Market Panic Grows

Hey team! Another eventful session has concluded as the market kicks off September with a sell-off. Let’s recap today’s session and see what’s next for the markets!

Impact Snapshot

US manufacturing edges up in August from 8-month low

Tomorrow: JOLTS Job Openings - 10:00am

Market Evaluation

Stocks experienced their sharpest decline since the market meltdown on August 5.

The S&P 500 and the Nasdaq 100 saw their worst starts to a September since 2015 and 2002, respectively.

Concerns about economic growth and monetary policy once again ignited a sell-off of risky assets, similar to the situation a month earlier.

Market sentiment declined after the Institute for Supply Management reported on Tuesday that U.S. manufacturing remained sluggish, showing only a slight improvement in August following an eight-month low in July.

September is widely regarded as one of the worst months for stock market performance based on data stretching back to the 1950s.

Traders are now focusing on several labor market reports ahead of Friday's non-farm payrolls data for August.

Markets Breakdown

Historically, September is a bad month for stocks. Seasonality is a big factor, especially when we’ve had such a solid performance for the year until the end of last month.

The overnight session began with another 'look above balance and fail' situation, failing to establish any meaningful momentum above, and then rotating all the way toward the balance lows.

After spending three hours attempting to contain activity within the range, sellers took control and aggressively pushed the market lower, breaking below balance and targeting the previous gap.

Despite the session already being down almost 100 points, there was a 'no man’s land' below balance, with the only meaningful support at the previous gap highs.

Sellers have more room to break to the downside to fill this void of price and completely close the gap, while buyers will look to attempt to find acceptance inside the previous range.

ES

Some references we’ll be looking going forward:

Upside Levels: 5568/5604/5616/5637

Downside Levels: 5508/5491/5485/5455

That’s all we got!

Like this post, share it with a friend.

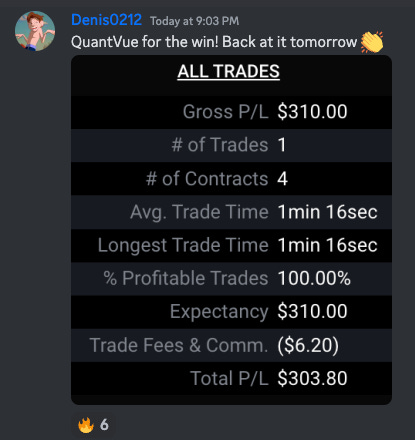

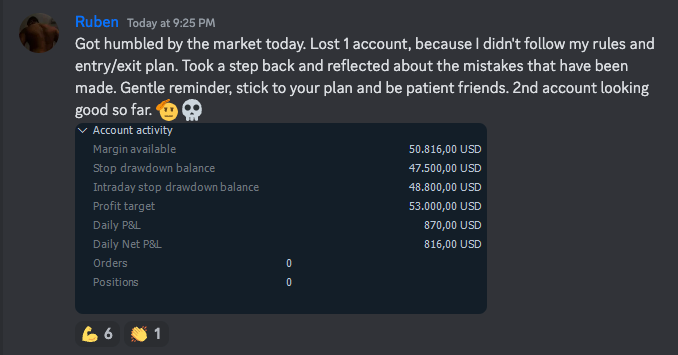

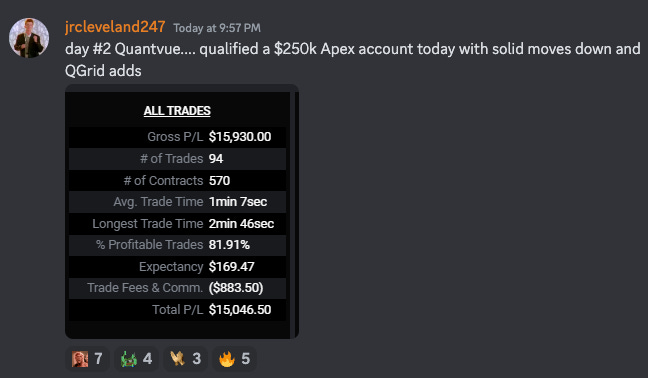

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

QuantVue ATS - Prop Automation Program

SEPTEMBER ATS AVAILABILITY UPDATE: 17 spots left

Join 125+ clients automating their futures prop firm trading with the QuantVue ATS (Automated Trading Suite).

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.