how we're trading the chop

Hey team.

We've got another market brief on $ES for you.

Let’s recap today’s market activity and see what’s next for the market!

Impact Snapshot

US retail sales increase less than expected in May

Tomorrow: Juneteenth Day - U.S. Stocks Closed

Market Evaluation

The S&P 500 rose to a fresh record with traders betting the potential for Federal Reserve rate cuts will keep fueling the industry that’s driven market gains this year.

There’s not much doubt in the market right now to curb the enthusiasm about the US stock rally driven by a small group of tech stocks.

Retail sales increased at a slower than expected pace in May as high interest rates and inflation continued to weigh on consumers.

Following the news, markets slightly increased bets on two Federal Reserve interest rate cuts this year, despite U.S. central bankers' most recent projections for just one easing.

Markets Breakdown

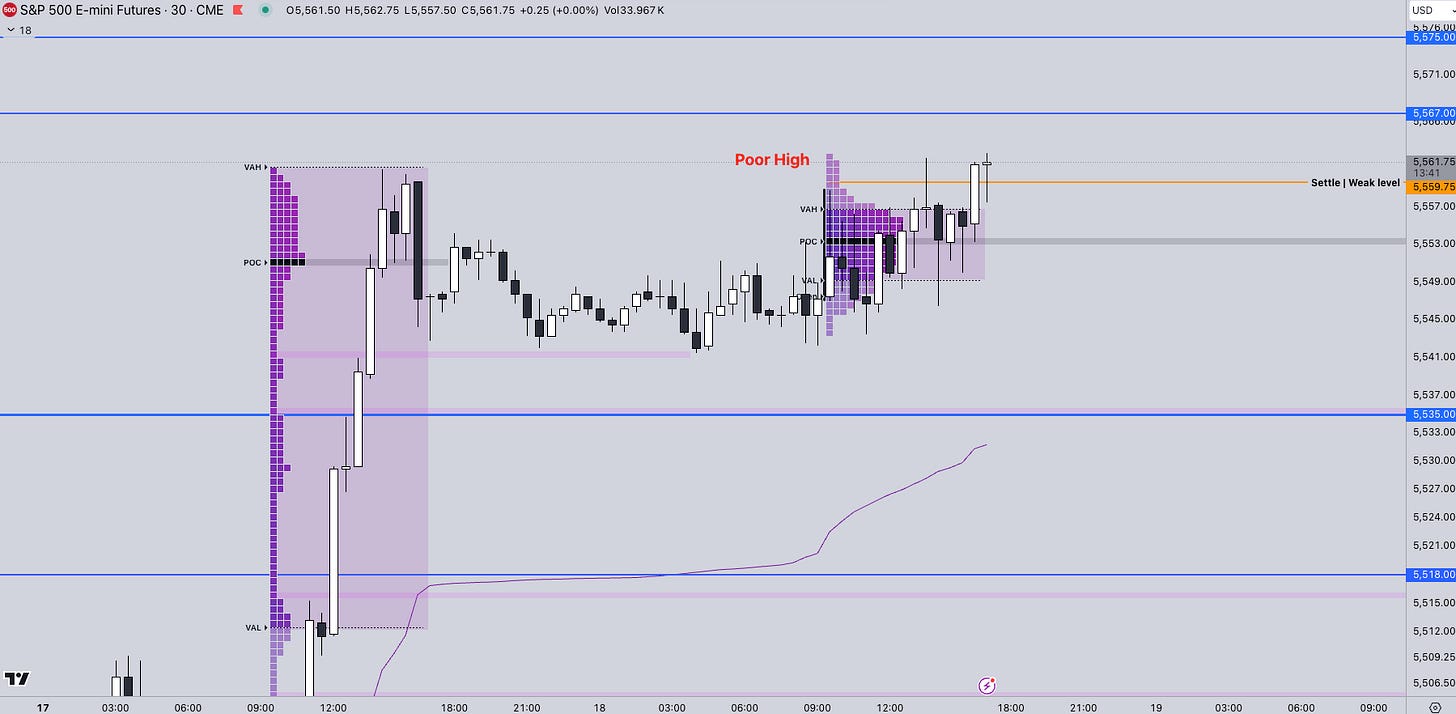

Monday’s trend-day was a breakout from the 3-day balance range formation we’ve formed since the CPI day last week.

One thing to note here is that when you get roll over, in this case ESM24 -ESU24 you get a spread that leaves rollover gaps which was the case with Monday’s session.

What we want to monitor throughout the week is acceptance of new prices and a formation of another balance range to confirm it, much like we’ve been getting throughout this uptrend.

There are a lot of single prints left on Monday’s trend day, in combination with the roll over gap, will be a key area of interest to the downside if the market see a break.

The absence of volume tomorrow will likely see another range-bound activity on the same range of Tuesday with an attempt to clear the poor all time high with excess above.

ES

Some of the areas we’ll be looking for Wednesday going into the Thursday’s ON session:

Upside Levels: 5567/5575/5580

Downside Levels: 5535/5518/5504

That’s all we got!

Like this post, share it with a friend.

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.