here is how we trade the week close

Hey team.

We've got another market brief on $ES for you.

The market rebounds but can the bulls sustain the momentum based on speculations?

Let’s discuss today’s session and see what’s next for the markets!

Impact Snapshot

Consumer Sentiment, Tomorrow 10:00am

Market Evaluation

The stock market surged to its peak since early April, extending a rebound that’s been fueled by speculation the Federal Reserve will be able to cut interest rates this year.

Investors have been more optimistic lately after the Federal Reserve indicated the next move is unlikely to be a hike, pointing to a cap on interest rates that could be bullish for equities.

A strong earnings season, as well as some softer labor data, have also bolstered confidence in the stock outlook.

On the economic front, May consumer sentiment data that’s due out tomorrow will be closely monitored.

Ultimate TradingView Suite

Stacking confluences is key for high probability trading setups. Our Tradingview suite paired with our QuantVue indicator toolkit offers just that. From our custom made market and volume profiles charts to our favorite momentum indicators, we created the ultimate confluence powerhouse.

Markets Breakdown

Early this morning we’ve highlighted the importance of sustaining activity above the settle at 5212 which would trigger upside continuation and clear the poor high above 5226.

Bulls took control of the market and successfully targeted our flip zone at 5223 that was a perfect entry for longs to reload on the way up for continuation.

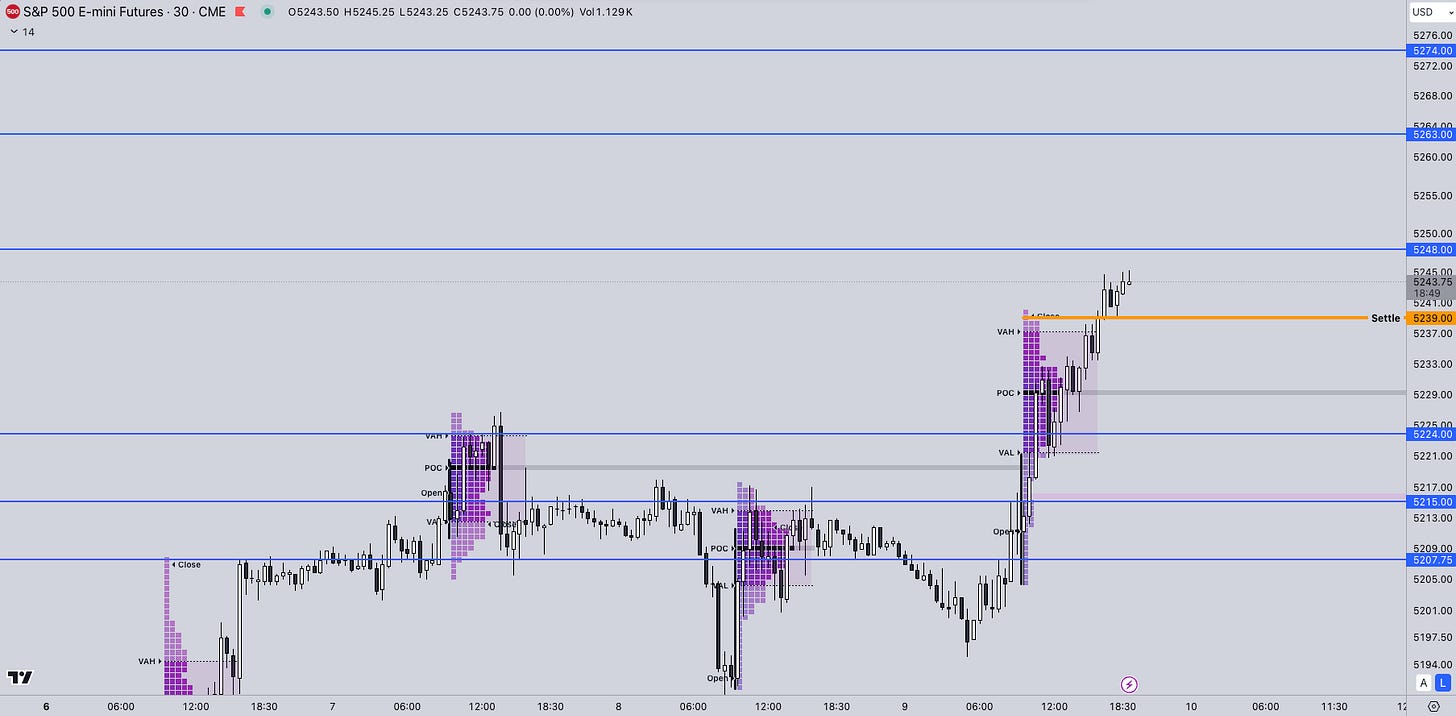

Heading into the week close, what we will monitor is continuation and acceptance of value above the 3-day balance range or the lack of.

Holding above the previous value area highs is a sign of strength for continuation.

ES

Some references we’ll be using for navigating the overnight heading to US open:

Upside Levels: 5248/5263/5274

Downside Levels: 5224/5215/5207

That’s all we got!

Like this post, share it with a friend.

We’ll see you again on the next one!

Oh, if you want access to our premium TradingView, NinjaTrader, or Sierra chart suite, go check them out on our website here.

Also, be sure to check out our one-time purchase products over on our Gumroad here that also include a FREE Trading Handbook!

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.