Hated Rally

Hey team. The S&P 500 gained 5.3% last week, with strong performance across sectors helping the index return to positive territory for the year.

Let’s see what’s ahead for this market!

Impact Snapshot

Unemployment Claims - Thursday

Services PMI - Thursday

Macro Viewpoint

Markets rallied early last week after the Trump administration announced a trade agreement with China, following a similar deal reached with the UK just days earlier.

The deal between the US and China calls for a 90-day suspension of reciprocal duties on each other's goods.

Concerns about stagflation and the risk of a recession have weighed heavily on investor outlook recently.

However, the easing of trade pressures and continued strength in economic data suggest the US economy is still on track to avoid a downturn.

Wall St. Prime Intel

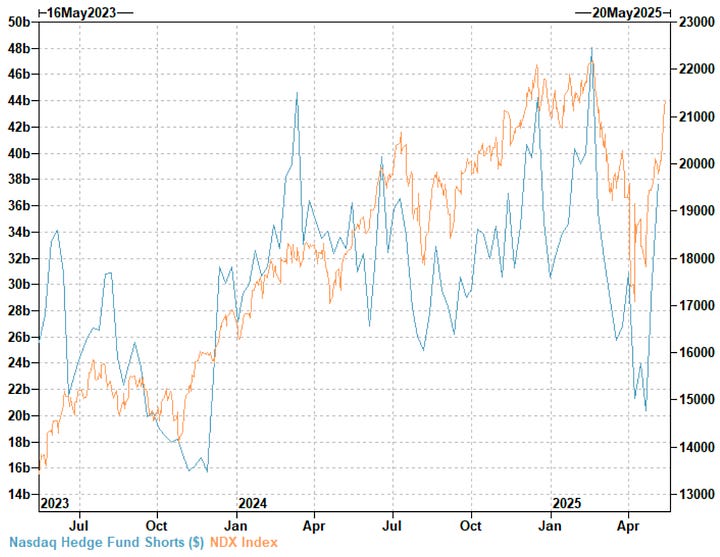

US equities saw the largest net buying since Dec ’21, driven by short covers and, to a lesser extent, long buys (mainly Mon + Tues), suggesting hedge funds were stopped in amid a continued market rally post a US-China trade deal.

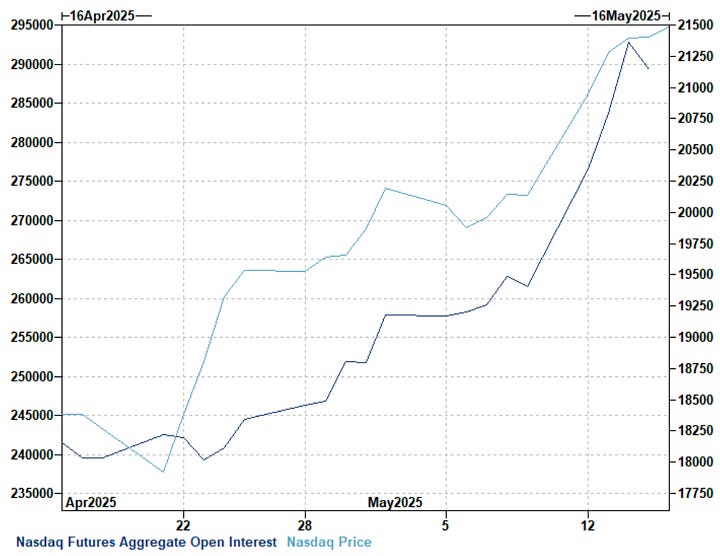

Aggregate open interest rose by ~$12bn, and 3-month funding versus Fed Funds richened by 8bps. This potentially left recently implemented hedge fund shorts significantly underwater.

The speed of the recovery has made this one of the most hated rallies, with the incremental buying coming primarily from retail investors and corporations.

We’ve been providing deep insights across the biggest trading floors throughout this week, constantly reiterating our market viewpoints on why this market was going higher before any news or catalysts could have hit, exclusively with our subscribers.

Feel free to read our before-the-fact releases in the archives, with all the data points to back our claims on this.

Today, we share a recap of what we monitored during last week, along with our updated market outlook. Is there more upside or not?👇

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.