Major Catalyst Ahead

Hey team. Today we’ve had a nice upside trend that followed our bullish scenario of the day with the market closing around our last upside reference after the PPI reading. Let’s re-cap today’s session and see what’s next for the markets!

Impact Snapshot

US producer prices rise less than expected in July

CPI Inflation, Tomorrow - 8:30am ET

Market Evaluation

Stocks rallied after the latest PPI inflation reading reinforced speculation the Federal Reserve will be able to deploy the next interest-rate cut in September.

The S&P 500 climbed 1.7%, led by gains in the world’s largest technology companies.

The largest market pullback of the year saw another rebound following a lower-than-expected inflation report. Today’s PPI data gives further evidence that the tide has turned on inflation.

The easing of price pressures has increased confidence among U.S. officials that they can begin lowering borrowing costs, allowing them to shift focus to the labor market, which is increasingly showing signs of slowing down.

Investors now await all-important consumer-price figures for July on Wednesday and retail sales data on Thursday to firm bets on an aggressive rate cut by the U.S. central bank.

Markets Breakdown

The contextual read since the weekly open has been a textbook interpretation of how using context around momentum can help with decision making.

Our morning brief on Monday here, highlighted that the market was looking to form a “chop range” around Friday’s session in anticipation of the key inflationary number.

The update posted here highlights the aftermath with the session seeing a full chop-range formation after the fact, with the market contained and value developed around Friday’s range.

In contrast to Monday’s session, today saw a key catalyst. As we always say, catalysts drive the market and often trigger trend days.

Our Morning brief posted here was seeing the upside continuation for the bulls once they flipped the key reference of 5421, which initially saw a nice rejection to load longs and target continuation with a full completion of the bullish scenario for the day.

Heading into tomorrow’s session, the key focus will be to monitor if the closing strength of the market will see follow up as the market is dealing with the all important CPI inflation report at 8:30am that will see another spike in volatility

ES

Some references we’ll be looking going forward:

Upside Levels: 5494/5510/5525

Downside Levels: 5431/5415/5378

That’s all we got!

Like this post, share it with a friend.

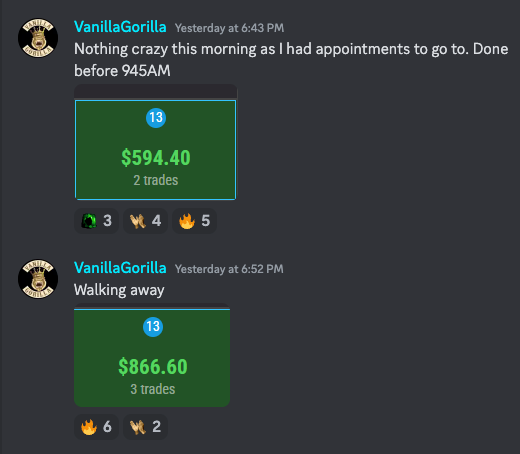

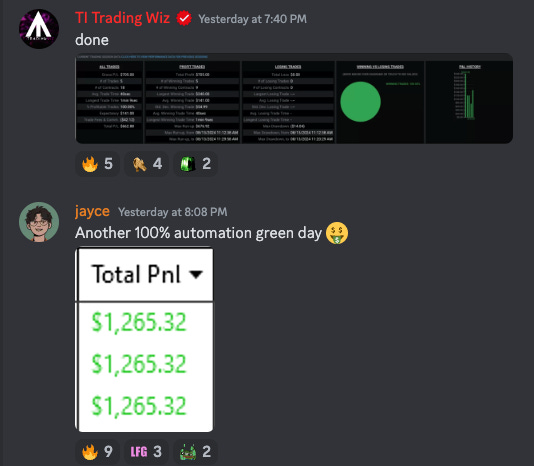

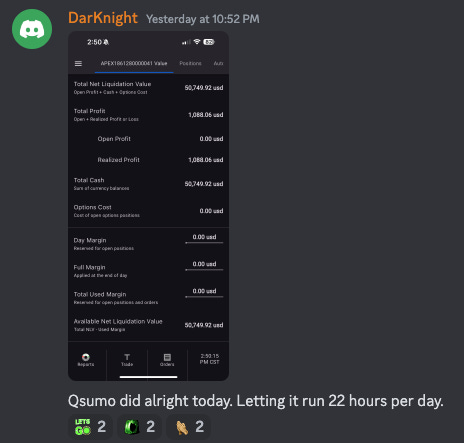

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.