Overnight Control

Hey team. A very eventful week has concluded, propelling the markets to another historic milestone following the U.S. elections and the latest rate cut.

Let’s re-cap last week and see what’s next!

Impact Snapshot

CPI Inflation - Wednesday

PPI Inflation - Thursday

Unemployment Claims - Thursday

Retail Sales - Friday

Macro Viewpoint

The S&P500 ended just below a historic 6,000, capping a strong week fueled by Donald Trump’s victory in the U.S. presidential election and a 25-basis-point interest rate cut by the Federal Reserve.

Trump's return to the White House will keep investors focused on potential shifts, including new tariffs, labor market developments, immigration policy changes, and benefits for major tech companies.

The Federal Open Market Committee lowered interest rates to a target range of 4.50% to 4.75%, following a previous 50-basis-point cut in September.

On Thursday, Fed Chair Jerome Powell stated that the outcomes of the presidential and congressional elections are unlikely to influence short-term monetary policy decisions.

Next week's economic calendar will be focused on the CPI and PP inflation numbers along with the retail sales data for October.

Evaluating the Overnight

Generally, overnight trade involves shorter timeframe, weaker-hands traders. If inventory gets too long or too short, the odds are good that there will be an inventory adjustment shortly after the pit session opening.

On occasion, the inventory adjustment can occur later in the session, depending on the confidence level in the current pit session.

If overnight inventory is long, for example, and the market doesn’t adjust, that is an indication of a strong market—at least in the short term.

During the overnight session, you want to focus on particular activities that took place and seek to spot market-generated information to add to your narrative.

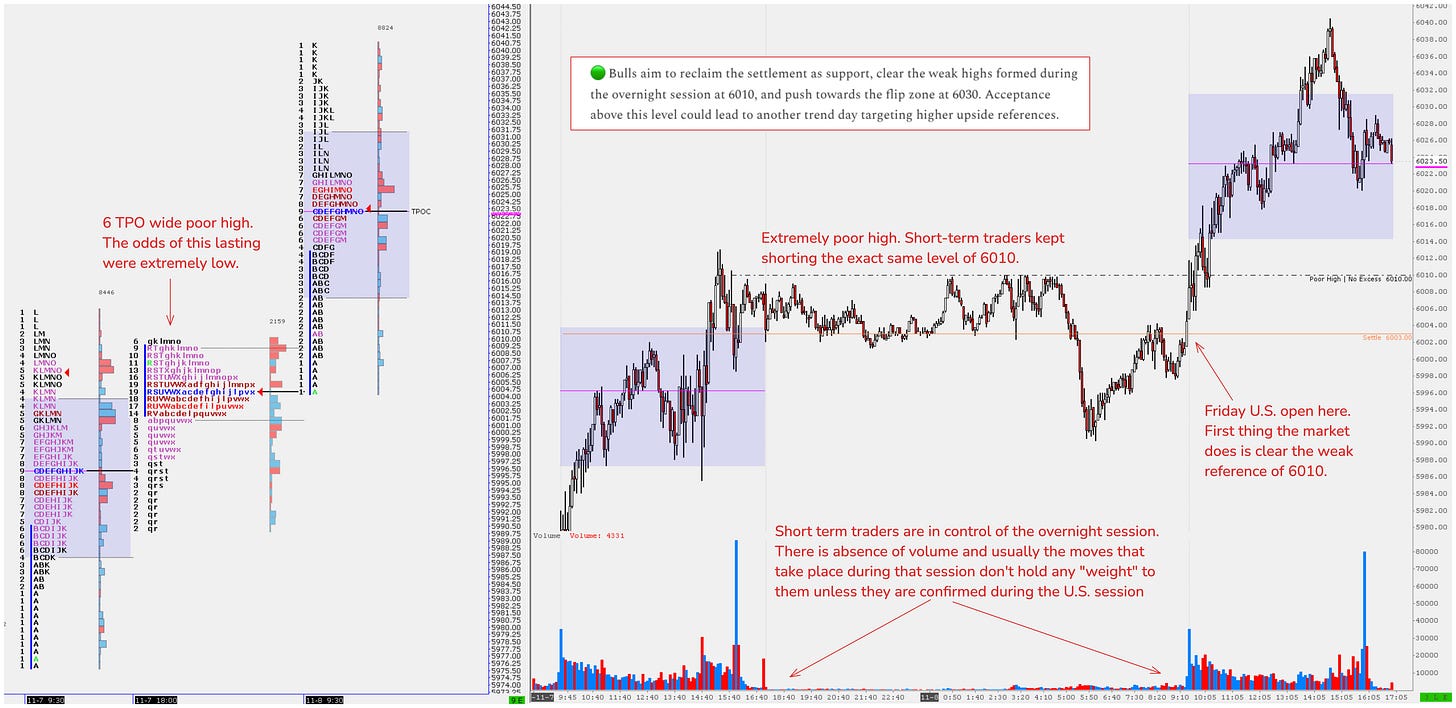

The chart above showcases the profile of Friday’s overnight session, featuring a 6 TPO-wide poor high at the exact level of 6010. Short-term traders repeatedly shorted the same level, resulting in no excess high.

When there is no excess, it means that the market has not gone high enough to shut off buying. This creates an extreme weak area that the market likes to return back to to print at least a couple ticks of excess above.

This kind of information, when added to your context, can help you set your expectations properly and manage risk. This way, you can potentially hold your trades longer, refrain from piling up at that exact level, and focus on value and continuation.