Pain Trade

Hey team. Last month felt like a year packed into just a few weeks. The S&P 500 index rose 2.9% this week after April jobs data came in above expectations.

Let’s recap the recent events and look at what’s ahead for the market!

Impact Snapshot

ISM Services PMI - Monday

Interest Rates - Wednesday

Unemployment Claims - Thursday

Macro Viewpoint

U.S. equities climbed broadly on Friday, with the S&P 500 notching a 2.9% gain for the week—fully erasing April’s tariff-driven pullback and extending its longest winning streak in over two decades.

The index has now returned to a level that closely tracks its median trajectory during a typical 10% correction. From here, the potential 15% swing into year-end will hinge largely on how recession risks unfold.

It’s evident that sentiment and consensus positioning have reached some of their most bearish levels in recent memory. This is showing up across hedge funds, CTAs, volatility-targeting strategies, and other systematic players. Meanwhile, retail investors have largely stayed put—leaving few sellers left in the market through much of April.

Uncertainty doesn’t play well with sentiment, and that’s especially true in the current backdrop. The unusual disconnect between soft and hard data, the 90-day pause on new tariffs, and the questionable narratives around demand pull-forward and inventory distortions—highlighted in this week’s GDP report—have made any recession call, bullish or bearish, inherently speculative.

We expect more attractive entry points to emerge as underlying economic fragilities come into sharper focus. That said, with volatility resetting, hedging is finally becoming more feasible again—a notable shift after weeks of distorted pricing.

For now, it’s still too early to form a clear conviction about the extent of economic damage. In the meantime, markets have moved counter to the heavily skewed bearish positioning, while the gradual rollback and carve-outs on tariffs have helped limit the probability of more extreme downside scenarios.

Pain Trade

Given large MF underweights & HF l/s ratio across Mag 7 at 9-year lows , the ultimate pain trade is a tech led rally.

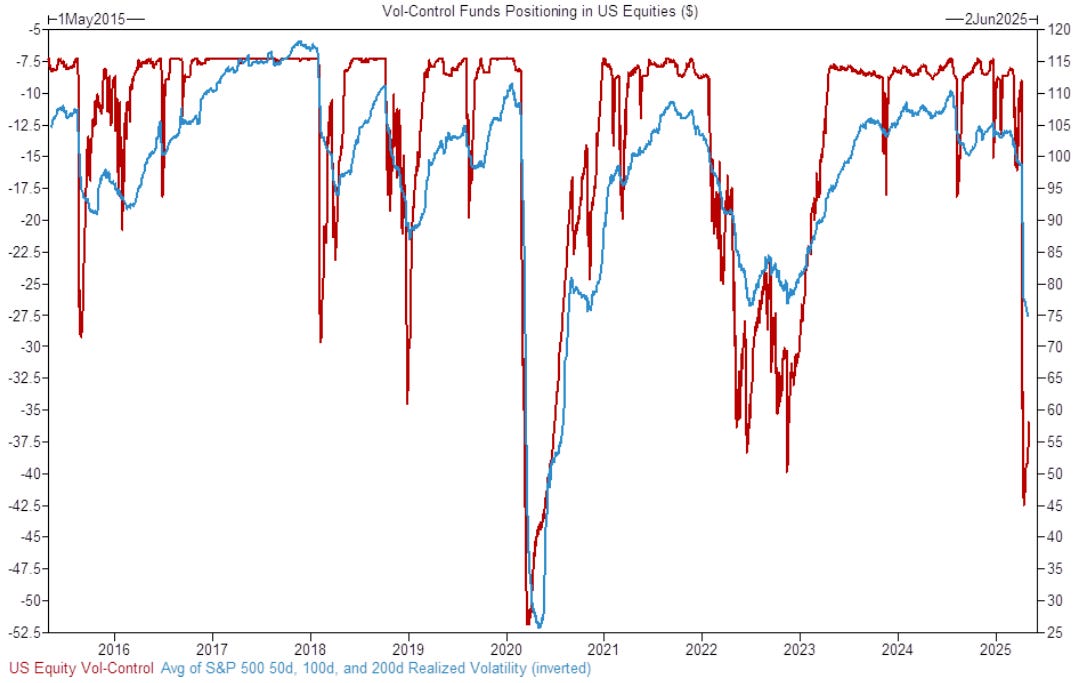

Vol control funds are starting to become a large focus. They are typically next in line when it comes to moving their feet.

The context below will give you an inside look at what it actually looks like behind the scenes when it comes to institutional money managers.

Investment managers who make their returns based on time in the market and aren’t fully invested will underperform if the market rises. They will be affected as if they are short, as their performance suffers.

These managers are put into a peer group, and then they are rated on a relative basis to other members of their peer group. So if they are 95% invested and their peer group is on average 98% invested, they will underperform if the market rises.

This is what a “pain trade” is for them. The market rising will only put more pressure on managers that haven’t added U.S. exposure, especially tech.

Wall St. Prime Intel

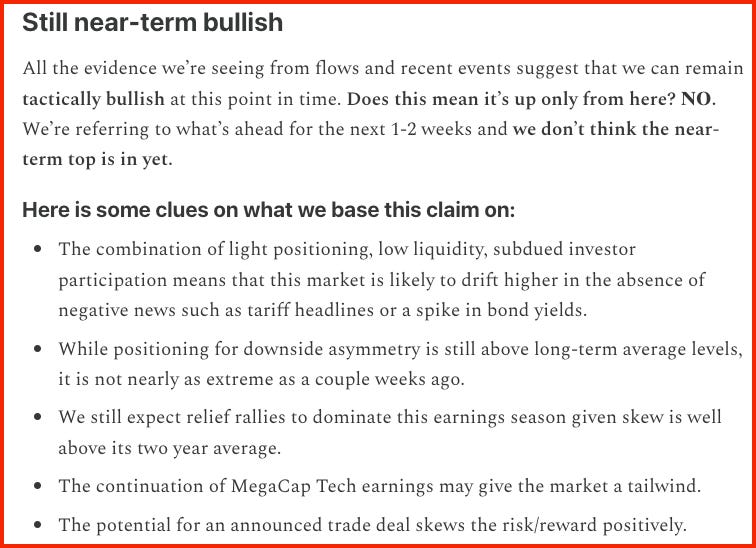

This is the same context we shared with our subscribers early last week (before the fact as always) to reiterate our near-term bullish stance. We now find ourselves in the midst of one of those historic upside streaks.

Unless your bias is grounded in data, relying on intuition alone can be a performance killer. Our approach mirrors the exact blueprint used by major institutions—we apply that same discipline to our market research. If it isn’t backed by data and quantified, it doesn’t exist.

In today’s weekly edition we discuss the following👇:

Latest positioning of the biggest market participants

Volatility Dynamics and Options

Technical market overview

CTA Trend Followers Shift Positioning

Our Updated market outlook

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.