How we prepare for Friday's payrolls report

Hey team.

We’re back with another market evaluation report.

Let’s start with a re-cap of the markets and a walkthrough of what we were watching early in the session today.

Key Economical Reports 5/3

Average Hourly Earnings - 8:30am

Non-Farm Payrolls - 8:30am

Unemployment Rate - 8:30am

ISM Services PMI - 10:00am

Market Evaluation

The world’s largest technology companies drove stocks higher, with traders gearing up for Friday’s jobs report.

In the run-up to the monthly employment report, data showed US labor costs jumped the most in a year as productivity gains slowed, adding to risks inflation will remain elevated.

The Fed decided Wednesday to leave the target range for the benchmark rate at 5.25% to 5.5% following a slew of data that pointed to lingering price pressures.

After Wednesday’s Fed decision to hold rates, the length of the current pause reached 280 days which remains the second-longest on record.

A slew of economic reports will continue the volatile theme we’ve had going this week with the key reports of NFP and Unemplyment rate being the main focus.

Sierra Chart Suite - Order Flow Guide

Be sure you check out our latest YouTube video of how we implement our Sierra Suite to real-use case scenarios.

Markets Breakdown

When we look at the market every morning, a good rule we use is to ask what other market participants are doing.

We often say “don’t focus exclusively on price itself” which is probably one of the most nuanced things we’re dealing with. Instead, we focus on where the market builds value.

Early this morning on our market report we’ve posted on Twitter(X) Here, we’ve highlighted the importance of looking at a correction for safer entries.

Profitability in trading is not about winning more trades, it’s about picking the right R:R trades.

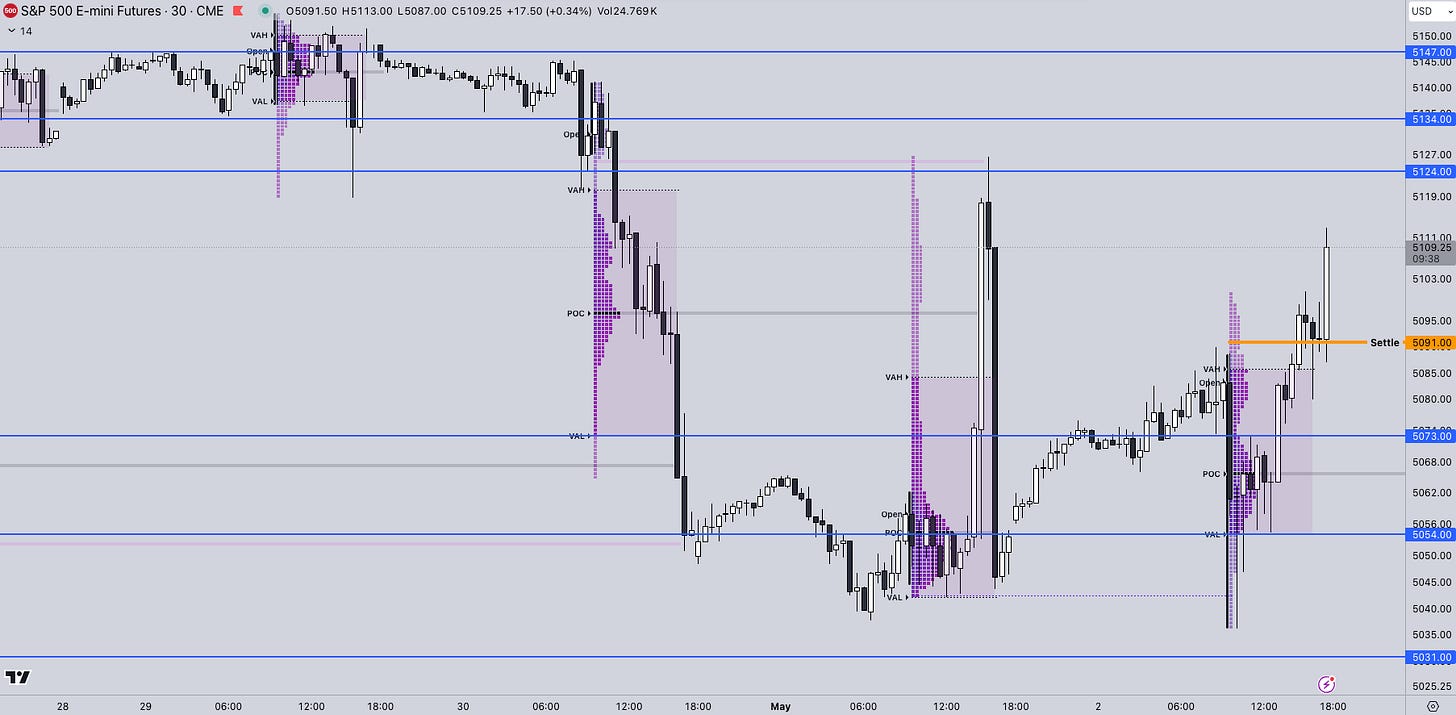

In this case, at the time of our report which was in the overnight session (you can check the timing), the market was over extended to the upside and even on our Bullish scenario, we were expecting some correction.

At least for us, the amount of risk going long on a 0.80% upside in the overnight with no confirmation whatsoever was considerably high.

After the post market tanked around 1% before we’ve gotten a complete recovery with our bullish scenario executed to the tick towards 5113.

You shouldn’t be entering a trade without knowing where your profit will be, how much room the market has to get there and if the risk is really worth it.

ES

Some references we’ll be using throught the overnight session going into US open:

Upside Levels: 5124/5134/5147

Downside Levels: 5073/5054/5031

That’s all we got!

Like this post, share it with a friend.

We’ll see you again on the next one!

Oh, if you want access to our premium TradingView, NinjaTrader, or Sierra chart suite, go check them out on our website here.

Also, be sure to check out our one-time purchase products over on our Gumroad here that also include a FREE Trading Handbook!

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.