Market edge and nuances

Hey team. With just one trading session left in the month, the S&P 500 is on track to close September in positive territory.

Let’s recap the last market session and share some of our insights on how we interpret context around momentum.

Impact Snapshot

Fed Chair Powell Speaks - Monday

ISM Manufacturing PMI - Tuesday

JOLTS Job Openings - Tuesday

ADP Non-Farm Employment Change - Wednesday

Unemployment Claims - Thursday

ISM Services PMI - Thursday

Non-Farm Payrolls - Friday

Unemployment Rate - Friday

Macro Viewpoint

The S&P 500 index gained 0.6% this week, supported by data indicating steady economic growth in the second quarter and further cooling of inflation in the past month.

The GDP report revealed that U.S. economic growth in Q2 remained stable, defying predictions of a slight downward revision.

Traders also welcomed favorable inflation data, which could provide the central bank with more confidence to continue cutting interest rates.

In August, the PCE index rose by 0.1%, in line with expectations, bringing the annual inflation rate down to 2.2% from 2.5% in July.

Investor optimism about a soft landing for the U.S. economy faces a crucial test next week, as the government releases key labor market data following a series of weak jobs reports.

As the month and third quarter close on Monday, investors will be closely watching the release of September employment figures later in the week, heading into the final quarter of 2024.

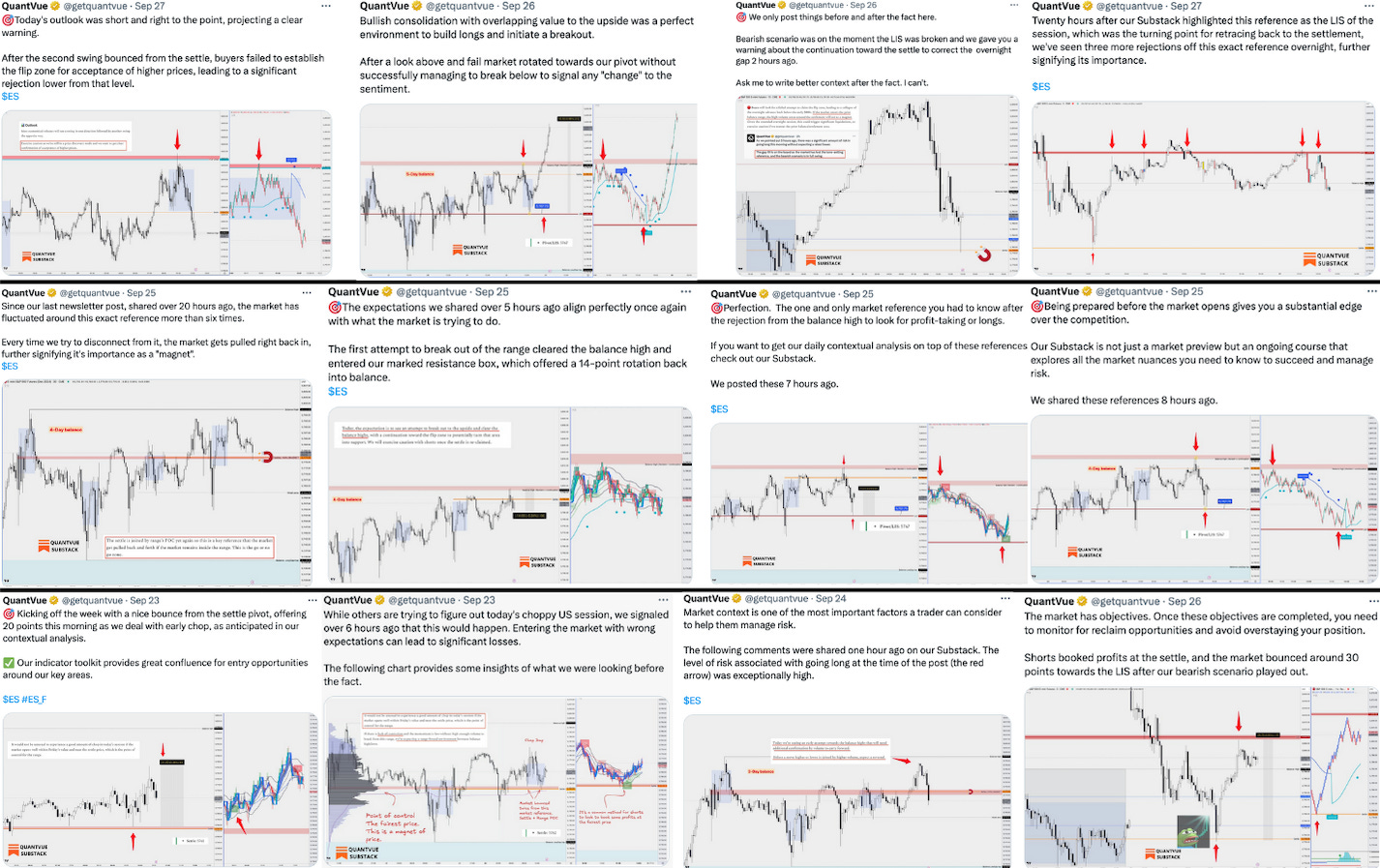

Gaining an edge in the marketplace

One aspect of being successful in trading, which is the hardest to master, is understanding the nuances.

It doesn’t take much to make the difference between being successful and un-successful. There are not many successful traders.

All the evidence we’re getting over the years is that it’s a pretty small universe. But guess what, it’s a pretty small universe for heart surgeons that want to do heart surgery on you.

There is as much money there as there is in here so guess what, it’s going to be competitive and there are not going to be a lot of people that make it and can do that competition.

The scope of our Substack is to address these market nuances that can make a real difference.

We demonstrate how we build frameworks of potential scenarios to assess certain situations and how they perform after the fact, all through an ongoing course process.

Getting practical

The picture below showcases our comments from our market brief on Friday, posted here on Substack before the US market open.

The key comment shared in that reports was this: “ Most economical releases will see a swing in one direction, followed by another swing the opposite way.”

That’s a market nuance.

Does this always happen? No. It’s simply one data point to build into your narrative.

In the market you can’t manage your return. The market will do what it does. What you can manage is your risk.

Most retail traders focus exclusively on trading momentum, often not realising the amount of risk they are exposing themselves to in certain situations.

But how can we interpret this information? The key strategy was to wait for a correction rather than jumping in at the top. A good point to anticipate that correction, matching the swing low in size, was the settle pivot.

This offered a much better and safer entry opportunity to play for rotations toward key resistance on the upside, our flip zone. The market failed to establish support at this zone, leading to a complete rollover and a sharp rejection triggering our bearish scenario.

By interpreting the right context early in the session, we both assess the right expectation for the open and refrain from conducting trading in unfavourable positions.

Being prepared means you’re not surprised when something does happen and you’re ready to act on a moment’s notice when it does happen.

That’s exactly what we’re doing every morning and share daily with out subscribers.