How we're trading next week

Hey team.

We've got another market brief on $ES for you.

Let’s do a re-cap of last week’s activity and Friday’s session and see what’s next for the markets!

Impact Snapshot

Consumer Confidence - Tuesday

Q1 GDP - Thursday

Unemployment Claims - Thursday

PCE Inflation - Friday

Consumer Sentiment - Friday

Market Evaluation

The S&P 500 index climbed by 0.6% during the shortened week, marking its third consecutive week of gains and pushing the market benchmark to new all-time highs.

Despite the S&P 500 being up 14.6% this year, the majority of the broader index's gains have been concentrated in the information technology and communications sectors.

This concentration has led to concerns among investors about the overall health of the market.

The total U.S. market saw its highest trading volume since March 15, due to the triple expiration of stock options, stock index options and stock index futures options.

Next week, the stock market will wrap up the first half of 2024 with several key economic reports, including data on Unemployment Claims, the second revision to Q1 GDP, and the May personal consumption expenditures index.

Markets Breakdown

Friday’s session was yet another example of the saying we use “It’s better being a bit late to a move than being too early”.

Our Market report posted on X here captured the whole market activity that took place with a tick-perfect bounce off of the pivot for rotations to the upside.

As we’ve written in this report, there would be no acceptance of lower prices unless we breached and held below 5518. We’ve given warnings to exercise caution with shorts at that area. Read the update we’ve shared here.

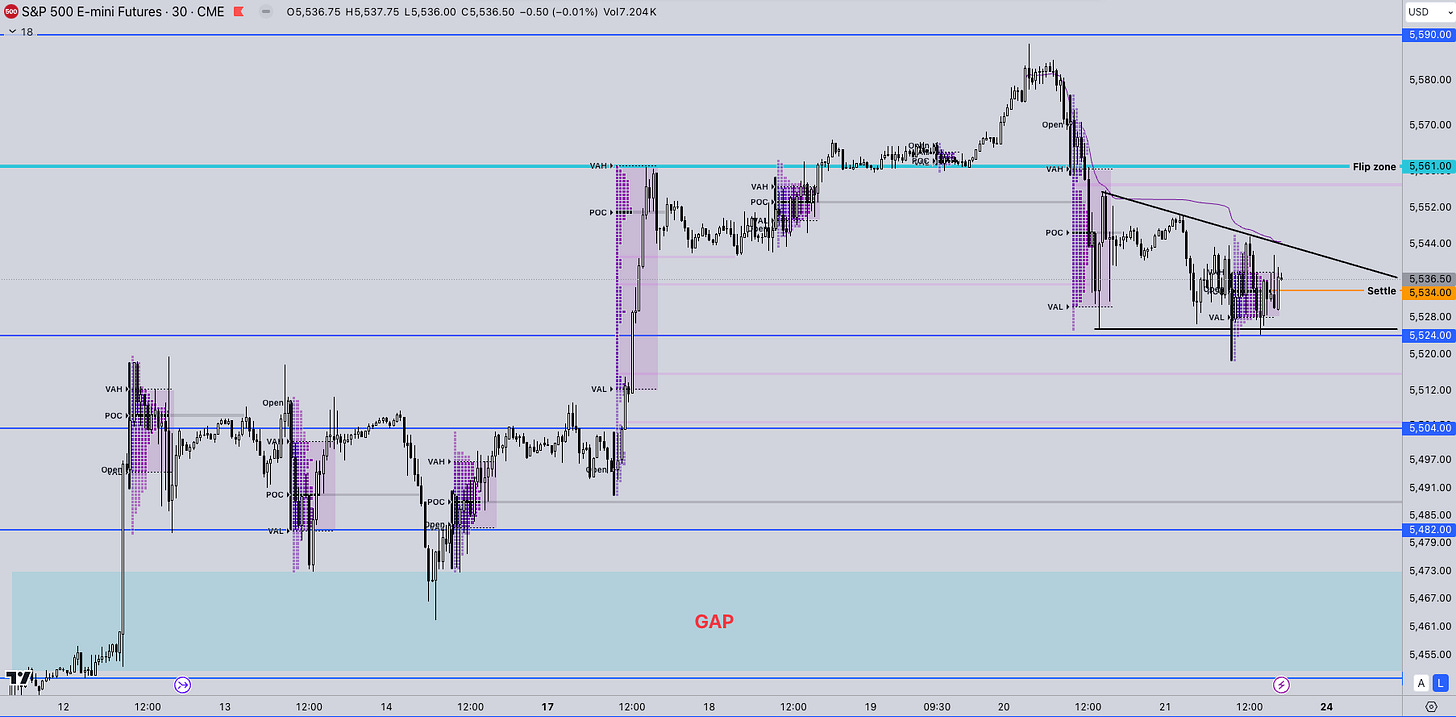

Heading into the next week, the market is looking to open at the lower-end of the balance it has established and is sitting at the key support which needs to hold.

Acceptance on the range below will likely see this descending triangle play out. If we get a breach and hold below the 5520s on increasing volume, that’s a good signal of downside continuation.

The highlighted gap to the downside is a key reference area for the market to and fill back in if we are to undergo a more serious liquidation break.

ES

Some references we’ll be looking heading in tomorrows US session:

Upside Levels: 5561/5590/5561

Downside Levels: 5524/5504/5482

That’s all we got!

Like this post, share it with a friend.

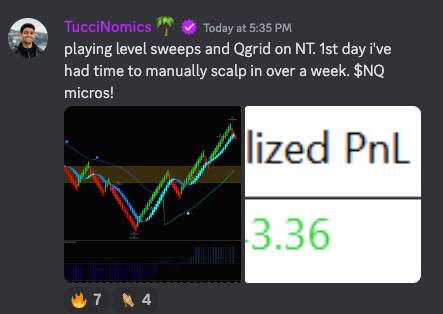

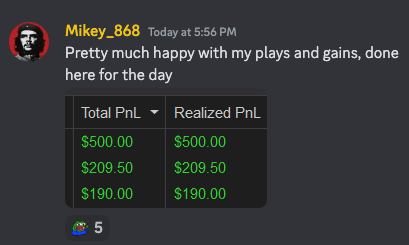

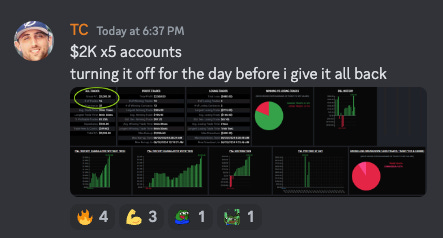

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.