Near the Summit

Hey team, another eventful week has concluded with the market sitting just a couple of points short of the all-time highs. Let’s recap the last session and see what’s next!

Impact Snapshot

CB Consumer Confidence - Tuesday

Key Earnings of NVDA 0.00%↑ - Wednesday

Prelim GDP - Thursday

Unemployment Claims - Thursday

Core PCE Price Index - Friday

Market Evaluation

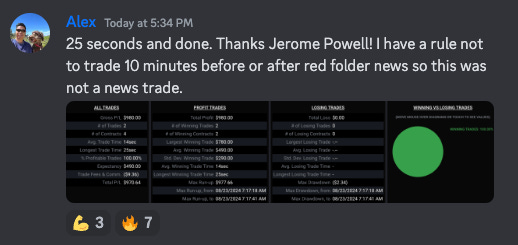

U.S. stocks surged on Friday after dovish comments from Federal Reserve Chair Jerome Powell solidified expectations that the central bank will reduce its key policy rate in September.

In eagerly awaited remarks at the Jackson Hole Economic Symposium, Powell stated that "the time has come" to lower the Fed funds target rate, noting that "the upside risks of inflation have diminished."

Investors were already anticipating that Fed officials might begin cutting rates at their September policy meeting Powell's latest comments make that possibility seem even more likely.

The final week of August will feature the second revision to Q2 gross domestic product on Thursday, followed by the July personal consumption expenditures index on Friday.

Markets Breakdown

Our market report, posted here before the U.S. market opened on Friday, emphasized the importance of focusing on momentum, especially when emotions are in control of a market.

Most traders don’t understand why prices move the way they do during key economic reports or anticipated market catalysts and end up getting caught trying to go against the momentum of a sharp move.

When catalysts like economic data, earnings reports, or Fed speeches occur, the order book becomes very thin.

This happens because traders reduce their exposure to the market (removing their limit orders), making prices easily manipulated by any aggressive buyer or seller.

This can create a completely misleading impression of what's happening, as focusing solely on price might make you think that strong buyers or sellers are driving the market in that direction and end up getting caught up.

Until the market fully "digests" the information from that catalyst, you’ll see swings to highs and lows that people often describe as "making no sense."

Most of these swing highs and lows occurred near our initial upside references. The market then pulled back to the day's pivot at 5604, which was the absolute session's bottom, before bouncing 54 points to close out the week. Read the update here.

ES

Since last week throughout our market reports over on X and Substack, we’ve been signalling that the market was seeking to form a range. We’re now on a 5-day balance range and balance guidelines are applicable.

Look above and go. Prices move above the high of balance and find acceptance and continue higher. The target should be double the balance area.

Look above and fail. Prices move above the balance high but fail to find acceptance and reverse back into the balance area. This is now a short with a stop above the high just outside of balance that was recently made, with a target to the opposing low end of the balance area.

Some references we’ll be looking going forward:

Upside Levels: 5674/5691/5708/5727

Downside Levels: 5629/5619/5588/5570

That’s all we got!

Like this post, share it with a friend.

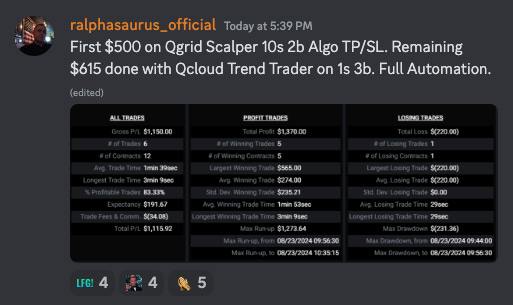

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.