Mapping Markets

US stocks traded higher Friday but ended the week modestly lower, as investors have been digesting stronger-than-expected economic data set against the recent uptick in real rates.

Impact Snapshot

JOLTS Job Openings - Tuesday

ADP Nonfarm Payrolls - Wednesday

Manufacturing PMI - Wednesday

Unemployment Claims - Thursday

Nonfarm Payrolls - Friday

Unemployment rate - Friday

Macro Viewpoint

Earlier last week, Fed Powell said policymakers face a “challenging situation,” with near-term risks to costs tilted to the upside and those to employment leaning downside. New tariffs also added to investors’ inflation concerns.

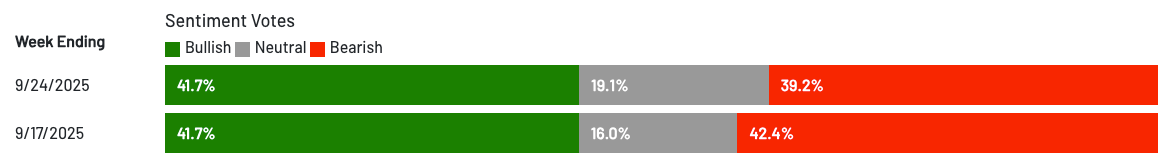

What’s clear is that despite markets only a smidge off all-time highs, sentiment/positioning is pretty middling.

What is reaching unprecedented levels is the length of time without at least a modest pullback. It has been months since we’ve seen a 3% or greater drawdown from the highs.

Prime Intelligence

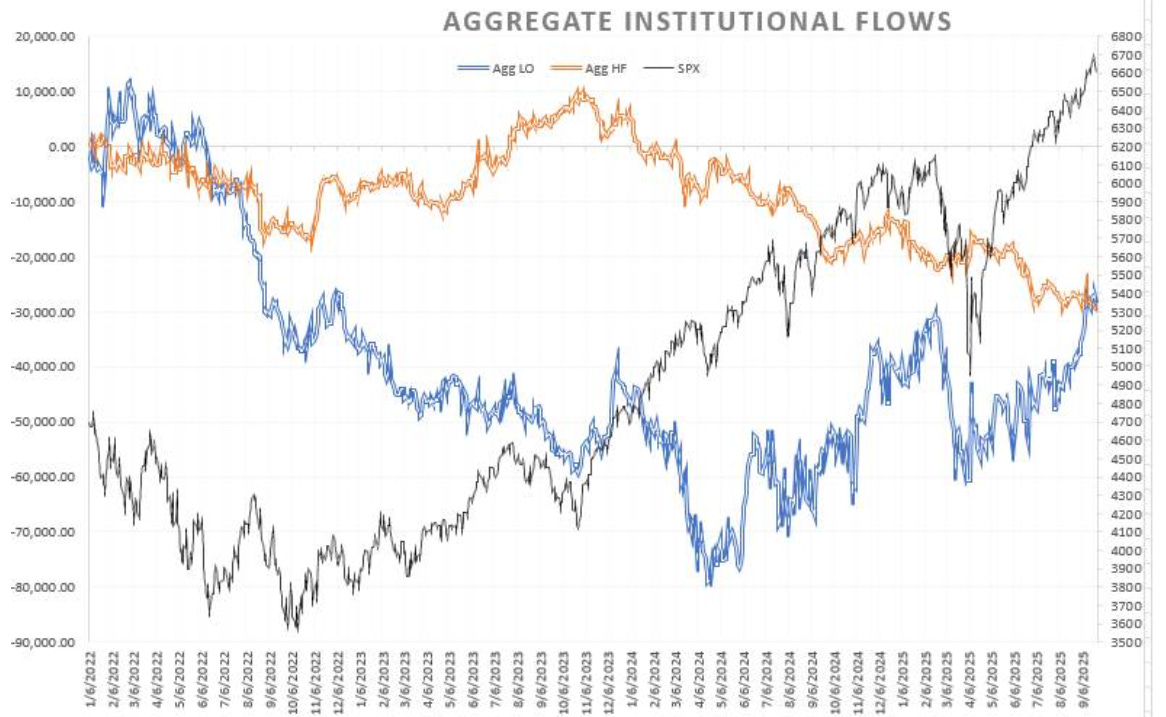

US equities saw little net activity on the week, as HFs net bought Fri and Mon but net sold in each of the subsequent three sessions. Overall gross trading activity decreased for the first time in 9 weeks, driven by short covers slightly outpacing long sales.

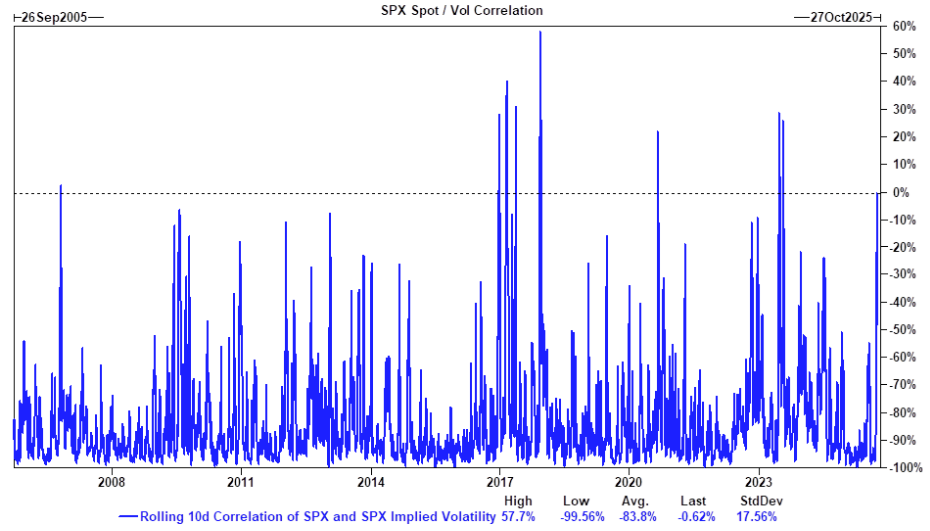

We have seen a dramatic uptick in spot vs implied volatility correlation. Over the last 10 sessions, SPX spot and 1-month implied volatility have had a realized correlation of almost 0.

This phenomenon is unusual and indicative of chase on up days and unwind of hedges on down days.

📰 In today’s Prime Intelligence, we dive into institutional trading desk insights and tackle the big question: what’s next for the markets?

Today’s article “Mapping Markets,” explores both short- and long-term market horizons, plus key positioning and flow trends from institutional investors.