Navigating The Chop

Hey team. The market has been volatile over the past week as investors start to question the post-election rally.

Let’s re-cap Friday’s session and see what’s next!

Impact Snapshot

Consumer Confidence - Tuesday

Q3 GDP - Wednesday

Unemployment Claims - Wednesday

PCE Inflation - Wednesday

FOMC Meeting Minutes - Wednesday

Thanksgiving Day - Thursday

Macro Viewpoint

The S&P 500 index climbed 1.7% this week, with gains across all sectors except communication services.

Friday’s trading continued a trend where investors reduced their exposure to tech stocks in favor of sectors tied to economic growth.

Next week’s economic calendar features key reports, including November consumer confidence and October new home sales on Tuesday.

On Wednesday, markets will see a flood of data, such as October personal consumption expenditures, unemployment claims, and the first revision of Q3 GDP.

Markets will be closed on Thursday in observance of the Thanksgiving holiday.

Prior Session Deep Dive

One of the things that will likely give you a great advantage over the competition is understanding what type of day you’re going to deal with as the session begins to take shape.

There is a significant difference between trading a trend day versus a balancing day, and the misinterpretation of what the day is going to be can significantly impact your trading account.

Friday’s session was another example of how context, along with momentum and a solid set of references, can help you navigate the complexity of these markets and prevent exposing yourself to unnecessary risk.

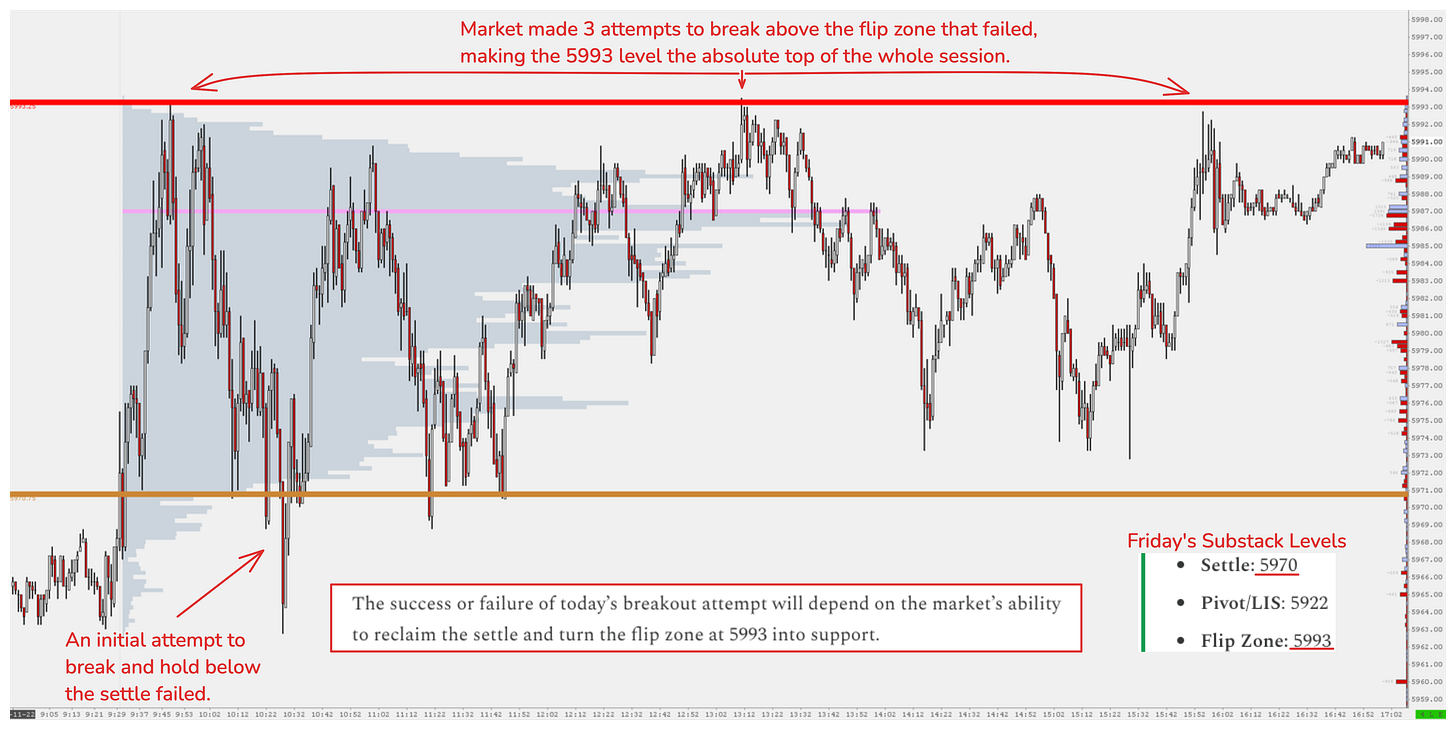

The session began with a rally to the upside that lacked the necessary momentum to break from the flip zone, which would indicate strength for continuation (trend day) as our contextual analysis suggested.

After a tick-perfect rejection off of that pivot at 5993, the market pulled back towards the settle and momentarily broke below but failed to get any follow-through to the downside, quickly retracing back inside the initial swing range.

This type of lack of conviction in the market is what forms a balancing day. Balance means that both sides are satisfied with the prices being traded, and the market is waiting for new data. There can be intraday balance like we had on Friday or multi-day balance.

When you’re trading a balancing day, the opportunities will arise at the edges of that distribution, which were exactly set between the settle and the flip zone for the entire session.

This offered a mean-reversion trading day, with longs finding opportunities near the settle and booking profits at the midpoint, while shorts used the flip zone reference to take trades back inside the POC of the session.

Market preparation: Virtually all performance literature recognises the link between preparation and performance. Without preparation we are unlikely to overcome our emotions when it really counts.

If you want our daily market plan along with our market references delivered daily in your inbox during the overnight session consider subscribing below.