Fragility Emerges

US stocks ended roughly flat last week on the heels of a reopening of the federal government, growing AI skepticism, and increased uncertainty surrounding the path of rate cuts.

Impact Snapshot

FED FOMC Minutes - Wednesday

Nvidia Earnings - Wednesday

U.S. Jobs Report - Thursday

Services/Manufacturing PMI -Friday

Consumer Sentiment - Friday

Prime Intelligence

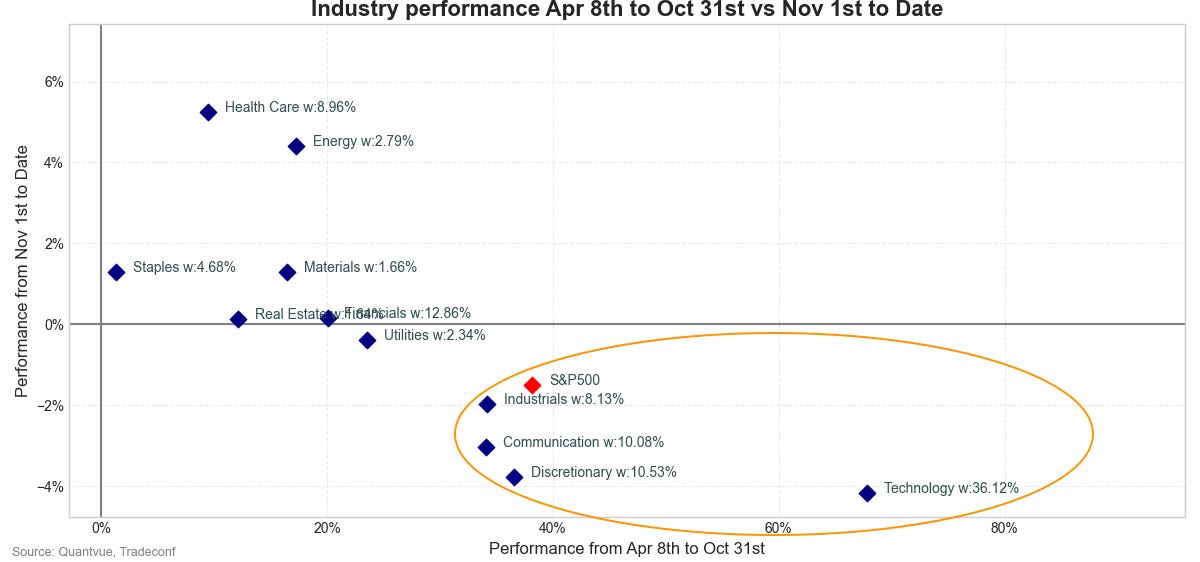

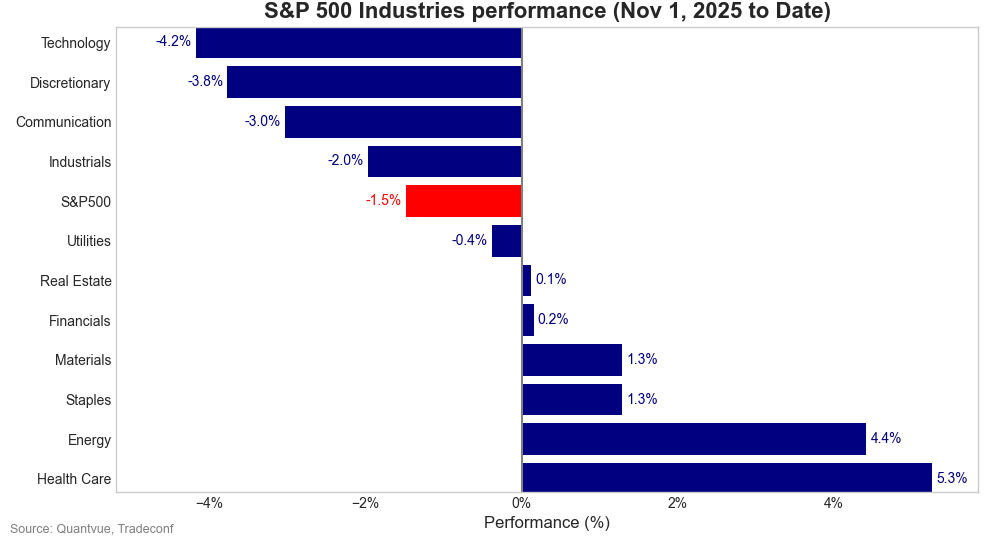

The technology trade cuts both ways. When it’s good it’s really good but when it’s bad it’s real bad. XLK is the most important piece of the S&P500 puzzle which holds a weight of over 36%.

The industry performance we see this month is inversely related to that during the rise from the April bottom. Those industry groups that had rallied the most from the bottom have sold off the most in the last two weeks, suggesting a bloodletting of momentum.

Performance within the S&P 500 through the selloff this month is neatly divided across industries, with about half up and half down.

However as we’ve flagged since the last two week, sustainability to moves requires broad market participation which we currently lack.

This has quickly became the most challenging setup for this rally since the rebound from April. While we see capital rotations into safer pockets of this market, that can quickly change into a broader unwinding if the “heavyweight” sectors continue to bleed out.

🔄 Friday Session Re-cap

“Markets do not hand out invitations at the lows; they force you to act when it feels uncomfortable.”

Market movements are frequently attributed to recent headlines, yet empirical evidence in market microstructure research demonstrates that price action leads the news because it is the most direct and immediate reflection of market sentiment.

Our methology when we’re creating our pre-market plans every morning and share them with our subscribers uses a data-driven approach centered on flow analysis and price dynamics rather than headline-driven interpretation.

Below is our market plan we’ve shared with our Subscribers during the ON session on the right side and how the market unfolded after.

Early morning volatility is mostly driven by retail participants making emotionally biased decisions. They constantly seek the next trending headline to confirm their bias. We call this the hammer syndrome: when you’ve got a hammer, everything looks like a nail.

The distinction between data-dependent analysis and headline-driven trading remains critical for sustainable market performance. The foundation of our research is grounded in quantified data rather than market speculation.

📰 In today’s brief, we’ve written an article on all the things you should be aware of. Was Friday’s rebound really new-money buying or prone to a collapse?