Know Your Competition

Hey team, in today’s article, we share some insights on how you can identify the type of session you’re dealing with and who is likely in control of it, which can play a significant role in how you approach and position yourself for that session.

Impact Snapshot

Unemployment Claims - Thursday

Flash Manufacturing/Services PMI - Thursday

Consumer Sentiment - Friday

Key Earnings: KO 0.00%↑ TSLA 0.00%↑ IBM 0.00%↑ GE 0.00%↑ TMO 0.00%↑

Macro Viewpoint

The S&P500 index rose 0.9% this week, as a number of heavyweight US companies released quarterly results that topped expectations.

The three major indexes clinched their sixth straight positive week. This marked the longest string of weekly advances in 2024 for both the Dow and S&P500.

The upbeat earnings of financial companies, and broadly positive economic data, have helped sustain the three main indexes' grind upwards in recent days.

More than 70 S&P 500 companies have reported earnings this season. Of those, 75% have beaten expectations.

The primary market driver next week will be major earnings reports, as there is a lack of significant economic data to serve as a catalyst.

Decoding Market Control

One part of knowing your competition should involve making a continual assessment of whether the session is controlled by the short-term traders or the longer-timeframe traders.

This will give you a great idea on how other market participants will react to a given change in price and how much conviction there is to breakout from any given support or resistance level.

If we know who is likely in control of the market then we can decide if:

Is it a sell rallies and buy dips day meaning range-bound environment that is established by short term traders? (chop day)

Can we buy new highs (strength) and sell new lows (weakness) which is a trend-day triggered by longer-term traders?

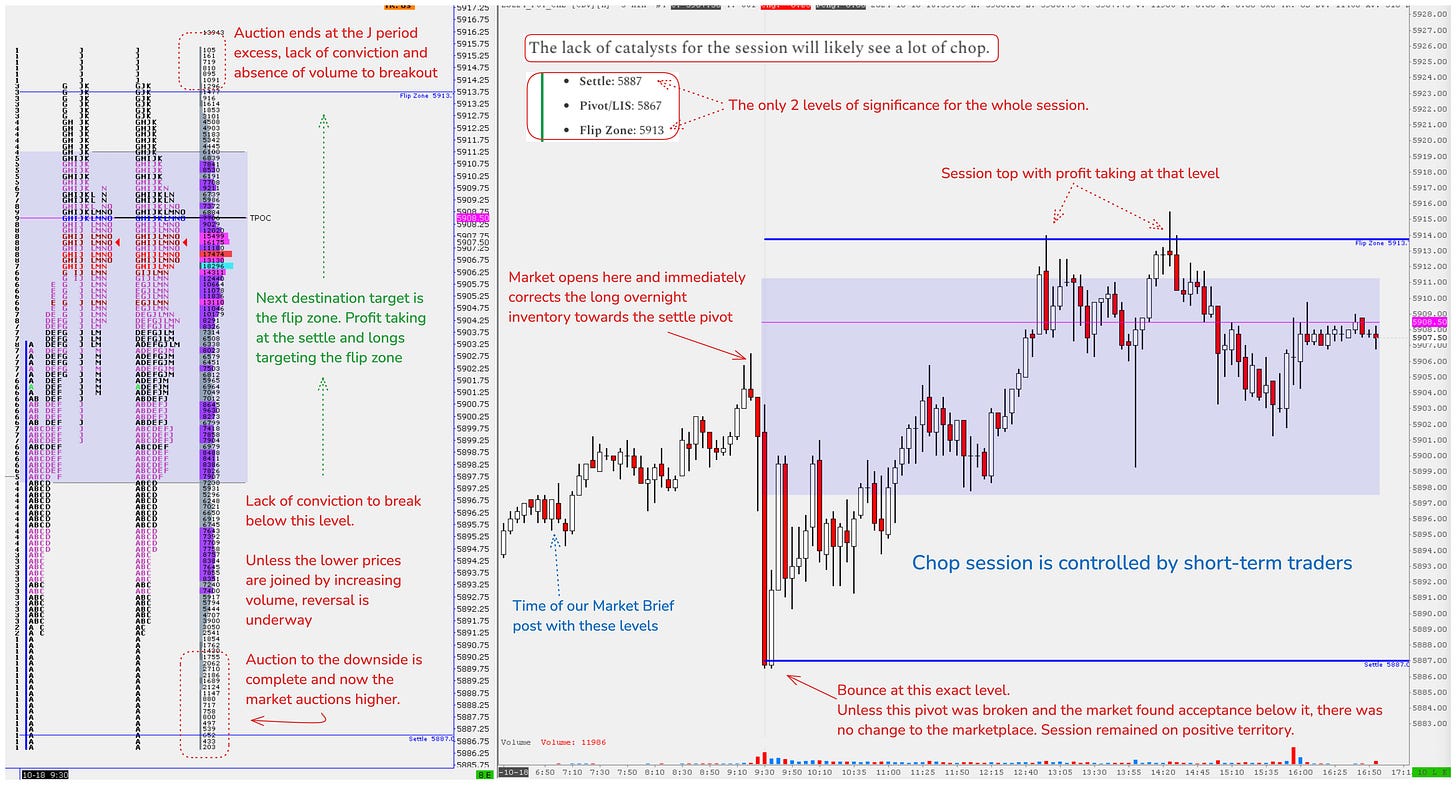

Friday’s session was a perfect example of how understanding what kind of day it’s likely to be can give you a much clearer sense of the type of follow-through you’ll have during that session.

Our market report was sent on Friday, around 7 a.m. ET, hours before the U.S. open, with the expectation of chop around of the marked references we used on the chart.

After the bounce from our first downside pivot, we spent around two hours within the initial 5-minute range after the open. Think of the amount of risk associated with misinterpreting who is in control of the session and the difference between trading a trend and a choppy range.

Longer-term participants and money managers don’t care about short-term references. Their size is simply too big and they need a long time horizon to buy or sell their positions.

When you see this type of exactness in the market, with bounces at very visual levels, it indicates the session is largely controlled by shorter-term traders and minor s/r will hold their weight, offering a lot of opportunity for range-bound trading.