How we're trading next week

Hey team.

We've got another market brief for you. Let’s re-cap last week’s events and see what’s next for the market!

Impact Snapshot

Fed Chair Powell Testifies - Tue/Wed.

10-y Bond Auction - Wednesday

CPI Inflation - Thursday

Unemployment Claims - Thursday

PPI Inflaiton - Friday

Market Evaluation

Stocks on Friday had a somewhat muted reaction to the jobs data, but tech stocks did lead markets higher as the prospect of lower interest rates bolstered the outlook for high growth names.

The unemployment rate rose unexpectedly to 4.1% from May's 4%. It's the highest reading in nearly three years, and it's the latest signal that the economy is cooling.

Jerome Powell said Tuesday that he is encouraged by cooler inflation but reinforced that the central bank will need to see more evidence before cutting interest rates.

Economic data on focus next week will be the consumer price index (CPI) and producer price index (PPI) for June.

Both inflation readings are likely to be closely watched as investors try to predict the Fed's next moves.

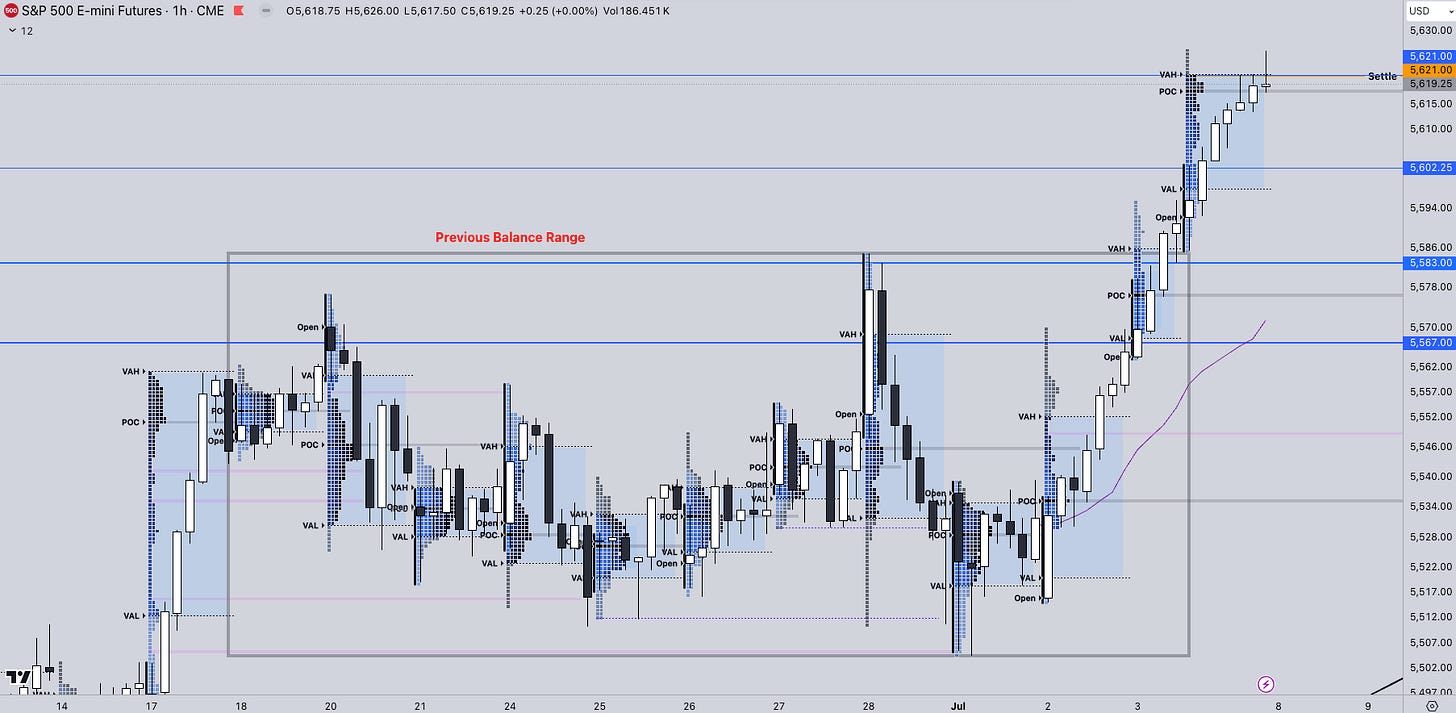

Markets Breakdown

The shortened week closed with an upside continuation on Friday as the market entered an imbalance state, seeking it’s next fair price to range.

After the jobs report, the market successfully held the settle pivot from our market report which saw continuation with a nice flip of 5616 as support to reach the first resistance of 5626. Read the update we’ve posted here.

This coming Thursday's Consumer Price Index report will be the next catalyst we’ll be watching.

With the major economical releases later in the week, it will not be unusual for the market to seek a formation of a new balance range with overlapping value areas around Friday’s range instead of over extending early in the week.

The previous balance range highs will be major support for the bulls to maintain activity above, indicating the acceptance of higher prices.

More often than not, highs made during holiday periods, often accompanied by lower volume, are frequently retraced at least partially.

We’ll keep that note in mind heading into the weekly open and refrain from conducting trading in unfavourable areas.

ES

Some references we’ll be looking going forward:

Upside Levels: 5621/5637/5649

Downside Levels: 5602/5583/5567

That’s all we got!

Like this post, share it with a friend.

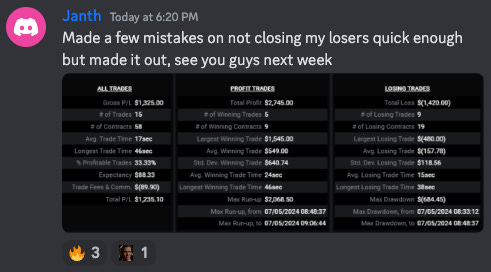

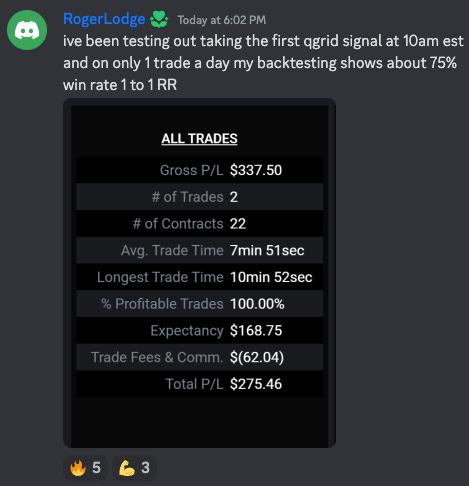

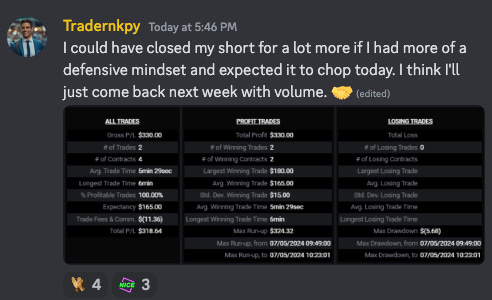

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.