Overnight Evaluation

Hey team. This week, the US stock market displayed concerning signs as the optimism following the election begins to confront some challenging economic realities.

Let’s re-cap last week’s events and see what’s next!

Impact Snapshot

ISM Manufacturing PMI - Monday

ADP Non-Farm Employment - Wednesday

ISM Services PMI - Wednesday

Unemployment Claims - Thursday

Non-Farm Payrolls - Friday

Unemployment Rate - Friday

Fed Chair Powell Speaks - Friday

Macro Viewpoint

February often brings market volatility as investors adjust following the momentum of the Santa Claus rally and January's early-year optimism. This trend is particularly pronounced in post-election years, as markets digest new leadership and evolving policy directions.

The S&P 500 declined 1% this week, bringing its total February loss to 1.4%, erasing much of January’s gains. The index, which closed lower in three of the past four weeks, remains up 1.2% year-to-date in 2025.

Economic data released Friday showed an unexpected decline in consumer spending, even as the Federal Reserve’s preferred inflation measure slowed on an annual basis.

Market sentiment has also been pressured by concerns over tariffs imposed or threatened by President Donald Trump, with investors weighing the potential economic impact. Additionally, a tense exchange on Friday between Trump and Ukrainian President Volodymyr Zelenskyy contributed to investor uncertainty.

Looking ahead, attention will turn to key labor market data. ADP’s employment report is set for release on Wednesday, followed by the government's nonfarm payrolls and unemployment rate report on Friday.

Overnight Evaluation

Doing nothing is your superpower. Too often, traders focus excessively on taking action when they see a market move and try to pile up on it, often exposing themselves to unnecessary risk.

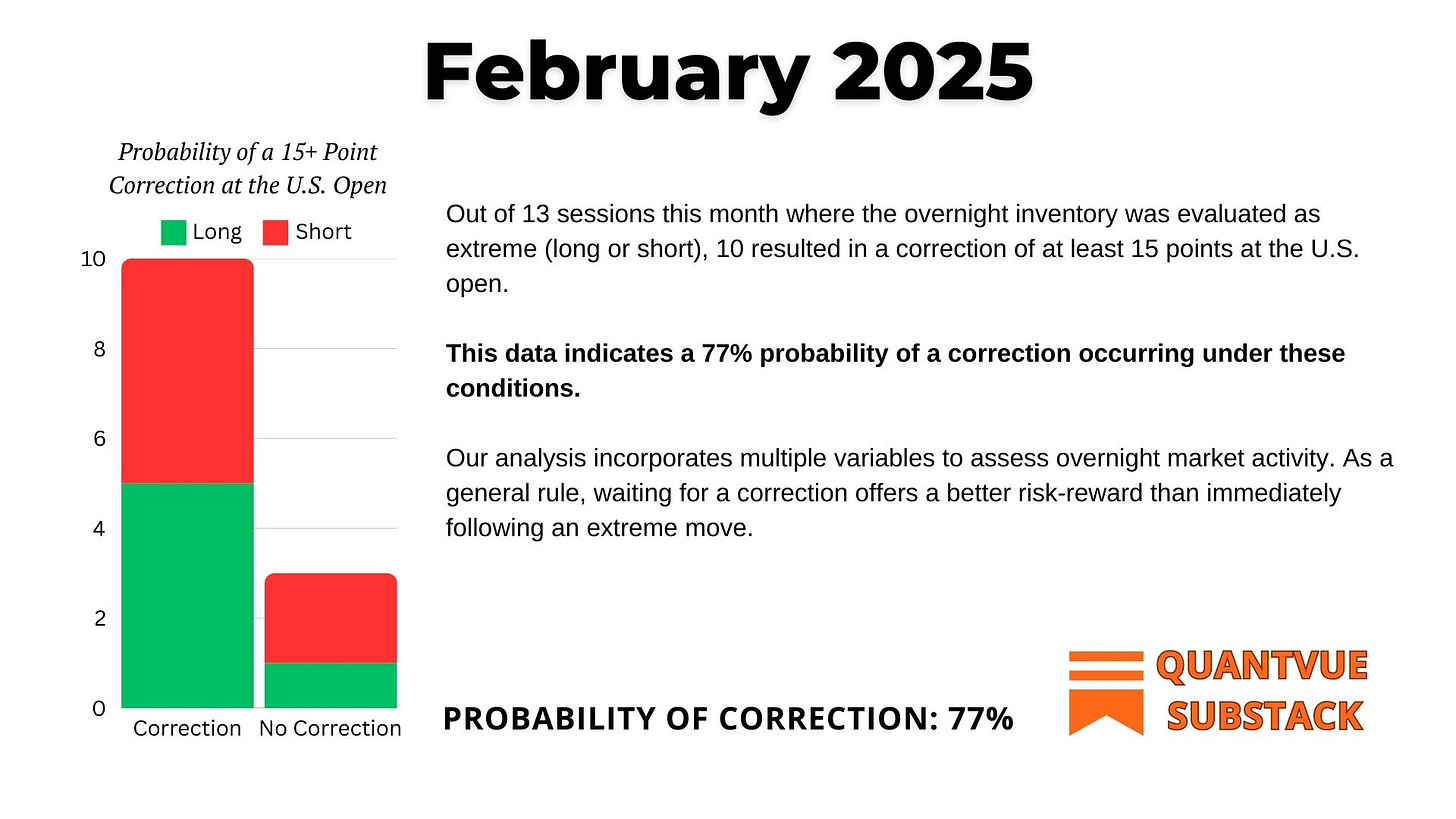

Transparency is essential, and all results we share is based on what we have written on the prior session or days before the fact. Each morning in our market brief, we conduct an overnight evaluation of the session leading up to the U.S. open.

For example, when we categorize the overnight session as "extreme long" in our report card, our expectation is that a correction will occur to some degree before any continuation. This correction helps shake out weaker-hand participants, who predominantly influence overnight trading.

“Generally, overnight trade involves shorter timeframe, weaker-hands traders. If inventory gets too long or too short, the odds are good that there will be an inventory adjustment shortly after the pit session opening.” - Quantvue Orderflow eBook

Regarding the month of February, historical probabilities indicate a 77% chance of a correction occurring after we’ve assessed the overnight as either too short or too long.

Therefore, waiting for that correction would have provided a significantly better risk-to-reward (R:R) opportunity.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.