How We’re Tackling Fed Week

Hey team.

It's Fed week, bringing fresh inflation data and a return of volatility.

Let's recap last week's market activity and look ahead to what's coming next!

Impact Snapshot

CPI Inflation - Wednesday

Fed Interest Rate Decision - Wednesday

PPI Inflation - Thursday

Unemployment Claims - Thursday

Consumer Sentiment - Friday

Market Evaluation

The S&P 500 gained 1.3% over the week, boosted by a rally in Nvidia. Investors analyzed the latest jobs report and anticipated the Federal Reserve's upcoming monetary policy meeting next week.

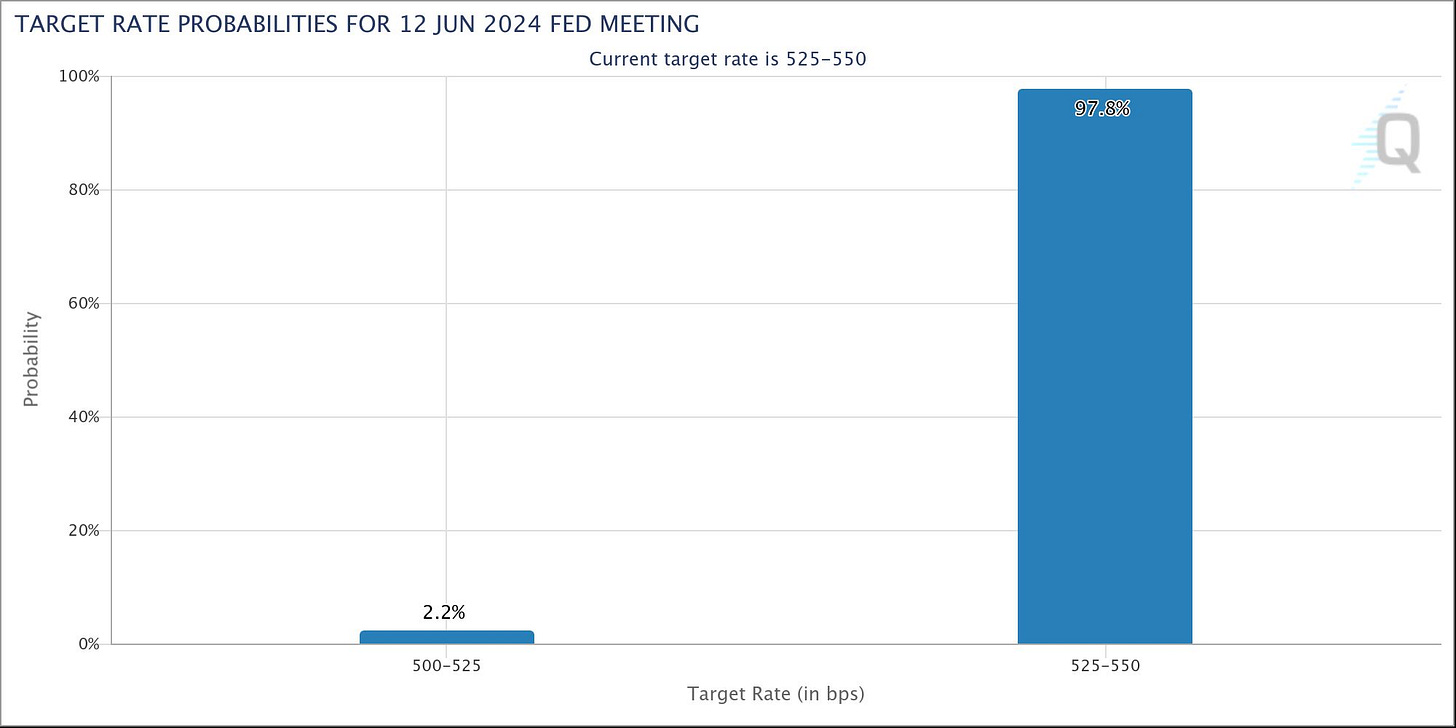

Policymakers are expected to again hold interest rates steady at meetings next week and at the end of July, according to the CME FedWatch Tool.

On Wednesday, attention will likely turn to the Federal Open Market Committee's Summary of Economic Projections.

This report might suggest a shift from three rate cuts to two this year, in response to stronger inflation data from the first quarter.

Next week, critical economic data releases will include the official consumer and producer inflation reports for May, along with an initial reading of consumer sentiment for June.

Markets Breakdown

Friday’s market activity was the perfect example why focusing exclusively on price by itself and get emotionally attached to economical reports, robs you from opportunities.

On our last Substack posted Thursday (Here) , we’ve given a heads up for the expected upcoming volatility at 8:30am after the jobs report.

We closed our breakdown of the markets with the following line:

Many times, such reports will have a swing in one direction that will be met with another swing in the opposite direction.

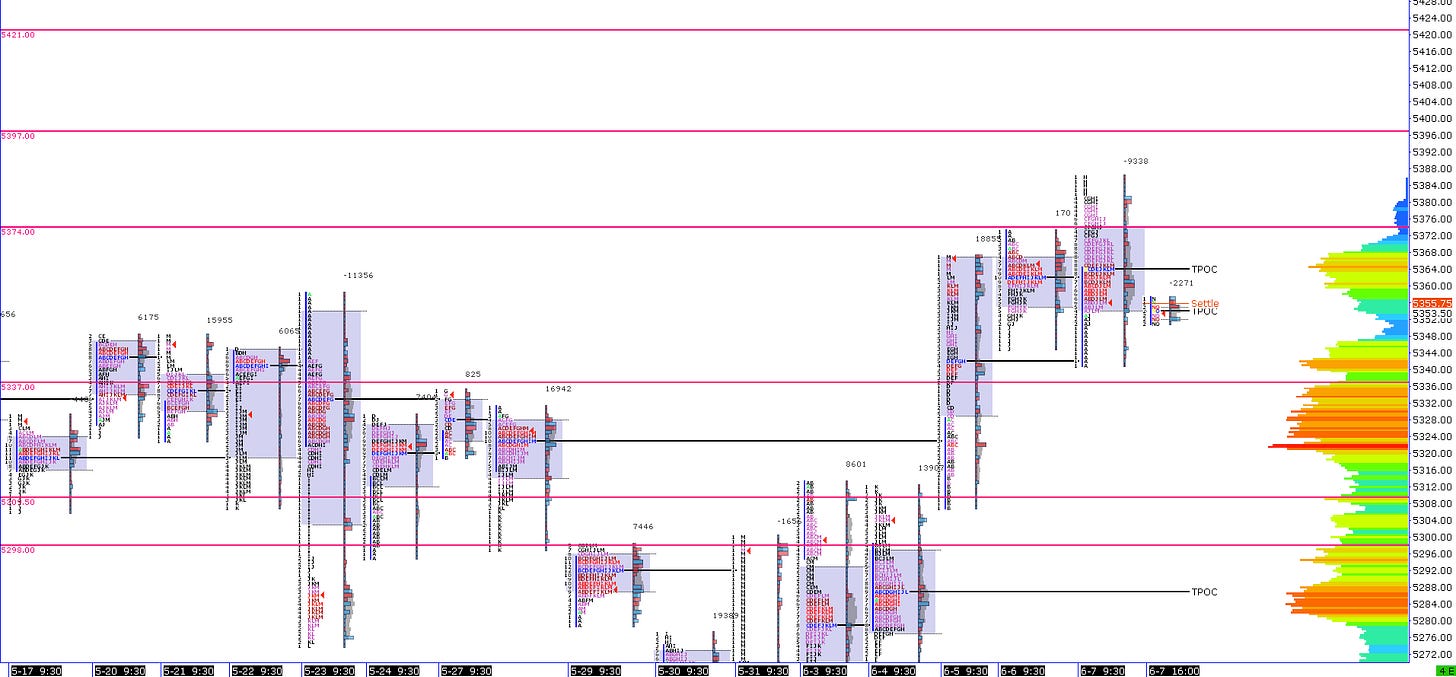

This couldn’t have been a more accurate statement that followed right after the initial pullback, with the market bouncing off of one of our key pivots at 5328 and targeted continuation towards a new ATH, exactly like our pre-market followup report was seeing it. Read Friday’s pre-market report here.

Heading into the weekly open, we’re likely to see some range-bound activity inside the range formed on the 6/5 as the market is anticipating the key economical catalysts on Wednesday.

As we always say, market likes to range/balance prior to these type of key economical reports that will send the market into an imbalance state.

ES

Some key references we’ll be looking heading to the weekly open

Upside Levels: 5374/5397/5421

Downside Levels: 5337/5309/5298

That’s all we got!

Like this post, share it with a friend.

We’ll see you again on the next one!

Oh, if you want access to our premium TradingView, NinjaTrader, or Sierra chart suite, go check them out on our website here.

Also, be sure to check out our one-time purchase products over on our Gumroad here that also include a FREE Trading Handbook!

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.