Outsized Swings

Hey team. Another session of major volatility took place on Thursday, wiping Wednesday’s early attempt for continuation. Let’s review today’s session and see what’s next for the market!

Impact Snapshot Tomorrow

Non-Farm Employment Change - 8:30am

Unemployment Rate - 8:30am

Average Hourly Earnings - 8:30am

Market Evaluation

U.S. stocks began August with a significant drop after Thursday's economic data raised concerns that the economy might be slowing more rapidly than expected.

The S&P 500 sank 1.4%, just one day after rallying 1.6%. The Nasdaq surged by 3% on Wednesday but nearly erased those gains on Thursday, before paring the decline at the close, for its biggest up-to-down rotation since May 2022.

The ISM manufacturing index, a barometer of factory activity in the U.S., came in at 46.8%, worse than expected and a signal of economic contraction.

Cracks in the labor market are beginning to emerge, with initial jobless claims climbing to the highest level in nearly a year.

These weak data releases come a day after central bank policymakers chose to keep rates at the highest levels in two decades.

Jerome Powell signaled officials are on course to cut rates in September unless inflation progress stalls citing risks of further jobs weakening. Monthly employment data due Friday will add fuel to the debate.

Markets Breakdown

Thursday’s price action was another episode of extreme volatility that has featured rapid rotations into and out of asset classes and sectors.

Market initially opened higher, supported in part by gains in META 0.00%↑ after its quarterly results topped expectations.

These early gains, however, evaporated after data showed a measure of manufacturing activity to an eight-month low in July.

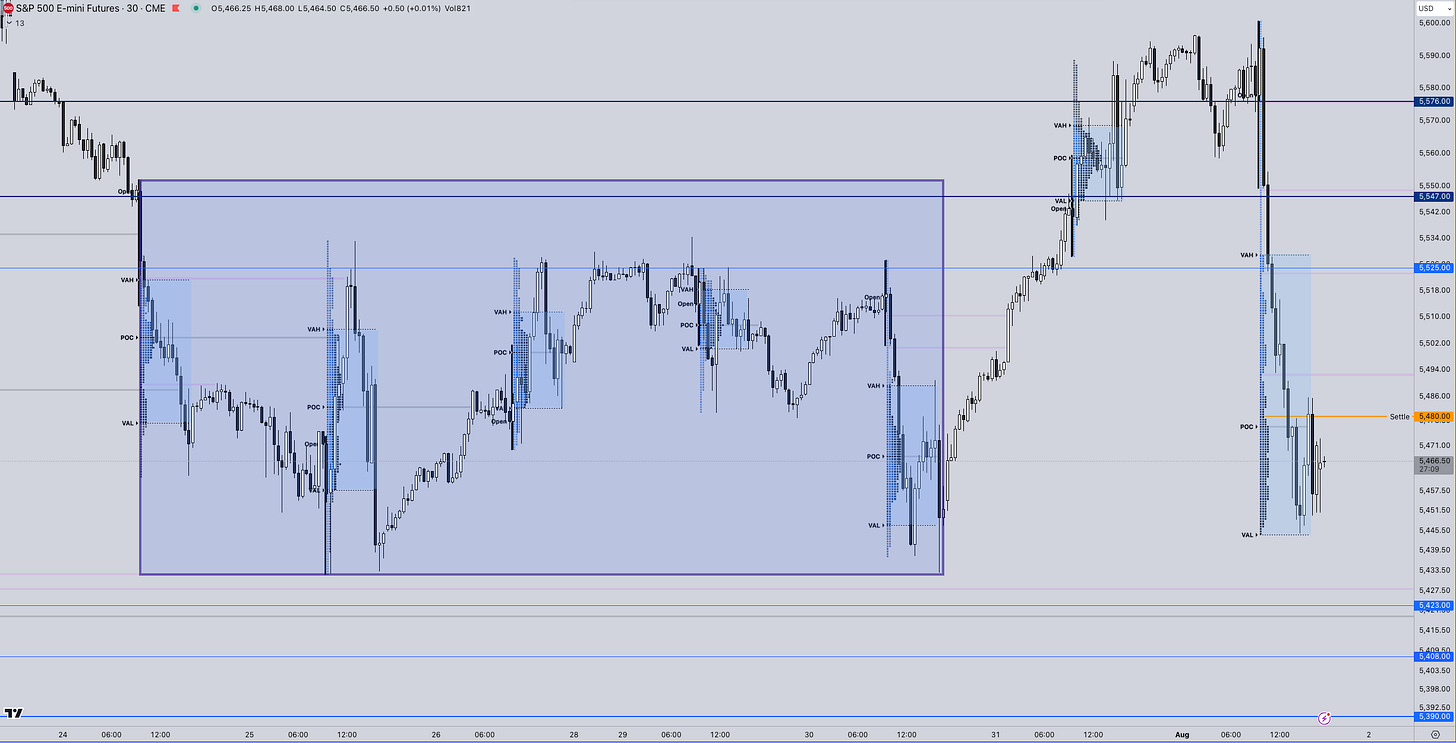

We always talk about markets needing a catalyst to turn emotional and this played a pivotal role after the market failed to hold above the previous multi-balance range.

After an aggressive rejection off of the 5600s, market entered the previous balance and saw a 157-point range session that ended at the previous balance lows.

Tomorrow, volatility will remain high as we will see another slew of major catalysts at 8:30am.

ES

Some references we’ll be looking going forward:

Upside Levels: 5525/5547/5576

Downside Levels: 5423/5408/5390

That’s all we got!

Like this post, share it with a friend.

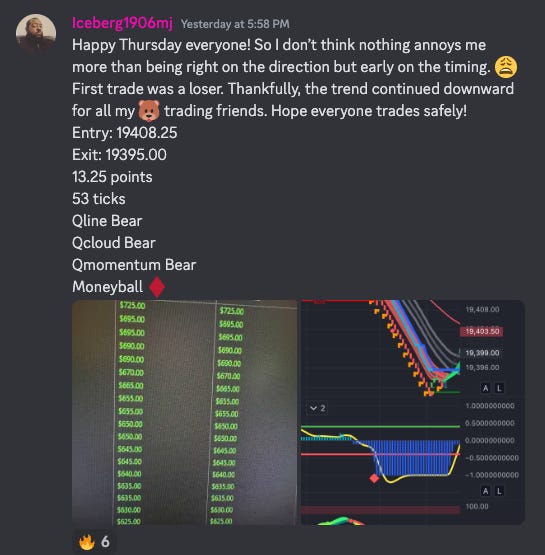

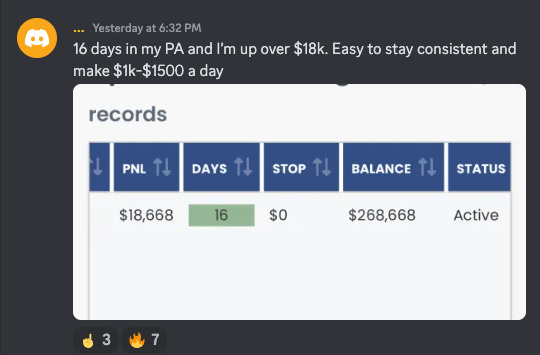

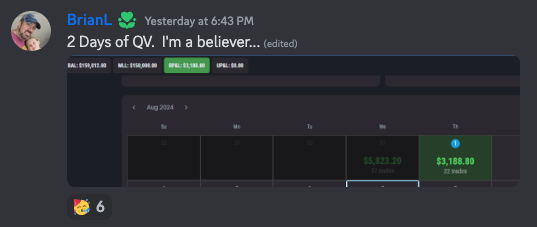

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.