how we're trading the all time highs

Hey team.

We've got another market brief on $ES for you.

Fresh records across the equities on prospects of a resilient economy, ebbing inflation and robust earnings.

Let’s discuss all the key things we’ll be watching for the weekly close!

Impact Snapshot

Jobless claims move lower after spiking a week ago.

Market Evaluation

US equities edge lower after breaking fresh records this week.

To the satisfaction of Fed Chairman Jerome Powell, the CPI came in cooler than expected.

The April CPI Inflation report may give the Fed the confidence to start paving the way for rate cuts in the coming months.

The central bank should keep borrowing costs high for longer as policymakers await more evidence inflation is easing.

The Fed will need at least three or four consecutive reports showing soft inflation before considering a rate cut. In the meantime, they remain in a holding pattern, awaiting more data to guide their next move.

Markets Breakdown

Early this morning we shared our expectations for the day which was seeing the possibility of the market trying to form a balance range. Read it here

Usually it takes some type of catalyst, with the key economical reports being the main ones, that drives the market in an imbalance state and a trend day like we’ve had yesterday.

Balance is market’s mechanism of communicating it’s anticipating further information prior to initiating another directional move.

The lack of them gave us the confidence to write a comment on our market report this morning, expecting the market to form a balance range around Yesterday’s session which is exactly what we’ve done.

Having expectations for the day can help you not get caught up by the price noise.

Is it a sell rallies and buy dips day which is favored in range-bound balance days or can we buy new highs and sell new lows on a trend-day like yesterday?

Heading in tomorrow’s session we want to see a posibility of maintaining activity inside the 2-day balance range which further establish acceptane of new prices.

ES

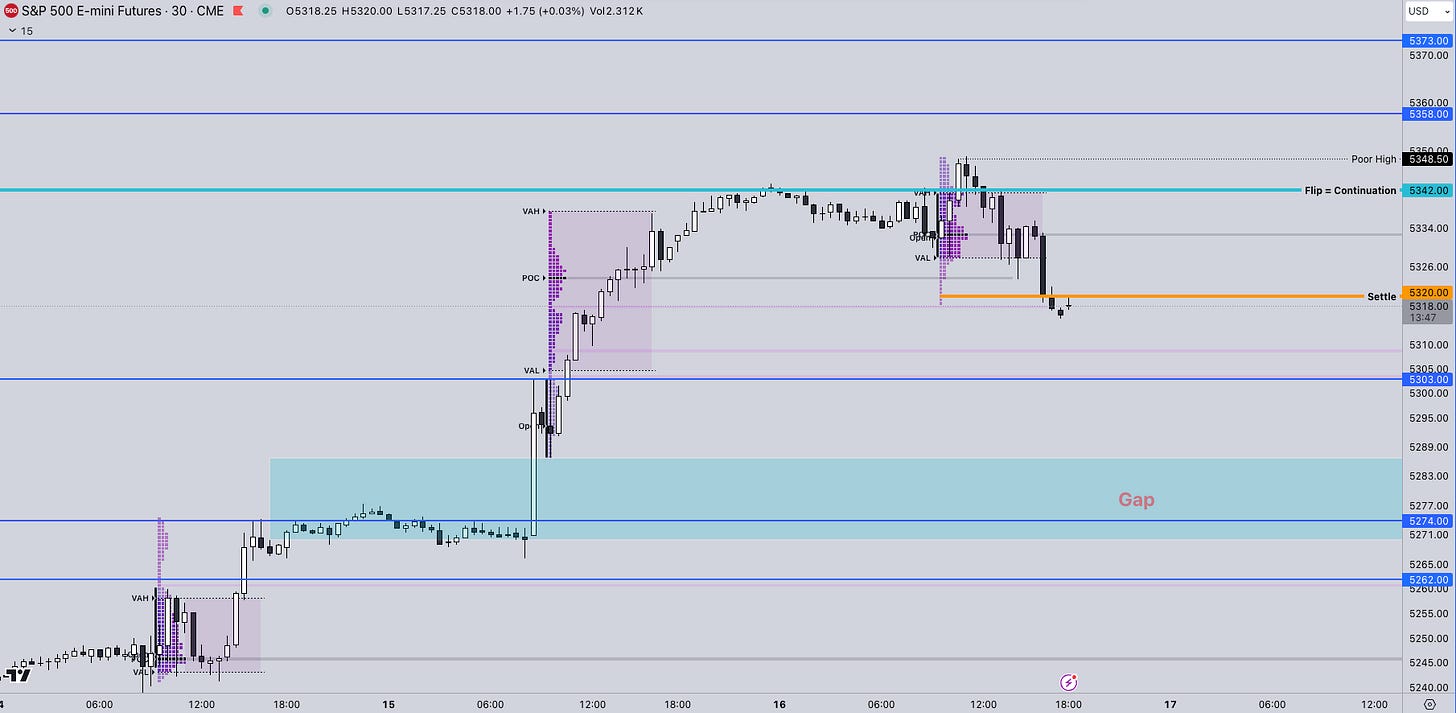

Some references we’ll be using heading into the weekly close:

Upside Levels: 5342/5358/5373

Downside Levels: 5303/5274/5262

That’s all we got!

Like this post, share it with a friend.

We’ll see you again on the next one!

Oh, if you want access to our premium TradingView, NinjaTrader, or Sierra chart suite, go check them out on our website here.

Also, be sure to check out our one-time purchase products over on our Gumroad here that also include a FREE Trading Handbook!

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.