How we're trading next week.

Hey team.

Let’s recap last week’s market activity and discuss some of the thing’s we’ll be looking moving forward!

Impact Snapshot

ISM Manufacturing PMI - Monday

Fed Chair Powell Speaks - Tuesday

JOLTS Job Openings - Tuesday

Unemployment Claims - Wednesday

ISM Services PMI - Wednesday

FOMC Meeting Minutes - Wednesday

Non-Farm Payrolls - Friday

Unemployment Rate - Friday

Market Evaluation

The S&P500 experienced its first weekly decline since late May, despite rising nearly 15% in the first half of 2024.

Revised gross domestic product data this week revealed that the US economy grew at a slightly faster rate in the first quarter than initially projected, while inflationary pressures intensified.

US consumer spending in May increased less than anticipated, and inflation decelerated both on a monthly and annual basis.

Next week, investors will concentrate on June employment data. ADP will release its monthly employment report on Wednesday, followed by the US government's release of Non-farm payrolls and the unemployment rate on Friday.

The US stock market will be closed on Thursday for Independence Day.

Markets Breakdown

The much anticipated volatility of Friday’s session has given great opportunities to those that were paying attention to what was really going on.

Our market report posted here has given context around the references that turned out to play beautifully with an initial tick-perfect bounce on our pivot that has offered a 37 points bounce towards the key upside resistance that the market failed to re-claim, leading to a pullback rotation. Read the update here.

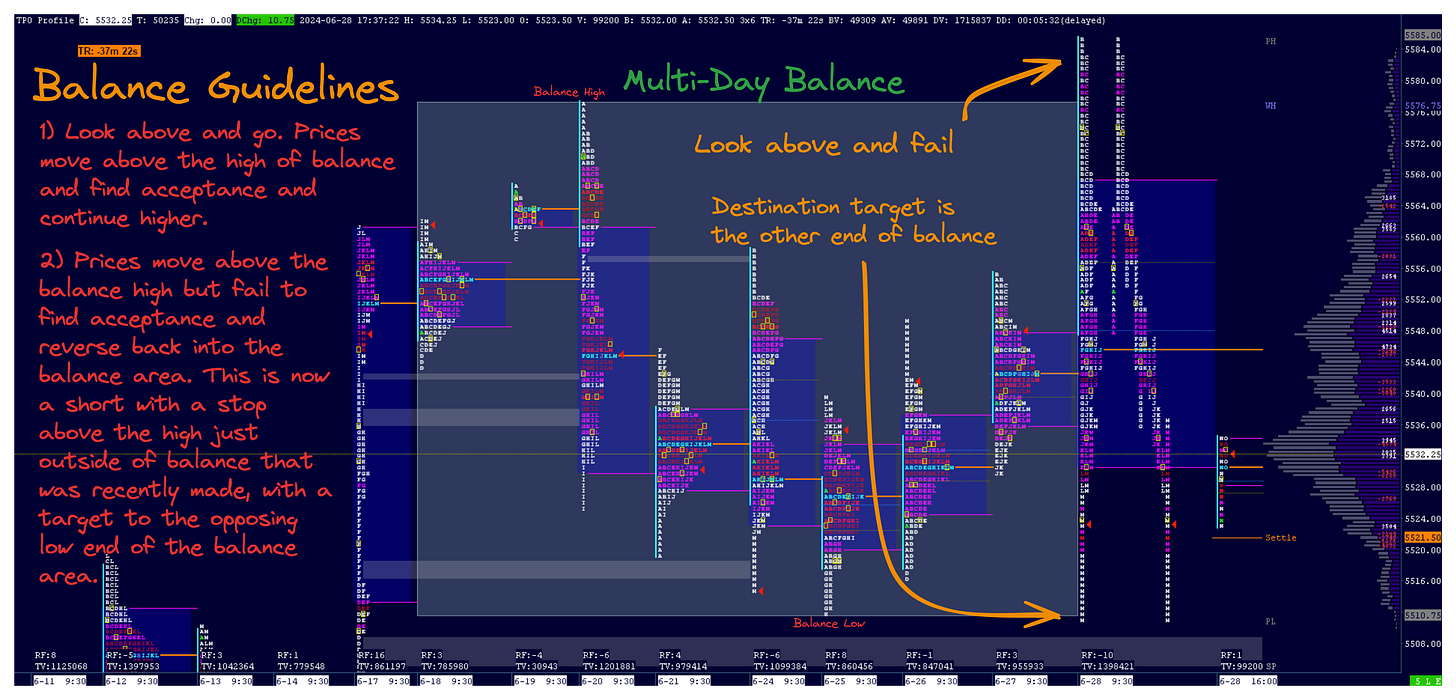

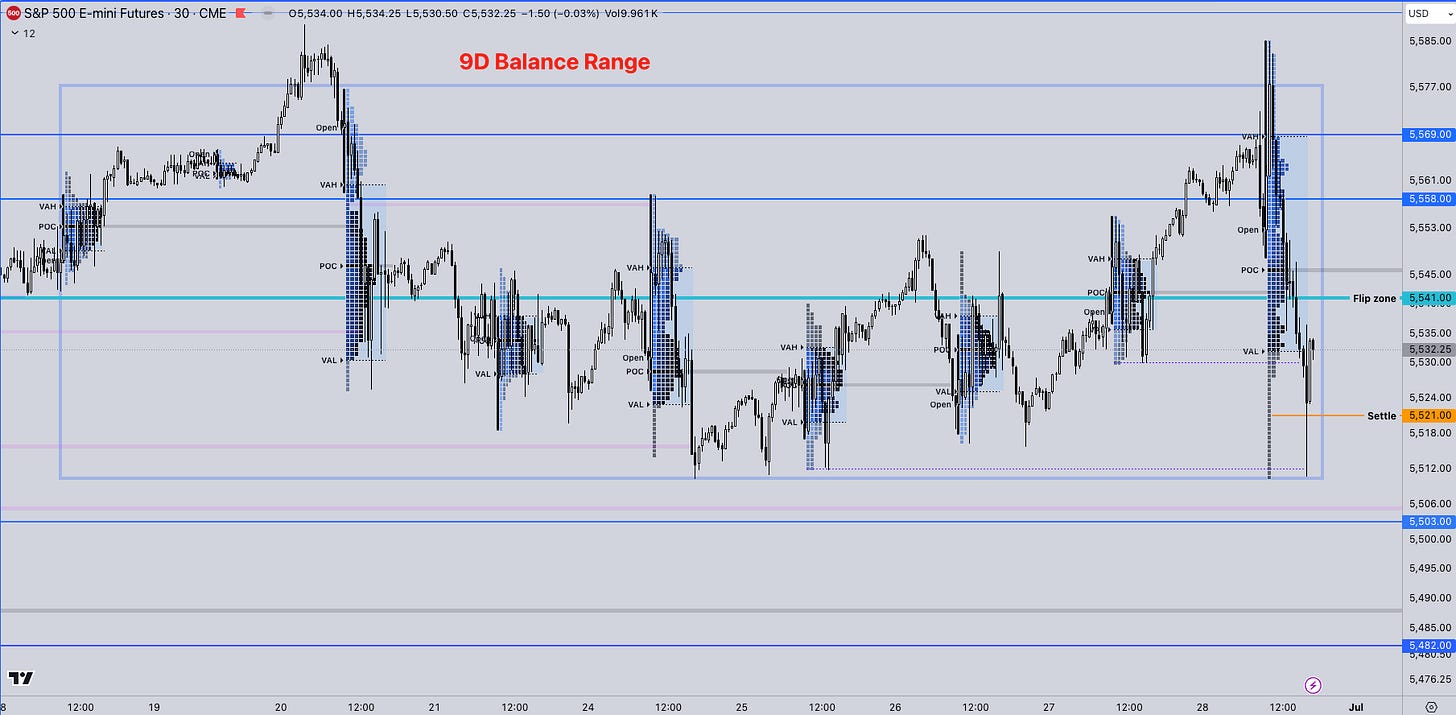

This was a typical “Look above balance and fail”scenario. The picture above captures this exact attempt of the market to break from balance. Failure to reclaim our flip zone at 5578 meant that the market was looking for a rotation all the way towards the other end of that balance. Always important to keep these balance rules in mind.

Having a framework of different scenarios of what is potentially going to happen is very important. This is the initial base for obtaining an advantage over those who are less prepared.

There is nothing that beats context around momentum which is how we’re using our market context to compliment our indicator toolkits for high probability trades.

Being prepared means you’re not surprised when something does happen and you’re ready to act on a moment’s notice when it does happen.

ES

Some references we’ll be looking going into the US open

Upside Levels: 5541/5558/5569

Downside Levels: 5503/5482/5450

That’s all we got!

Like this post, share it with a friend.

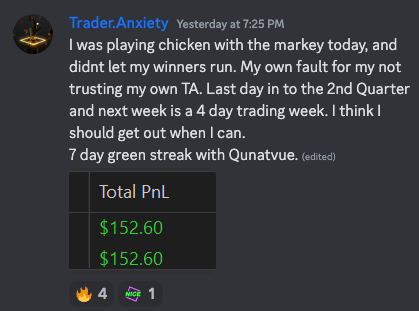

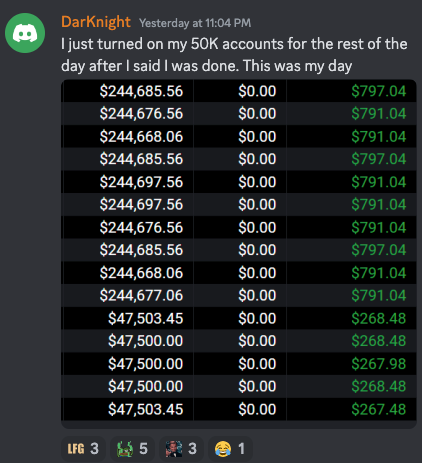

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.