"It was the news"

Hey team, we’re back with another weekly recap with all the important catalysts you should be aware of heading into the week ahead.

Today’s article discusses market action and how a careful study of price action is all you really need to add to your narrative and cancel the fundamental noise that could cloud your vision.

Impact Snapshot

ISM Manufacturing - Monday

JOLTS Job Openings - Tuesday

ADP Non-Farm Employment Change - Wednesday

ISM Services PMI - Wednesday

Unemployment Claims - Thursday

Non-Farm Payrolls - Friday

Unemployment Rate - Friday

Key Earnings: GOOGL 0.00%↑ UBER 0.00%↑ AMZN 0.00%↑

Macro Viewpoint

The S&P 500 index declined by 1% this week as concerns over competition in the technology sector and the Trump administration's tariff plans weighed on investor sentiment. Despite the weekly drop, the benchmark index still managed to post a gain for the month of January.

This week saw the release of quarterly earnings reports from several major companies, with many exceeding analysts' expectations, including Apple.

Meanwhile, the Federal Reserve's preferred inflation gauge, the personal consumption expenditures price index, aligned with forecasts.

On Wednesday, the Federal Open Market Committee held its policy rate steady in the 4.25% to 4.50% range, as anticipated.

However, the committee adjusted its statement, emphasising that inflation remains elevated while removing a previous acknowledgment of progress.

Market Action Discounts Everything

“Anything that can possibly affect the price—fundamentally, politically, psychologically, or otherwise—is already reflected in the market price. It follows, therefore, that a careful study of price action is all you need.”

The above quote is the cornerstone of Technical analysis and unless you fully understand that premise, the rest of this article won’t make much sense.

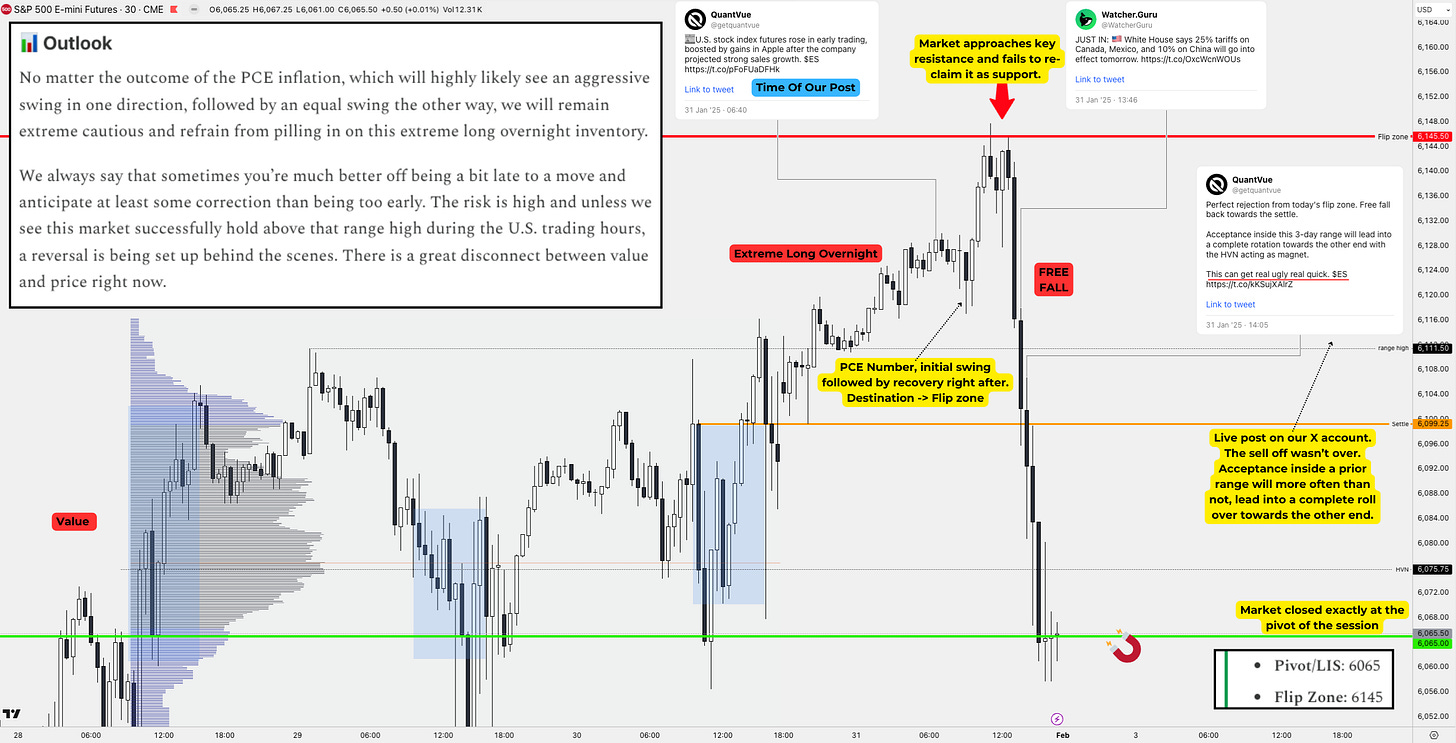

Before you continue reading this article, take a moment to review the outlook we shared during the overnight session in our last market brief at 6:40 AM, shown in the picture above, along with the comments and the follow up of how events unfolded.

During the overnight session, we pointed out that the market was experiencing an extreme long overnight with high risk associated with piling up on that extreme.

During the PCE release, we saw the first part of the outlook play out with an initial swing low and the expectation of another swing the other way. This offered a much better entry opportunity with the destination target, the flip zone.

The moment the market touched that reference, as seen on the chart, it completely stalled, and a correction of over 80 points followed right after. The moment this was happening, news outlets were blaming “tariffs” and other fundamental reasons as to why the market was pulling back.

Consider a scenario where you didn’t have the internet to view these headlines as they were coming in, and you simply focused exclusively on the charts.

Extreme Long overnight inventory, anticipate at least some correction.

Market saw the “PCE number” swing low followed by a high.

The destination target for the upside was the key resistance at 6145.

Failure to accept above lead into a pullback with destination the pivot 6065.

Acceptance inside the prior range was expected to roll-over towards the other end.

This is a technicals snapshot which includes the same concepts we’ve been showcasing for years.

Traders hate uncertainty. They will often search for a negative headline to explain why things turned bad or their indicator that showed “sell” at that time, therefore that was the reason the market tanked.

It’s easy to draw a bunch of rectangles and lines on a chart after the fact and say, “Yep, we went lower because of that.” You could ask 100 traders why the market pulled back on Friday, and you would likely get 100 different answers.

In the 2+ years we’ve been running this Substack, there hasn’t been a single instance when we did a market recap on things that we didn’t say hours or even days before the fact. It’s always based on our previous market briefs else it wouldn’t make any sense.

Could we have possibly known during the overnight session at 6:40am ET, what the PCE number would be or that there would be “news” regarding tariffs as the market approached the PM hours? No.

We don’t know where the market is going. What we do is build a framework of potential outcomes and be prepared. Being prepared means you’re not surprised when something does happen and you’re ready to act on a moment’s notice when it does happen.

Everything you want to know is reflected in the price action and structure of the market you’re trading. Don’t let “noise” cloud your vision.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.