence the Federal Reserve’s approach to rate adjustments.

Gaining your own Edge

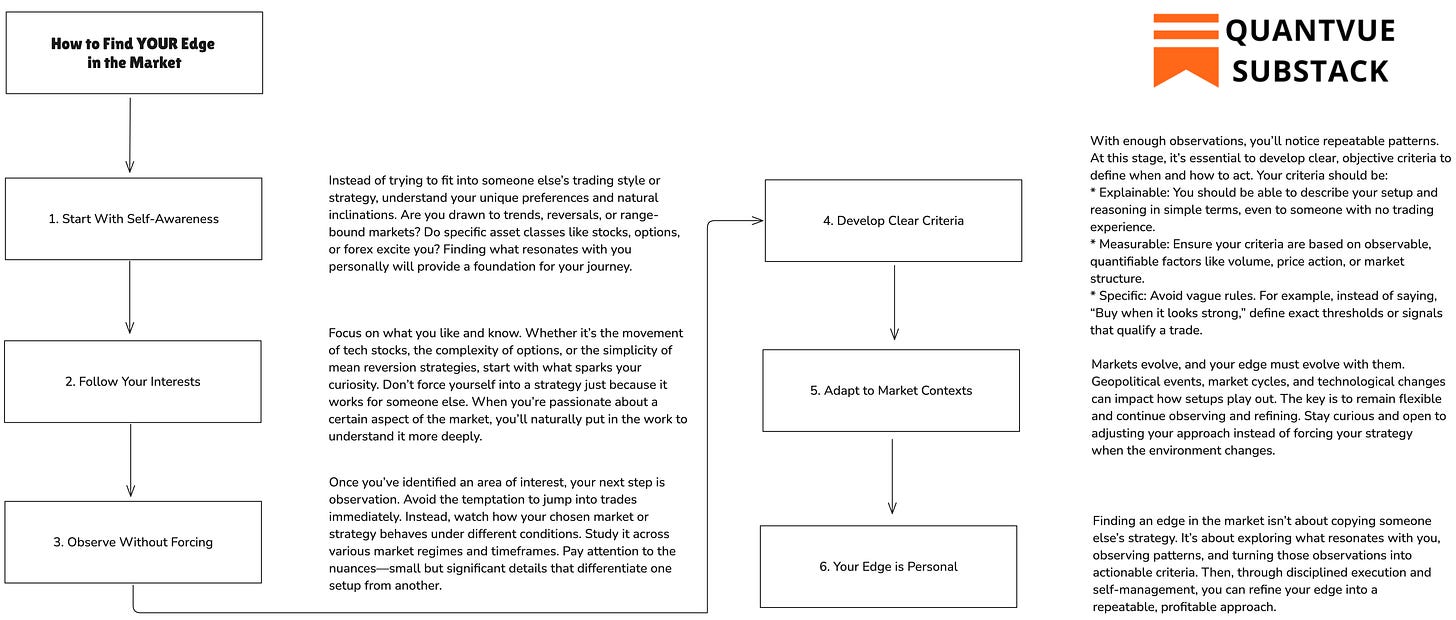

Finding an edge in the market isn’t about copying someone else’s strategy. It’s about exploring what resonates with you, observing patterns, and turning those observations into actionable criteria.

As you observe, start cataloging the nuances of how specific setups behave. For instance, if you’re focused on how bad news affects security prices you’re trading, note the different reactions:

Does a high-volume sell-off indicate a likely reversal?

Does a low-volume bounce signal a weak continuation pattern?

Document these variations and create categories for each nuance. Over time, this detailed understanding will become the foundation of your edge.

For example, you might notice that a particular volume behavior consistently leads to a profitable reversal trade, while another signals a false breakout.

One thing that might come as a surprise for some traders is that the strategy plays a smaller role than risk and self-management. You can be given a profitable strategy, but if you don’t have self or risk management in place, you will lose money on it.

You can take a basic strategy, such as the EMA crossover, and if you apply it in the right way with the correct risk management, you could find profitability in there.

Finding an edge doesn’t guarantee success—managing it effectively does. This is where risk management and self-control become crucial. Even with a solid edge, you’ll encounter psychological challenges like fear, greed, and overconfidence. Self-awareness becomes a vital tool for mitigating these tendencies.

Stick to your criteria, even when emotions urge you to deviate.

Size your positions appropriately to avoid taking on excessive risk.

Develop routines to stay disciplined, such as reviewing trades daily.

Trading isn’t a one-time discovery process—it’s a continual cycle of repetition and refinement. Use your criteria to trade, then analyse the outcomes. Identify what worked, what didn’t, and how you can improve.